Rachel Reeves’ Treasury team and the No. 10 communications staff should enjoy a drink tonight. The Spring Statement is a success, at least in the terms that matter most to the Chancellor.

That statement is probably most important for what it tells us about Reeves’ priorities. She’s more worried about the gilt markets than about Labour backbenchers.

That’s sensible, but also quite revealing about the condition of Britain in the 2020s. Britannia, which once ruled the waves, is now ruled by the markets.

Reeves had to cut spending to do two things: maintain the projected gap between spending and revenue (the ‘fiscal headroom’), and meet her own fiscal rules, thus demonstrating to bond markets the government’s fiscal discipline.

Another episode of this drama would be no surprise in the autumn when the full Budget approaches

In that, she succeeded. Forecast gilt issuance is down a bit and the markets are calm. That’s also a testament to a well-executed communications strategy around the statement. Markets hate surprises and there were no surprises here. In macro terms, she did what she had signalled she would do.

Of course, the micro details are politically agonising for Labour MPs, and personally painful for many welfare claimants.

But Reeves, by necessity, has put those groups below bond traders in her order of priorities. After a scare over spiking yields earlier this year, the Chancellor knew she had no other choice. A fiscal statement in which she didn’t demonstrate that she was willing to ensure a bit of balance in her budget could have sent UK borrowing costs up again, risking political disaster.

Hence a package of cuts that makes some Labour MPs very nervous. ‘Always shoot the crocodile closest to the boat’ is generally sound advice and that’s what Reeves has done today: address her biggest, closest problem.

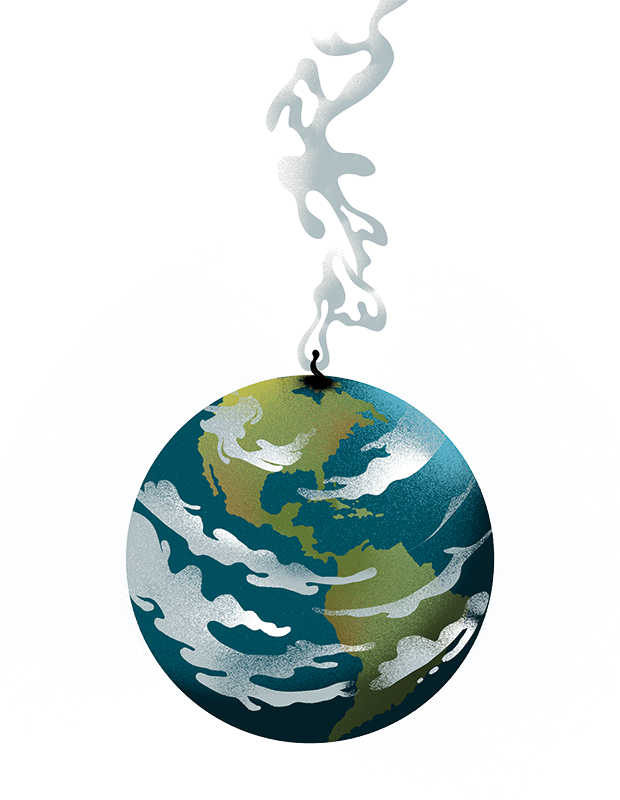

For now, at least. Because Britain’s large stock of debt, low growth rates and chronic overspending mean that gilt buyers are going to remain important players in UK politics for the foreseeable future.

Here’s a key line from the OBR’s Economic and Fiscal Outlook:

Were Bank Rate and yields on gilts issued across the forecast to both be 0.6 percentage points higher, less than the 1 percentage point volatility in 10-year gilt yields since early October, it would be enough to eliminate the headroom against the fiscal mandate.

Translated into human-speak, a move in bond markets smaller than those experienced in the last six months would be enough to wipe out all the savings Reeves has just extracted from welfare. A few bond investors getting nervous could decide that all today’s political pain had been for nothing, and the Chancellor would have to cut more and/or tax more.

So another episode of this drama would be no surprise in the autumn when the full Budget approaches.

Here, it should be noted that neither Reeves is hardly the first politician to accept, reluctantly that now matter how might you are, the bond markets are above you.

A classic text here is Bob Woodward’s 1994 The Agenda, which chronicles the first years of the first Clinton administration.

In that book, it was revealed that Clinton, elected to the most powerful office in the world and full of charisma and energy, was still subject to the force of fiscal gravity, asking his economic aides:

You mean to tell me that the success of the program and my re-election hinges on the Federal Reserve and a bunch of fucking bond traders?

Why is Britain at the mercy of the bond markets? No matter how hard her critics try to argue otherwise, this situation was not caused by Chancellor Reeves. She’s been in the job for nine months but the UK’s weak growth and weak public finances are the consequence of years of decisions made by a succession of governments, of all parties. We have lived beyond our means for years, without properly investing in the things that deliver higher growth and without removing the obstacles to that growth.

That’s because addressing our structural economic problems is hard and slow and generally unpopular. It’s easy to demand fundamental cuts in the size of the state, but cutting the benefits bill (which includes the state pension, don’t forget) inevitably meets public and political resistance. Likewise supply side reform: Labour’s NIMBY wars are just beginning. And let’s not even talk about increasing labour supply, either via immigration or higher retirement ages.

All the sensible, incremental stuff that Reeves is doing to address Britain’s structural economic challenges is welcome, but is unlikely to be big enough or quick enough to solve those problems in this Parliament, or the next.

The Chancellor has done the sensible thing and shot the crocodile closest to her boat. But the bond-croc isn’t dead and this story is far from over.

Comments