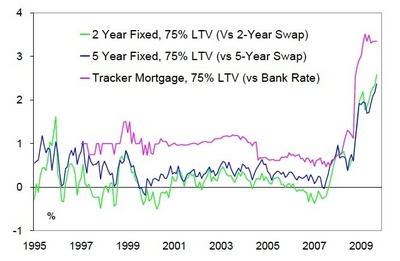

What is the true price of Gordon Brown’s economic incompetence and inept bank regulation? The soaring national debt is one. And if you own a mortgage, you’ll find that you’re paying another. The gulf between the Bank of England base rate and the average mortgage rate is now at a huge high – as banks rip off their customers, trying to fill the hole in their balance sheets. This is an under-discussed topic. The “action we have taken” (a phrase Brown uses to try to lay claim to the Bank of England’s base rate reduction) would have a far greater effect on the economy if the UK banking system was not (still) so badly broken. The below graph, from Citi, shows spreads (ie, gap between base rate and retail rate) on key UK mortgages from 1995.

This is an interesting aspect of the recovery. We don’t really feel this pain, because mortgage rates have been around 5% for so long. But put it this way: that lucky bloke in the pub who is getting an extra round in because he’s got a variable pegged to the base rate? That should be you. By now, you should have been able to remortgage and pay half the intrerest that you did. You are being denied this, because someone Scottish thought he would personally rewite the bank regulation system and proceeded to make an almighty mess of it. And the credit crisis may be global, but Britain is worse hit than anyone else. Look at the staggering graph below – JP Morgan data, based on IMF estimates, of the cost of the banking crisis not in billions, but as a percentage of GDP.

So yes, Britain is hurt more than twice as badly as America. So we pay for Brown’s bank incompetence in two ways. One is the national debt, which is increasing at a sickening rate, and the other way is by paying through the nose for mortgages. And because the banks are still screwed, they can act as a cartel and rip us all off. This is why Gordon Brown can probably be judged the most expensive leader of any Western democracy since the war. The costs of his arrogance, misjudgments and rank incompetence will be with us for years, perhaps decades, to come.

Fraser Nelson

Fraser Nelson

Brown’s double hit

Comments