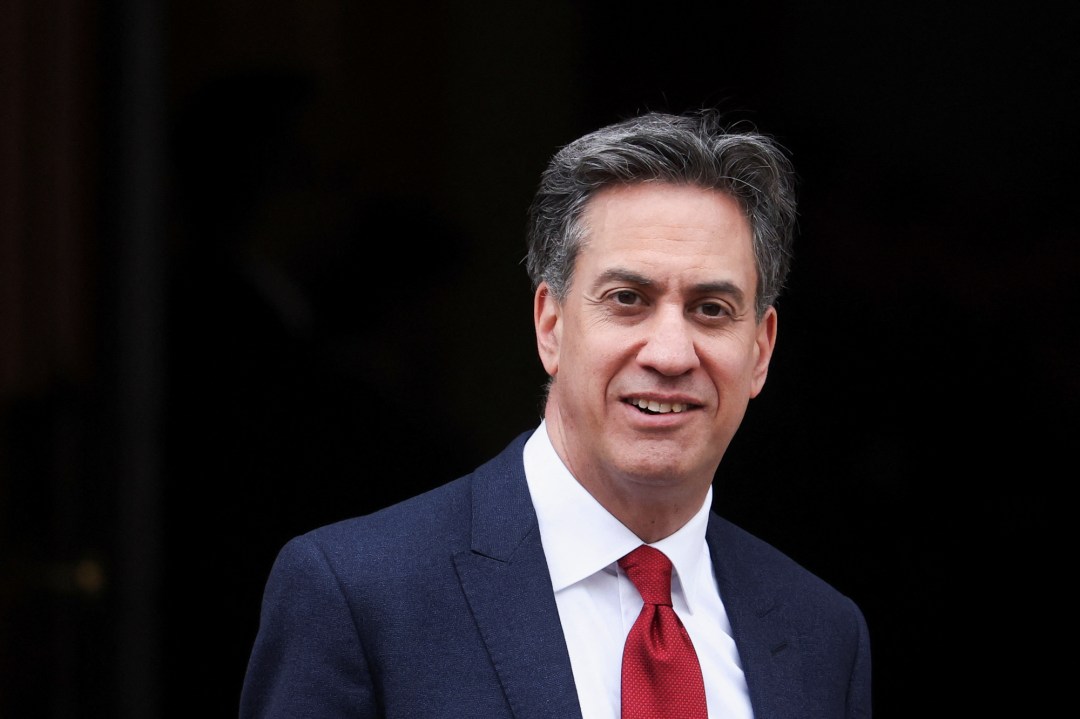

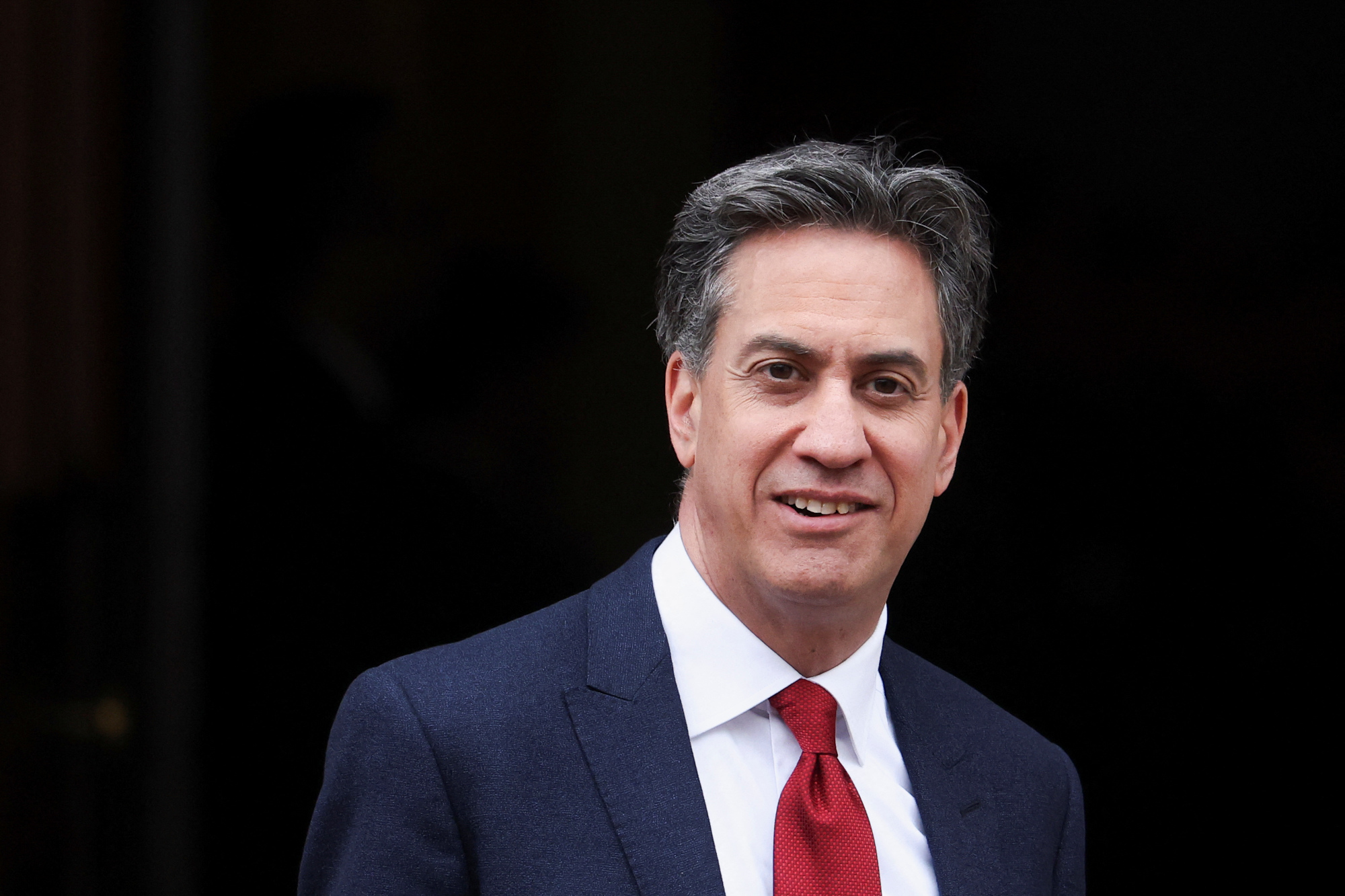

It’s official: subjecting oil and gas companies to a 78 pence tax rate (which is corporation tax plus the government’s windfall tax) doesn’t increase energy prices in the UK. That is what Ed Miliband told us on Sky News this morning, so it must be true. He will no doubt be hoping that we don’t look at the figures published by his own department which show that gas consumers in Britain pay an average of 10.17 pence per kilowatt-hour while US consumers – where the oil and gas industry is encouraged rather than taxed to near-extinction – pay the equivalent of 4.04 pence.

Sky's @WilfredFrost questions the Energy Secretary Ed Miliband on whether UK gas prices would decrease if the tax rate of 78% on energy companies was lowered by the government. https://t.co/TC2ROCL7wW

— Sky News (@SkyNews) April 24, 2025

📺 Sky 501, Virgin 602, Freeview 233 and YouTube pic.twitter.com/w1QPD01XbZ

Ed’s argument – which is a standard argument put forward by advocates of ditching fossil fuels in favour of wind and solar – is that gas is a commodity traded on international markets, the prices in which are fixed by what he keeps calling (although he didn’t use the term in this morning’s interview) ‘fossil fuel dictators’. Therefore, argues Miliband, it doesn’t make a blind bit of difference what the UK government charges the industry in tax; we will be paying the internationally-set price regardless

There are several things wrong with Miliband’s analysis. While Britain is not a major producer of gas, we do still produce a useful amount – we accounted for 0.8 per cent of global production in 2023. If you suddenly took that 0.8 per cent out of global gas production, say by taxing the industry out of existence, the world would notice. But even if you discount Britain’s influence on global gas prices, the market is not in the hands of dictators – the largest producer, by some distance, is the US.

Secondly, contrary to what Miliband imagines, users of gas around the world do not all pay the same price. There are all kinds of contracts, long and short-term, involved. US gas prices are largely set by what is called the Henry Hub price, while European prices conform more to the TTF price (Title Transfer Facility) based in the Netherlands. The latter is currently around three times as high as the former; at the height of the energy crisis in 2022 it was more than five times. But even within Europe there is a spread between the TTF price and local prices.

There is a very good reason why there are regional gas prices – distributing it requires a lot of infrastructure. Buying gas is one thing; but it also costs a lot to transport, especially when you are transporting it by ship in liquified form – as we are increasingly are as our own gas supplies from the North Sea dwindle. That requires the gas first to be cooled to form a liquid. Then it needs to be kept refrigerated for the journey, before being regasified so that it can be used. The whole process consumes about a tenth of the energy contained within the gas itself. There are also costs involved in transporting gas by pipeline. The more gas we can produce locally, the more we can lower the transport costs. Here is where the 78 per cent windfall tax on North Sea oil and gas production comes in. By disincentivising local gas production in the North Sea it is forcing us to import a greater quantity of expensive LNG.

Thirdly, there is the issue of national energy security. Governments don’t just have to sit there, powerless in the face of international commodity markets. Ultimately, if there is a price spike caused by supply problems somewhere in the world, they can impose an export ban on gas – or any other commodity – in order to protect their own consumers. Were global gas supplies to be disrupted, in other words, a gas-rich country would not necessarily have to suffer as much as a gas-poor one.

When it comes to green electricity Miliband argues that native production helps keep prices low and supplies secure – even though electricity, like gas, is now traded across national borders. Funny, though, he won’t accept the point when it comes to oil and gas. I wonder why.

Comments