The IFS post-Budget briefing was laden with other fascinating points. It seemed like half of London was packed into the theatre they hired for the venue, but for those of you who weren’t there here are four other observations:

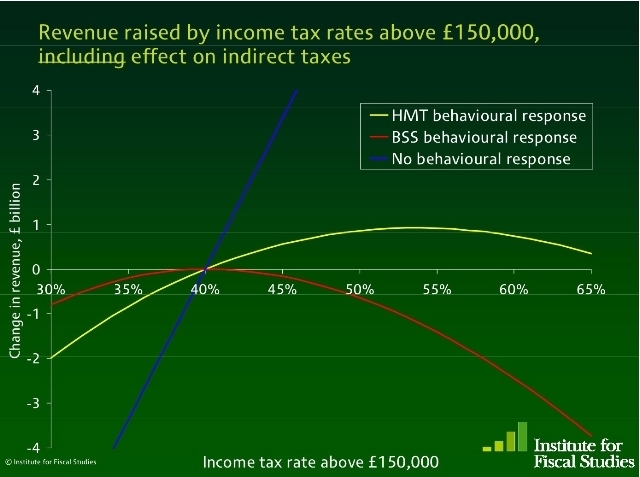

1. The 50p tax will not raise £2.4bn and may lose money. Crucially, when Darling estimated he’d squeeze £2.4bn from his 50p tax he didn’t factor in the fairly obvious point that the super-rich won’t be spending money that is being taken from them. So “the lower indirect tax revenues could eat up most of the £2.4bn” says Stuart Adam – he reckons about £1.5bn and questions the £2.4bn figure. The IFS stress that there are many models to factor in avoidance, etc, and that Darling has closed down one escape avenue: pensions. Adam’s conclusion: “Its quite possible the Treasury may get some money from this [50p tax]. It’s also possible that they will lose. But if they do get money in, it’s unlikely to be as much as the £2.4bn they forecast”.

What fascinated me was to see three rival Laffer-esque curves – everything depends on the assumptions. The Treasury use their own curve, the workings of which are a mystery but helpfully make the case for a 50p tax. The IFS curve (in red, below) makes the case against a 50p tax. If this were America, there would be scores of taxpayer-championing think tanks scrutinising the assumptions in these curves, and working out if they justify high taxes. It’s not static scoring: that is in blue. So here, for the first time ever, the Treasury’s deformed and highly suspicious Laffer curve (yellow). Seriously, debates about the assumptions behind these curves will define Britain’s fiscal future:

2. Debt Freedom Day – 7 Feb 2032. “Debt will rise quickly and remain high for a generation” says Carl Emmerson. He suggested a “debt freedom day” that will arrive when net debt hits goes back below Brown’s 40% target: 7 Feb, 2032. Here’s his graph:

3. Another pensions raid is likely. The IFS didn’t say as much, but pointed out the logic. If the Treasury says it is “unfair” and “anomalous” that people can get higher-rate relief above £150k, then why not £70k or £100k? The IFS produce the following graph on pension relief rates for various income groups. This struck me as a prime target for the Treasury to flatten when (and it will be when) the next black hole opens in the accounts. And this, I suspect, will be the next grab.

4. Fuel duty protests ahoy? The duty escalator was made into a time bomb in the Budget, timed to detonate about the time of the election after next, when the fuel duty will be back to the levels during those June 2000 fuel protests. You have to hand it to Brown: he thinks of everything.

Comments