Matthew Lynn says shareholder activist Eric Knight is right to castigate HSBC’s strategy, and that the bank’s deeply religious chairman Stephen Green now faces a battle to hang on to his job

When he isn’t running the world’s second biggest bank, Stephen Green, the chairman of HSBC, is an ordained priest and amateur theologian. In 1996 he published Serving God? Serving Mammon? Christians and the Financial Markets, in which he explored whether you can do the Lord’s work whilst also commuting to Canary Wharf every morning to do battle in the boardroom and kick ass on the trading floor. ‘Christians can serve God in the world of finance and commerce, but it is also possible to fall into the trap of serving Mammon there,’ he wrote. ‘Yet the kingdom of God can be found in the thick of the markets.’

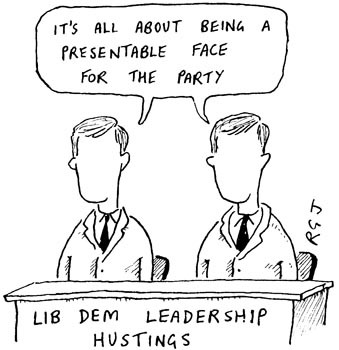

The trouble is that some investors and analysts — predictably, you might well argue — have been signalling that they would like a bit less theology and a bit more Mammon. In the past few months, Green and HSBC have been on the receiving end of a ruthlessly orchestrated campaign by the Monaco-based hedge-fund manager Eric Knight and his firm Knight Vinke. After building up a stake in the bank, Knight had been pushing for an overhaul of its strategy. His campaign has culminated in a series of full-page newspaper ads that called on HSBC to consider ‘radical alternatives’ to ‘unlock the very substantial value of the group’.

What happens to HSBC matters. Britain has only a handful of truly world-leading multinational companies: BP, GlaxoSmithKline, Vodafone, HSBC. But once aggressive, publicity-savvy hedge-fund managers sink their teeth into you, however big you are, the outcome is rarely in doubt. It’s not long since another hedge fund, TCI, started picking holes in the strategy of another major international bank, ABN Amro — which in consequence is about to fall into the clutches of Royal Bank of Scotland, Fortis of Belgium and Santander of Spain and be carved up between them.

Could a similar fate await HSBC? It’s probably too big to be taken over: with a market capitalisation of $230 billion, it is the 13th largest company in the world. But that doesn’t mean the board can’t be swept away by a shareholder revolt, nor that the group could not be broken up. Either way, Stephen Green may be in need of celestial intervention to save his career.

It would be hard to conceive of two men with two more different takes on the financial markets than Green and Knight. With a Dutch mother and a father who worked for the US multinational Dow Chemical, Knight was born into the globe-trotting executive classes. Young Eric was educated at Eton, Cambridge and Massachusetts Institute of Technology; he became an investment banker, and then, like so many of his generation of smart young financiers, set up his own hedge fund. Knight Vinke has backing from CalPERS — California’s state pension fund, the largest in the US — which means it carries real clout. His strategy is very simple. He picks up stakes in big, underperforming companies, then rallies shareholders to force change. His past targets have included Shell and the French utility Suez.

In some respects, Green is chiselled from the same stone as Knight. He is a product of Oxbridge (though Oxford rather than Cambridge) and also completed his education at MIT. But he started his career with the Ministry of Overseas Development, then did a spell with McKinsey before joining HSBC in 1982. In profiles of Green, one word recurs again and again: cautious.

The case against HSBC boils down to what Green might call sins of omission rather than commission — not so much that the bank has done stupid things, although there have been a few, as that it has left too many opportunities on the table.

HSBC is a curious beast, born out of colonialism yet despite that, perfectly placed to ride the wave of 21st-century globalised capitalism. It was founded as the Hong Kong & Shanghai Banking Corporation by a Scotsman, Thomas Sutherland, in 1865, and has always been dominated by Scots. For much of its history, it was just one among many colonial banks — until the explosive post-war growth of Hong Kong and southeast Asia carried it into a higher league. In 1992 it came home, both metaphorically and financially, buying the Midland Bank and switching its headquarters to London.

HSBC’s development may have much to do with the luck of being in the right places at the right time, but it is hard to think of a better inheritance. It has a mighty presence in London, which has outsmarted New York in the last decade to become the world’s most powerful financial centre. It owns one of the leading retail banks in Britain. It has a powerful presence in rapidly-industrialising China: when you consider that seven of the 20 biggest companies in the world are now Chinese, it is hard to see how any well-managed bank could fail to make a fortune there. Throw in assets in the Middle East, the US and South America, and there’s no bank in the world that packs more potential punch than HSBC. And that’s the problem. There isn’t much sign of the right jab.

Like the mighty Liverpool football club of the 1970s and 1980s, HSBC has a tradition of grooming managerial talent from within. Green took over from Sir John Bond who took over from Sir William Purves — both having clocked up more than four decades of service in the HSBC hierarchy. There are strengths in that system, which was, after all, how every big bank groomed its future chiefs until a few years ago: the business is run by men who understand it, are passionately committed to it and nurture it over many years. But the downside is insularity and complacency.

While Asia has been on fire, HSBC has been looking in the other direction. The bank took a big bet on the US sub-prime business — oops — with the 2003 acquisition of Household International for $15.5 billion. And it has spent a fortune trying to beef itself up into a major investment bank, so far with little sign of success.

Household has been a catastrophe, cutting into profits as the sub-prime business went sour. It was the wrong time to be buying into the American trailer-trash sector — and plenty of people said so, even as the deal was signed. The investment banking side has fared little better. Under its co-head John Studzinski, HSBC’s investment banking arm went on a hiring spree, adding 1,400 people in 2005 alone. Investment bankers these days are almost as expensive as Premiership footballers, but HSBC’s didn’t perform on the pitch. There have been a string of defections, including Studzinski himself, who left for the private equity firm Blackstone. There’s not much league-table success to boast about either: HSBC ranked 13th for arranging share sales and 28th for advising on takeovers globally this year. For a bank with such inherent geographical strengths, this is a dismal performance.

The accumulation of mistakes has taken a toll. From the day before it bought Household, HSBC’s shares managed to climb only 25 per cent by September this year. By comparison, shares in Europe’s second-largest bank, Santander, rose by more than 110 per cent, and Switzerland’s UBS saw its shares rise by 84 per cent. It is no great surprise that other influential shareholders are starting to rally to Knight’s flag. New Star Asset Management’s Guy de Blonay has already voiced his sympathy for the campaign.

Belatedly, HSBC has been peddling back to Asia, making acquisitions in countries such as Vietnam and Korea. It’s hard to escape the conclusion that such moves are too little, too late. HSBC is a ‘large, complex, slow-growth bank’ according to a report by Goldman Sachs banking analyst Roy Ramos. Many of its shareholders think it should be a large, simple, high-growth bank. They jus t don’t think the present management team are the men to get it there — and it will be no use Stephen Green trying to remind them that forgiveness is divine.

Comments