After a two-hour phone call last month, Donald Trump and Vladimir Putin announced that an improved bilateral relationship between the United States and Russia ‘has huge upside’, including ‘enormous economic deals and geopolitical stability’. Days later, however, Trump said he was ‘pissed off’ with Russia over its foot-dragging on a ceasefire in Ukraine. Putin’s demand, moreover, that Ukraine’s government be replaced with a transitional one had made him ‘very angry’. Trump warned that if a deal couldn’t be struck, then the US would ‘put secondary tariffs on all oil coming out of Russia… That would be that if you buy oil from Russia, you can’t do business in the United States. There will be a 25- to 50-point tariff on all [Russian] oil.’

Secondary sanctions – or a slump in oil price, which fuels the Kremlin’s war machine – are two threats that Putin should be taking very seriously. Despite hundreds of sanctions imposed on Russia by the US and the EU, Russia’s main exports – oil and gas – have never been restricted in any meaningful way. The EU has paid far more money to Russia for energy during the Ukraine war than it has sent to support Kyiv’s defence.

The reason why Moscow’s ability to export oil and gas has remained largely untouched is simple. Remove Russia, the world’s largest energy exporter, from the global energy supply and a massive spike in oil prices will ensue. And sanctioning Russia’s main customers would involve launching a massive trade war with India, China and Europe. It would make the recent turmoil following Trump’s tariffs look puny by comparison. What Trump has threatened is the economic equivalent of a nuclear strike – and just like a nuclear strike, the fallout will blow back on the US too.

The question is whether Trump would ever go through with his threat to squash Putin if he refuses to play ball. For now, the mood in the White House seems to be heading very much in the opposite direction. Russia is one of a tiny handful of countries exempted from Trump’s tariffs (Moscow’s lucky companions include Cuba and North Korea).

The Kremlin, clearly rattled by Trump’s disapproving noises, has taken a new tack in negotiations. Figuring that the way to get on Trump’s good side is to offer him a fantastic deal, Putin has deployed his smoothest, most American-friendly acolyte to sweet-talk Washington.

Kirill Dmitriev, 49, was born in Kyiv but was sent to school in California aged 14. He’s an alumnus of Stanford, Harvard Business School, Goldman Sachs and McKinsey. For a decade he has run the multibillion-dollar Russian Direct Investment Fund. Yet Dmitriev’s more important role has been as Putin’s go-to man for back-channel diplomacy with the United Arab Emirates and Saudi Arabia. He has also held meetings with key Trump allies. Unlike some of the old KGB bruisers who joined him on the Russian negotiating team during recent ceasefire talks in Saudi Arabia, Dmitriev dresses and speaks like the American banker he once was.

The Kremlin’s pitch to the White House last week was designed to push three key Trump team buttons. One, appeal to Trump’s greed and his credo of The Art of the Deal. Two, address Trump and J.D. Vance’s curious obsession with Greenland and the control of the Arctic’s resources and sea lanes. Three, following Vance’s comments that ‘the best security guarantee [for Ukraine] is to give Americans economic upside’, to put together a better offer on profits – starting with rare earths and other minerals – than Ukraine could ever hope to match. This is pertinent since Volodymyr Zelensky has just rejected the latest version of Trump’s minerals deal as being too exploitative.

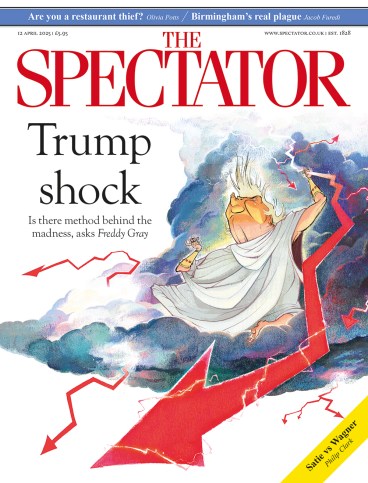

Trump has threatened the economic equivalent of a nuclear strike – and the fallout will blow back on the US

The shiny bauble that Dmitriev put on the table last week was a carve-up of the Arctic – ‘the gateway to Earth’s crown jewel’, as he put it, and humankind’s ‘next frontier’. According to Dmitriev, the frozen North contains 13 per cent of the world’s untapped oil and 30 per cent of its gas and represents a ‘trillion-dollar opportunity’. Plus the Northern Sea Route from Asia to Europe and North America will see 260 million tons of shipping a year by 2035 – ‘a 30-40 per cent faster Europe-Asia trade path vs Suez’, Dmitriev claimed.

In contrast to the apocalyptic threats issued by some Kremlin propagandists, Dmitriev’s message on US-Russia relations has always been unrelentingly upbeat and focused on mutual enrichment and world peace. He even recently suggested that Russia could provide a miniaturised nuclear reactor to power Elon Musk’s planned SpaceX colony on Mars.

Perhaps most cunningly of all, the Kremlin has deliberately not asked for sanctions relief as a part of any Ukraine ceasefire negotiation. Russia may have the economic juice to continue fighting for years – as long as it keeps exporting oil and prices hold up. But its defence-spending-driven economic boom is faltering, interest rates are high and there are chronic labour shortages. The MOEX Russia Index lost 8.05 per cent in the wake of post-tariff turmoil despite the country being exempt. Russian banks’ exclusion from international payments systems has forced expensive and impractical workarounds in order for Russia to be paid for its exports not only of energy but also grain and fertilisers.

The Kremlin’s biggest bluff, though, is presenting the prospect of US-Russian economic co-operation as a great sunlit upland of mutual profit. Just ask Mike Calvey, the one-time most prominent US banker in Russia and cheerleader for foreign investment, who was jailed in 2019 after falling foul of corrupt FSB chiefs. Calvey’s brilliant new memoir, Odyssey Moscow: One American’s Journey from Russia Optimist to Prisoner of the State, details the profound depths of cynicism and lawlessness of Putin’s kleptocracy – and how little the Kremlin cares for its image or for the interests of foreign investors.

Over Putin’s years in power, BP, Shell and other major western companies have been blatantly shaken down – and, in the aftermath of Putin’s 2022 invasion, hundreds more were essentially plundered by state-connected crooks: Danone, McDonald’s,Ikea, Starbucks, Volkswagen, among others.

Whether Trump will go for – or perhaps fall for – the Kremlin’s offer of co-operation is anyone’s guess. For the moment, the UK and EU remain (in principle at least) committed to maintaining economic pressure on Russia and supporting Ukraine’s war effort. In February, the Foreign Secretary David Lammy announced the ‘unleashing’ of ‘one of the largest sanctions packages ever levelled at Russia… We are starving the engine that fuels Putin’s war machine.’ The EU Commissioner Kaja Kallas called the latest sanctions the ‘most devastating ever’. But drill down into the details and Europe isn’t even close to hitting Putin where it hurts. Last year, the EU increased imports of Russian liquefied natural gas by 25 per cent, making Moscow the continent’s second-largest supplier after the US.

Europe has also expanded the list of oil tankers under sanctions – ignoring the fact that Russian oil itself is not, in fact, sanctioned. Instead, Urals Crude is subject to a price cap of $60 a barrel. Yet since the market price has recently dipped to $52 on global recession fears, the cap is close to meaningless. Meanwhile, Lukoil, Russia’s largest private oil company, continues to operate major refineries in the Netherlands, Romania and Bulgaria.

As the EU announced new sanctions, it also quietly agreed not to make further attempts to confiscate the approximately €240 billion worth of Russian assets it holds, choosing instead to merely freeze them until the end of the conflict. In July, the entirety of EU sanctions come up for their regular six-monthly renewal and have to be approved by a unanimous vote. Hungary has already signalled that it intends to veto the package. That may be a ploy to extract concessions. But if Trump does succeed in brokering a ceasefire, even an imperfect one, it’s hard to see the EU maintaining unanimity for sanctions.

Moreover, Europe has a much greater potential economic upside from reopening economic ties with Russia than the US. Hungary and Slovakia are keen to resume imports of piped Russian gas, which were suspended in January. One of the four Nord Stream pipelines under the Baltic, meanwhile, remains intact and the other three – blown up by saboteurs in September 2022 – are repairable. Germany’s rising AfD party campaigned on a programme of restoring cheap Russian gas.

Western leaders once viewed sanctions as a tool more powerful than armies. Instead, it seems that the greatest threat to Putin’s economy is not Trump’s threats of sanctions but a collapse in oil prices, which will do more damage to Russia than the West’s toothless sanctions ever did. And today, with the Kremlin offering so many real and imagined economic goodies, Trump’s threats to bring down economic fire and fury on Russia look increasingly hollow.

Comments