Today’s Oxford-AstraZeneca vaccine update has raised hopes that life in Britain could start getting back to normal by spring. But cheers in Downing Street didn’t extend to AstraZeneca’s share price, which fell by nearly three per cent in response to the news. Why the dip in the wake of such good news?

AstraZeneca vaccine’s effectiveness – recorded at 70 per cent – is notably lower than its Pfizer and Moderna competitors. What’s more, the 70 per cent figure has been reached by averaging results from two groups who received the vaccine in different doses: a smaller group, who were given half a dose at first, recorded a 90 per cent efficiency rate, and the larger group, who were given two full doses, only a 62 per cent efficiency rate.

While there is plenty of reason to be hopeful about these vaccine developments, the mixed reaction to Oxford-AstraZeneca’s update serves as a reminder that not even the prospect of a vaccine can act as a silver bullet to all of our Covid woes. In the best case scenario – normal life resumes in the spring – the effects of locking down society for a year are set to linger long after societies are declared to be largely protected from the virus.

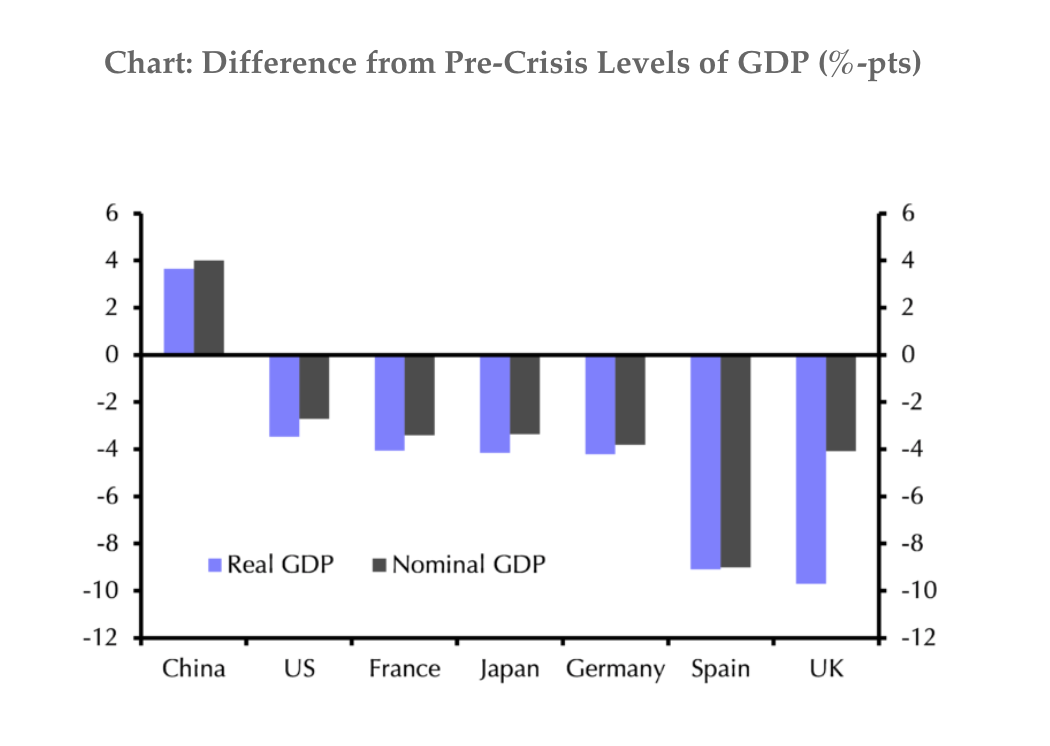

Capital Economics’s Neil Shearing warns that positive adjustments to economic forecasts, in light of vaccine success, must be interpreted with caution, as ‘rapid growth next year needs to be viewed in the context of large falls in output this year’:

The UK economy is still nearly a tenth smaller than it was at the start of the year. The abandonment of restrictions and social distancing next spring could result in rapid recovery, but a V-shaped boom would be occurring almost a year after original predictions suggested.

And while the combination of positive vaccine news and the extension of furlough until March next year will be boosting employer confidence, incentivising them to keep workers on their books until next spring, much of the economic damage has already been done. Unemployment has increased by 33 per cent for the over 50s this year. This is set to create serious, long-term pain, as many of those workers – plenty of whom will be over a decade away from retirement – will not easily find another job.

The prospects of getting a vaccine were already baked into some of the economic forecasts, which means there may be fewer revisions than expected. In the wake of the Pfizer vaccine announcement several weeks ago, Oxford Economics clarified they would not be revising their economic forecasts, as they ‘already assumed a vaccine would be available by mid-2021′. However, they noted ‘it does reduce the downside risks to the 2021 outlook as further lockdowns are now looking less likely.’

While the arrival of a vaccine would do wonders for the UK’s prospects of recovery, Europe’s ‘long Covid’ is not going to disappear overnight, especially as the data is likely to reflect a second economic contraction (albeit smaller than the first) this winter, due to the reintroduction of lockdown measures across the continent.

Comments