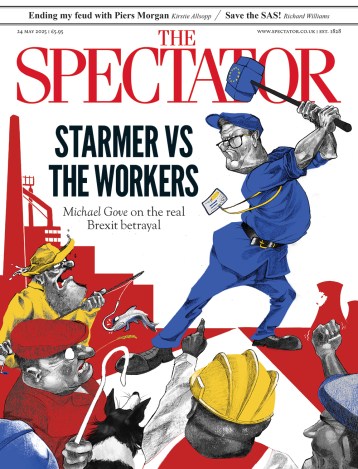

Britain is enjoying another Brexit dividend

Has there ever been a day when Brexit seemed such a good idea? The story of Brexit began to change on ‘Liberation Day’ on 2 April when Donald Trump announced a 10 per cent tariff on imports from the UK and a 20 per cent tariff on those from the EU. No longer was it possible for anyone to argue there were no tangible benefits from leaving the EU: here was one of them staring us in the face. Following that, all proposed tariffs were suspended for 90 days to allow negotiations. Since then, though, the story has changed dramatically – and in Britain’s favour. Thanks to the trade deal