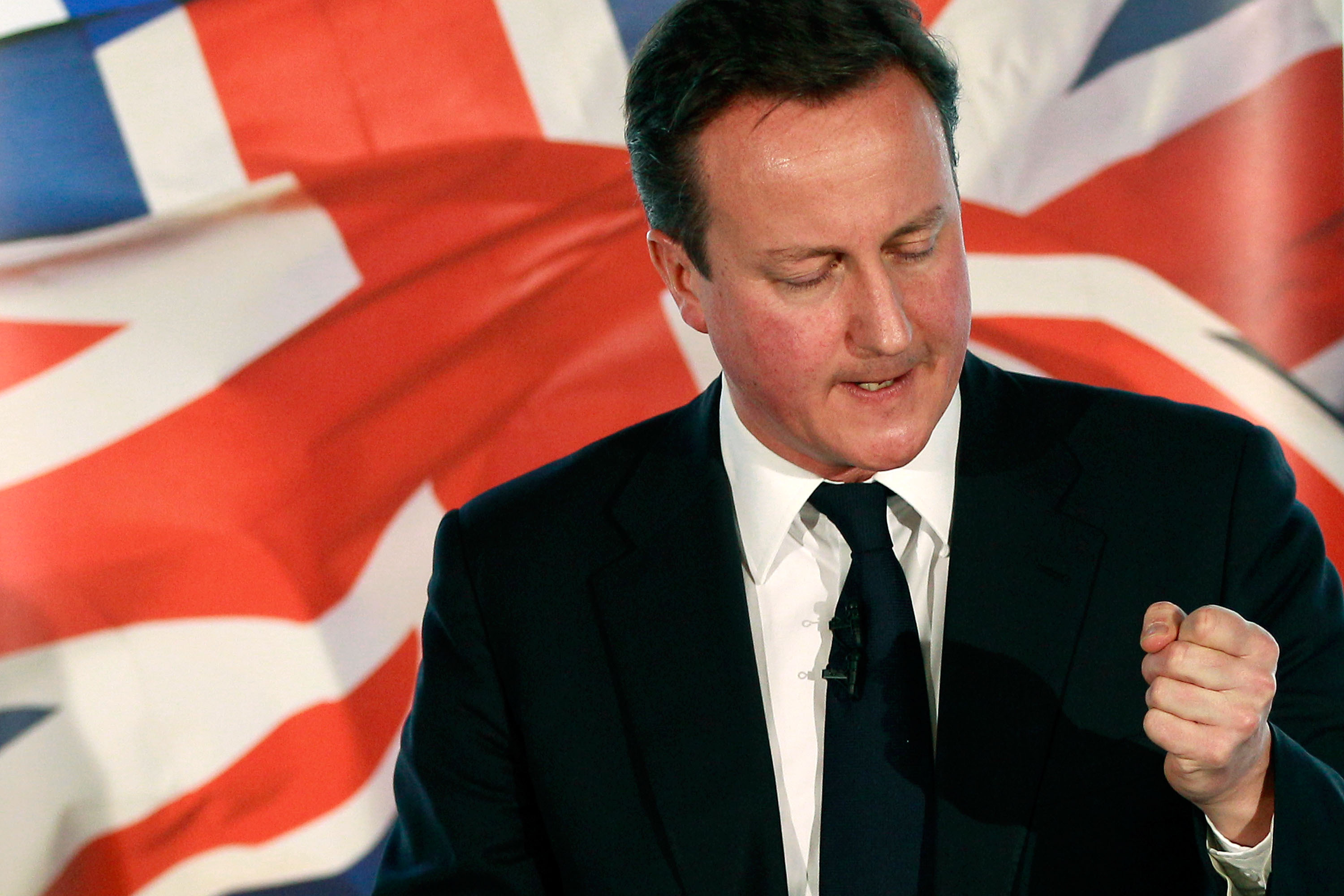

Ever since Ed Miliband’s ‘predatory capitalism’ speech at the Labour Party conference, the future of capitalism has been a subject that has much occupied our MPs. Clegg made his speech on Monday, and Cameron delivered his yesterday. I have had plenty to say about the coalition government’s inadequate economic policy, and its inability to stoke growth. But Cameron’s speech was impressive, and it’s worth going into in some detail. I look at it in my Telegraph column today.

Much rot is spoken about capitalism. It is not an ideology, there is no rule book you can tweak: it is simply the name given to the system where people trade with each other the world over. There are as many types of capitalism are there are countries: the very word is good for making speeches, or selling books, but not much else. Cameron is a proudly post-ideological leader, which is why his speech made so much sense. If you talk about capitalism as an ideology, you’re getting it wrong. The phenomenon being described is, basically, human freedom: belief in capitalism is belief in mankind. And it’s something that Conservatives have in spades.

Cameron started with an analysis of what happened, which is crucial. Many on the left talk as if capitalism has failed somehow, but, as Cameron said, we have just witnessed a crisis of government. Rather than regulate the banks, Gordon Brown entered coalition with them. The inept regulatory structure that he personally drew up allowed banks to take risks in London that would have been illegal in Wall St. Greed was a factor: Brown’s greed for tax revenues meant he asked no questions and every bonus was split 60/40 with the British government. It was a joint racket.

The great irony behind Brown’s excuse, that ‘it started in America’, was that America’s problems started in London. It was the London AIG, Lehmans and MF Global which were taking the most risks with the CDSs — doing so to escape the eye of Federal regulations. To an extent which has still not been been properly appreciated, Brown’s London was the contagion. (Those with strong stomachs should read this analysis by ZeroHedge.) Countries with properly-regulated system (Canada, Australia, Sweden) saw no banks collapse at all. Cameron put it well: Brown entered a ‘Faustian Pact” with the banks — and it wasn’t capitalism, but the most dangerous kind of corporatism.

Crucially, as Cameron pointed out, the issue was wrong-touch regulation, not right-touch regulation. There was plenty of red tape, as anyone who tried to open a bank account found out. But if you wanted to led unsecured billions to a Russian who had a small chance of paying you back, or re-hypothecate assets of 300 per cent of the collateral, then fine. As Cameron said: ‘Small companies were strangled in red tape while the banks were allowed to let rip.’ And how.

And the solution? Cameron says he wants less regulation. He doesn’t conflate the banking blow-up with a failure of capitalism, and says that what’s needed more are virtues that people, not governments, possess: ‘Intelligence; ingenuity; energy; guts,’ and the state can only do so much. ‘While of course there is a role for government, for regulation and intervention, the real solution is more enterprise, competition and innovation.’ Labour’s instinct would be to produce an Ingenuity, Energy & Guts Bill (2012). Cameron says different. ‘I believe that open markets and free enterprise are the best imaginable force for improving human wealth and happiness. They are the engine of progress, generating the enterprise and innovation that lifts people out of poverty and gives people opportunity.’

The part of Cameron’s speech that Nick Clegg wouldn’t and couldn’t say was a paean to entrepreneurs. ‘I admire more than almost anything the bravery of those who turn their back on the security of a regular wage to follow their dreams and start a company. If you take a risk, quit your job, create the next Google or Facebook and wind up a billionaire, then more power to your elbow.’ That’s the idea, anyway. But the fate of the Adrian Beecroft’s proposals give an example of just how hard it is for pro-entrepreneur policies to pass the various layers of this warring coalition.

Meanwhile the 50p tax is pretty much here to stay, a massive ‘keep out’ sign to today’s globalised entrepreneurs. The regulatory burden is getting bigger at the behest of Brussels and the tax burden is also growing to pay for a deficit which is now being halved in five years, worse than the four years that Alistair Darling planned.

There is a strong case to reset growth policy in the next Budget. If George Osborne were to do so, he should read and re-read Cameron’s speech about capitalism. The government has the agenda. Now all it needs is the policies to match.

Comments