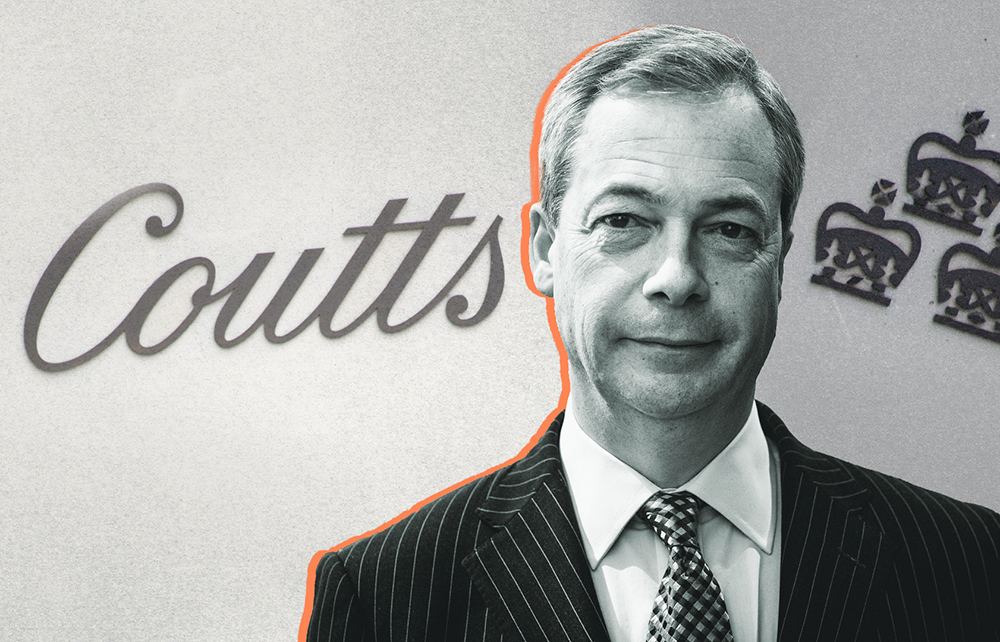

Nigel Farage’s cancellation by Coutts and Co – a blackballing which seems to have extended nationwide – brought to mind two similar events with which I had to contend a few years ago.

First, in the East, where I was fortunate to have a flexible bank manager who allowed me to step behind her PC and spy next to my name the words ‘politically exposed’ – affixed by an American credit agency which knew the square root of nothing about me, save what some bot had picked up from Google. ‘This will be on most banks’ systems in the world,’ I was informed, ‘and the majority of them will close your account or won’t allow you to open one in the first place.’

Thankfully, common sense prevailed and we were able to circumvent the problem. More alarmingly, however, was that this red flag extended to my adolescent children simply by dint of their association with me.

The implications here are totalitarian

The second incident occurred in the United Kingdom where my experience was identical to Farage’s – a bland notification that I had two months in which to withdraw any funds and place them elsewhere (if elsewhere would have me). Further enquiries revealed that the bank was under no obligation to inform me of its reasons and, moreover, that any investigation by the Banking Ombudsman, were I to lodge a complaint with him and even were he to find in my favour and have my account re-instated, would leave these reasons occulted.

We are all in agreement: the implications here are totalitarian. What is someone who is cancelled in this way to do, especially now that cash is being phased out to the extent that we are forced to operate a bank account (in itself surely unconstitutional)?

But the real point is that once cash ceases to exist and we jump to the next inevitable phase, namely centralised digital currencies – as being put in place by China – a more effective means of total control would be difficult to imagine. One day, someone like Farage could find himself in a distant country, the victim perhaps of some medical emergency, but because his social credit rating will have dropped beneath the required threshold – due to his opinion, for example, that a country should be able to govern itself – he will be stranded, unable to transact, will starve and will die. That kind of power is the logical and intended destination. However, another, more urgent imperative is at play, quite apart from control – survival.

The banks are bust. There is no prospect of the debts on their books, fraudulently described as ‘assets’, being repaid. Why not? Because the repayment of loans in the virtual economy which grow as a function of interest is based on the assumption of a corresponding growth in the real economy. That assumption, in a limited world, no longer holds – no matter how many times politicians too unimaginative to break away from the inadequate neoclassical economics taught to them at university repeat the mantra ‘growth, growth at all costs.’

Take cash. If it ceases to exist, then runs on the banks are more difficult. We can no longer queue at the teller to withdraw our funds, as occurred in Cyprus in 2012-13. Yes, we can move, electronically, our money out of Barclays and into HSBC but it remains within the system. HSBC can now pass those funds back to Barclays overnight for the books to be balanced and the House of Cards remains upright, for the time being.

The game therefore is to delay the evil hour when these debts are written off (as occurred regularly under different regimes throughout the ancient world) and the power of the tiny few who hold these instruments at the expense of the rest of us, evanesces. Which brings us back to Nigel Farage, who has long grasped this point. In his first speech after Brexit, he said that the vote represented not only a victory against an undemocratic and faceless bureaucracy in Brussels but ‘against the big merchant banks and big businesses.’

In short, Farage understands that Brexit, debates about sovereignty and what’s often called ‘populism’ are but subplots to a bigger story — the continued expansion of international capital’s power, given free passage by globalisation, to the point, via the medium of debt and banking, that we end up owning nothing and being the happier for it.

He grasps how Marxist and neoliberal economics lead to the same end point: the concentration of power and wealth in the hands of the state and a political elite in the former instance, and in the hands of large corporations and financial institutions in the latter. Flip sides of the same counterfeit coin.

Farage is right to fight for his right to bank. Viscerally, it is wrong that in an age in which having an account is a matter of life and death, such accounts should be closed without reason given. Quite the reverse: if a person has funds, and especially if he operates no other account, then his right to open one should be presumed in law. His obtaining of Coutts’s memos by means of a Subject Access Request reveal that his political opinions caused his persona non grata status, as opposed to some poppycock about his comparative poverty. There is now outrage across the political spectrum. And it seems likely that the banks’ ability to shut down accounts in this way, without legitimate reason, will be curtailed if not outlawed.

Farage’s channel, GB News, is facing some criticism for running a campaign to save the use of physical cash. But it’s a noble cause: cash represents a challenge to state and bank control. Our banknotes are legal tender. No shop, no restaurant, no financial institution, no service provider should be allowed to reject them as a form of payment.

We should all try to use cash more. We need to break bad habits. Swiping cards may be convenient but every time we do so a record of where we have been and when is registered and allows for a system of surveillance almost as effective as the nationwide network of CCTV cameras.

While Farage is at it, and if he’s considering another tilt at parliament, he should also draw more attention to another single issue: the question of debt and the slavery it brings, for this is the day’s most pressing concern by far.

Farage knows in his bones how freedom and sovereignty are fused and how the former is not simply defined by the ability to vote every five years for one set of clowns or another. Perhaps then his recent misfortune at the hands of the banks will be a blessing for him and the country.

Comments