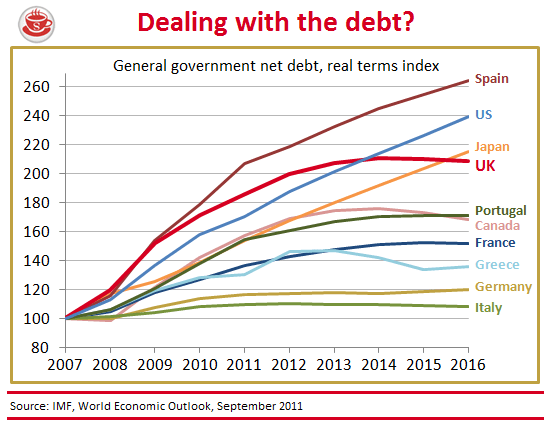

Why did Moody’s downgrade Britain to AAA with a negative outlook, but leave other countries on AAA? One crucial factor is the scale of our debt increase: 60 per cent over the parliament. You

won’t find it mentioned much today. The Chancellor is talking about austerity, helped by Balls who talks about his harsh deep cuts. Osborne today swears to keep ‘dealing with the

debt’ — but his definition of ‘dealing with debt’ would even make an Italian blush:

As Balls said on the radio this morning, the plan isn’t working. But Balls’ narrative — that Osborne is cutting harsh and deep — is untrue, as Moody’s knows. Osborne’s real plan is a

massive debt increase, bigger than Labour proposed, and as you’d expect this is doing precious little to help growth. Little wonder there are nerves abroad. The Chancellor now doesn’t even

have a plan to balance the books. His budget plans run all the way to April 2017, and even then he proposes deficits. It’s by no means clear how Britain will cope with this debt, given the

evaporating recovery — which looks pretty bad by international comparisons.

While America is gathering speed, here’s how we fare in comparison (the UK is in purple, at the bottom)::

I suspect it won’t be long before Osborne mentions his low gilt yields: the interest charged on a UK government ten-year note is now 2.13 per cent. Osborne has been a playing a tiny wee trick here, making out that this low figure is vote of confidence by the market in his deficit reduction plan — one not expressed towards the French and the Greeks. But he’s doing something they’re not: artificially lowering the cost of his debt with a QE scheme already up to £275 billion and (unlike America’s) devoted entirely to buying government debt notes. Pretty soon, the Bank of England (wholly owned by the UK government), will own a quarter of all UK government debt. The below graph, from a CitiBank report, shows the extent of BoE manipulation of the UK national debt market:

Without QE, and left to the markets, I suspect Britain would have lost its AAA rating a long time ago. As my colleague Jeremy Warner put it:

Perhaps Osborne has no choice but to do what he’s doing. But does that really mean that no-one should discuss what’s going on? In the downgrade debate today, I suspect no-one will mention what Moody’s sees all too clearly: the scale of the debt increase, and the effect of QE in keeping the price of government debt artificially low. To listen to Osborne go on about austerity, it’s easy to forget that he’s attempting one of the biggest debt increases in the developed world, midway through one of the weakest recoveries, all washed down by the biggest QE experiment the world has ever seen.‘Let’s get this straight. By switching on the printing presses, the Bank of England, which is 100pc owned by Her Majesty’s Government, is buying up a third of the debt owed by Her Majesty’s Government. The Treasury is becoming ever more in debt to itself. It’s as strange as that.’

For ideological reasons Miliband and Balls won’t mention debt, they don’t regard it as a problem. And because QE makes debt cheaper, neither will quibble with that either (Balls didn’t this morning). Osborne can only get away with his proposed borrowing binge if he can think of some ideas for growing the economy (Bruce Anderson outlines a few today). We’ll see in next month’s Budget if Osborne can do any better. Moody’s has today reminded him what will happen if he doesn’t.

PS Some CoffeeHousers take exception to my use of the phrase ‘downgrade’. Yes, we still have AAA but being switched to negative puts us on a different, lower grade. As were some others. But a notable list — The Netherlands, Sweden, Finland and Denmark — were left untouched. Orwell would have a field day with the use of language in economics: the way that Osborne claims he is ‘paying down the deficit’ (impossible, a deficit is an increase in debt) and the way Balls said Labour reduced debt, when he meant increased it (but decreased the debt/gdp ratio). Even the word ‘deficit’ is one understood by only a small minority; polls show most Brits think the national debt is falling. So I’m all for using straightforward language as possible, and when Moody’s puts is on a lower rating than we were before then I think we ought to say so.

Comments