In my cover story for this week’s magazine, I say that the damage of the 50p tax, various bank

levies and general banker-bashing is far greater than Osborne realises. Here are the top points I seek to make:

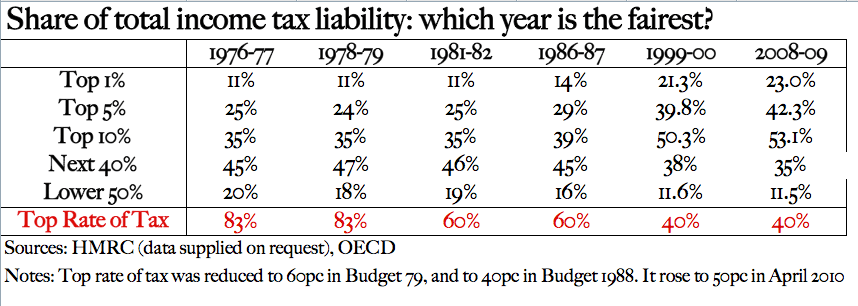

1. We may hate to admit it but the British tax base, and our chances of reducing the deficit, are heavily reliant on a handful of very rich people. The highest-paid 1 percent will

generate 23 percent of income tax collected in the UK in the year before the 50p tax (see the table below). And spot the correlation between the top tax rate, and the burden shouldered by the

richest and the poorest. Which are the most progressive – the figures on the right, or the figures on the left?

2. As JFK said, the “paradox” is that higher rates mean less revenue. This is basic economics, true long before Art Laffer tried to explain it by drawing a yield curve on

a cocktail napkin. Even the IFS suggests the 50p tax will lose £800 million. But this study assumed the ultra-rich are no more mobile now than they were in 1988. Obviously, the real impact to

Britain will be far higher.

3. The Taxpayers’ Alliance did the figures for us, and put the cost of the 50p tax at £4.5bn. This suggests the 50p tax is the single most expensive coalition policy. (Pupil premium: £2.5bn. Extra social care: £2bn. Regional Growth fund: £1.4bn. Green Investment Bank: £1bn). This is £4.5bn of extra tax that the not-so-rich will have to pay, or £4.5bn extra that we have to cut. To put this into perspective, the defence cuts will save £2.3bn. Isn’t it better to tax the rich in a way that actually raises money, and not degrade defence?

4. The ultra-rich in Britain come in all shapes, sized and colours. The Swiss press have pieces about “Les Traders Anglais” – but the people in the case studies are Americans, Japanese, French, etc. No data is taken on the ultra-rich, but a useful proxy is the Sunday Time Rich List. When it was launched in 1999, just 11 of the top 100 were immigrants. Now, it is 40. Given that a third of Londoners are immigrants, we can expect the nationality of the super-rich to be around this ratio. People who uprooted themselves to come here can leave just as easily. It is true that Brits, and others with kids in English schools, will moan about the tax but stay put. Even the TPA study suggests that the tax will raise £5.2bn this year. But it will chase away (or deter) £9.7bn of tax. The net result is £4.5bn.

5. It’s not just people leaving Britain – it’s people not coming. George Osborne was the one to break the truce on the non-doms. The £30,000 charge has now led to a 25 percent drop in folk applying to come here, according to the FT, thereby leading to less money. A recent Gallup global poll asking people where they’d like to emigrate to found Britain ranking behind Saudi Arabia and Kuwait. Again, anecdotal evidence from global corporations tells of the trouble they have of recalling staff to work in London. The gulf in tax is just too big.

6. It’s not just the 50p: it’s the bonus levy, the global assets levy and the overall mood music. People who give up their citizenship do not do so in a pique. Companies relocate for lots of different reasons. Normally, countries fall into one of two categories: those who see the rich as sacred golden geese, and treat them accordingly (as Britain did from 1988 to 2008, with spectacular results for our national wealth). Then there are the countries led by leaders who succumb to popular mood, and come at the golden geese with a carving knife. Britain has a Business Secetary who talks about a capitalism which “takes no prisoners, and kills competition where it can,” and even Osborne felt it necessary to insert a banker-bashing paragraph into his Spending Review speech. The bankers may well believe that Osborne is, at heart, a low-tax Tory – but one who feels that, for tactical reasons, he needs to whack bankers. There are simply too many who won’t stay around to be whacked.

7. I’m all for taxing the rich in these austere times – but in a way that raises money. There are things Osborne could have done that raise money: a luxury goods tax, a stamp duty tax, a tax on consumption that does not scare away the very people we need to fill this black hole in the budget.

8. Around the world, countries lower the top rate of tax – it’s because they want more money, not less. Look at this KPMG study and see how tax has moved over the years. Germany, France, Spain, Denmark, Italy, Singapore, Australia, Sweden – there are 36 countries who have cut the top rate of tax. Russia has kept it flat at 13 percent, most Arab states have it flat at 0 percent. The Western tax-risers are Greece, Iceland and the UK. This is why such a manoeuvre can be seen as an act of desperation – it is seldom indicative of a country acting for the long term.

9. But this comes down to – dare I say it – fairness. I define a fair tax system as one where the burden falls greater on the highly-paid: in other words, the right-hand scale of that table above. Many on the left, John Rentoul included, define fairness as the left-hand scale. It’s whether one values intentions more than outcomes. Left and right do tend to be divided on this point.

10. The banker-bashing is accelerating a trend, where wealth moves from West to East. People want to live in the East because that’s where the action is. At a time when Britain needs to go out of its way to keep its status, to maintain London’s role as Rome of the globalised world, we’re shooing them all the way to Switzerland and Singapore. It may play well politically. But it will make poorer taxpayers pay more.

UPDATE: My friend Jason Beattie takes me to task for the above in the Mirror, saying “I

am not sure how Fraser wants to raise income to pay for the police, rubbish collection, teachers and the Armed Forces”. My answer: by taxing the rich in a way that actually raises money.

“What is the price of a few rich people with no social conscience leaving the country?” About £4.5bn, which Mirror readers would have to help pay. In these austere times. A

politicians’ indulgence that no one can afford.

P.S. You can buy the current edition for £3.20 in the shops, £2 direct,

£4.99/month on iPad (free to subscribers) or join our subscribers from just £1/week. Click here for further information.

Comments