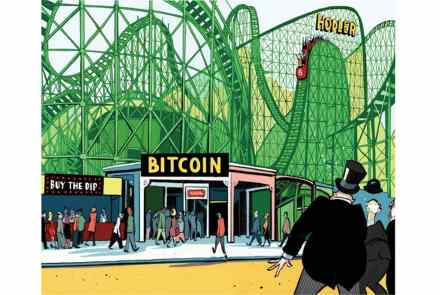

The nihilistic rise of ‘loss porn’

It’s been a terrible few weeks for that guy you know. Bitcoin dropped to a ten-month low (apparently thanks to something called ‘stablecoins’), while $1 trillion has been wiped off the largest tech companies on the stock markets. ‘Retail investors’ – non-professionals with little more than an internet connection – are struggling. You might expect many of them to put their heads in their hands and log off. But that would be to misunderstand the nihilism of online culture. Losing is the same as winning, only better. The thing to do is to post evidence of your catastrophic losses. It’s called ‘loss porn’ and if you look at the ‘WallStreetBets’ page on