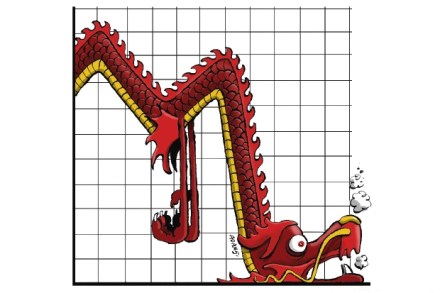

Exit the dragon

[audioplayer src=”http://rss.acast.com/viewfrom22/chinasdownturn-labourslostvotersandthesweetestvictoryagainstaustralia/media.mp3″ title=”Elliot Wilson and Andrew Sentance discuss China’s economic slump”] Listen [/audioplayer]I stood alongside the chairman of the board of a state-owned enterprise in eastern China. The factory floor, partially open to the elements, stretched out far in front of us, littered with towers and blades designed for some of the world’s largest wind turbines. It was an impressive sight, one to which regular visitors to mainland factories are accustomed: China as the workshop of the world. But something was missing: workers. ‘They’ve been given the day off,’ the chairman said with a slight cough, as we stared out over the vast compound. On a Wednesday? It was hot