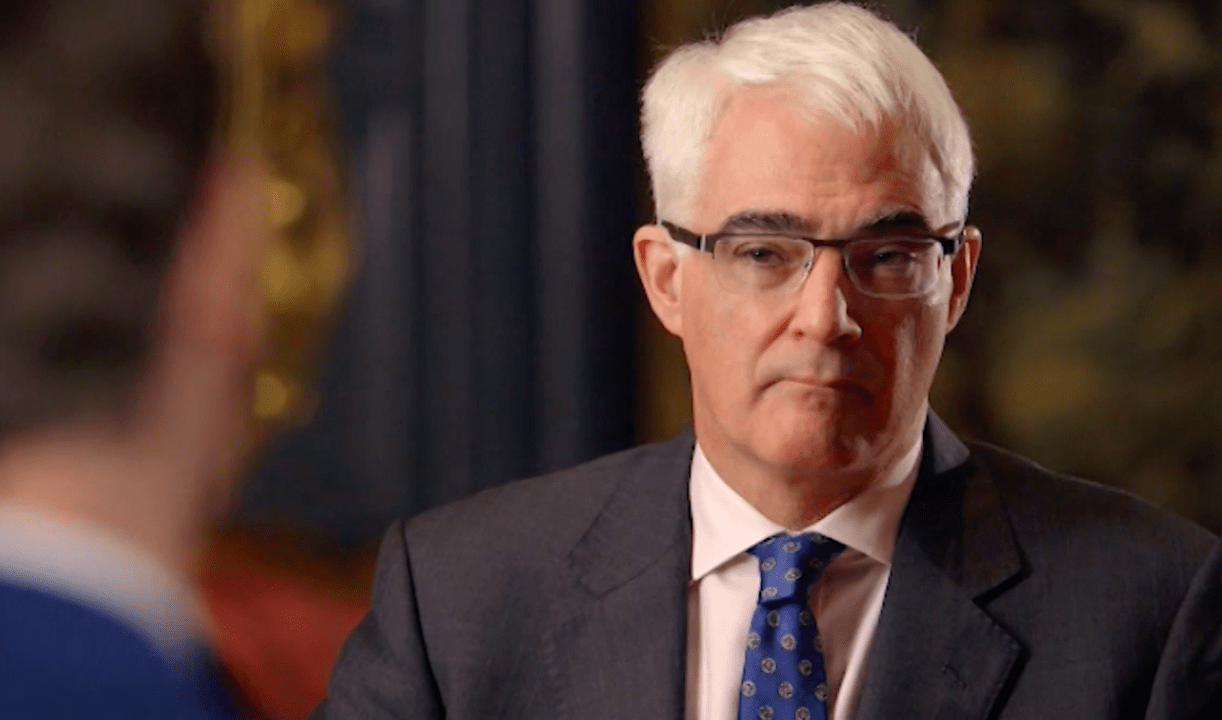

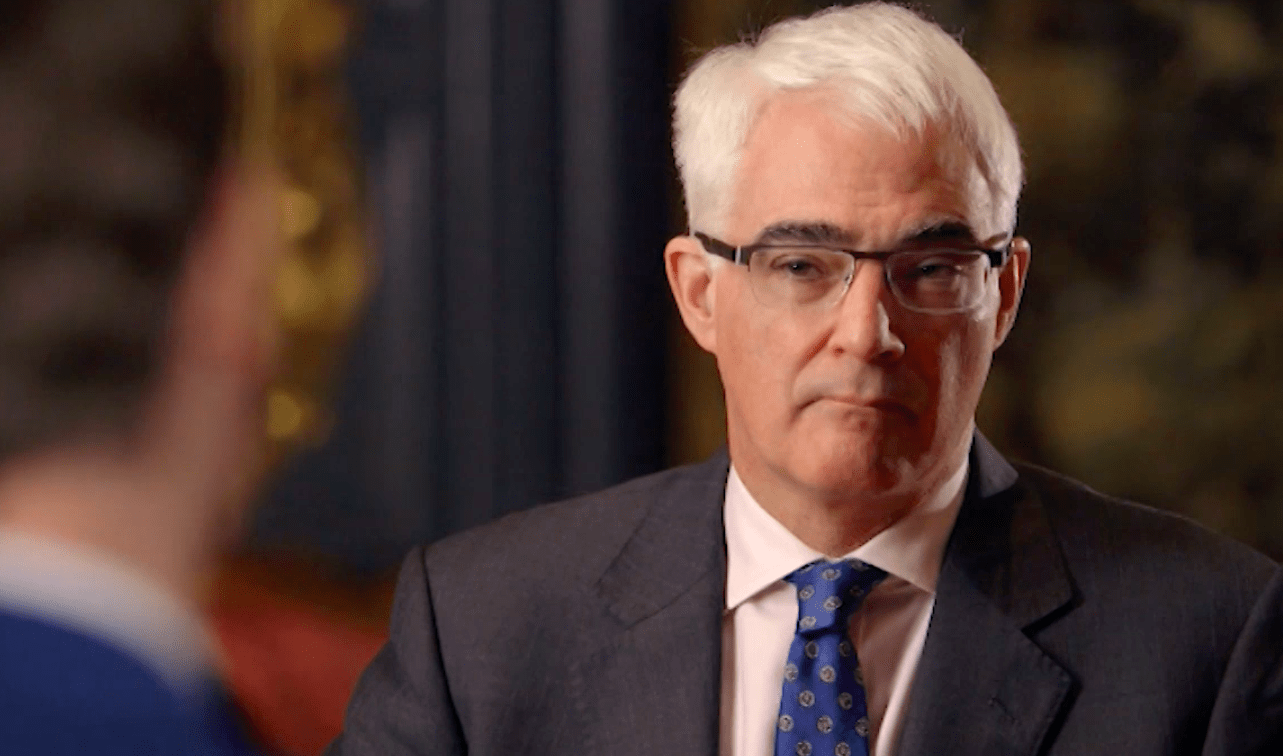

Last autumn, I presented a Ch4 documentary on inequality. I could have made three hours’ worth of that show – or written a book – but it was distilled down to 27 minutes so a lot was chopped. Including my interview with Alistair Darling about the malfunction of tax credits. (Our conversation to QE is above).

I later quoted from the unused clip in the Daily Telegraph a while back: he said that tax credits had come to subsidise low wages “in a way that was never intended.” This must have caught the eye of a No10 speechwriter because this quote has ended up quoted by the Prime Minister and the Chancellor (who mentions it in a Guardian article today).

Given that Labour’s take on tax credits is more newsworthy now than it was then, I thought CoffeeHouses may be interested in rest of my conversation about tax credits with Labour’s last Chancellor. We spoke last October.

FN: What would you say are the lessons from the Labour years about tackling inequality? What did you get right and what did you get wrong?

AD: In terms of reducing child poverty and pensioner poverty, our policies were absolutely right. I think the tax credit policy, when it was introduced, was right as well – although it has had the effect of subsidising wage levels, which is not good for public spending. It’s actually not good for the long-term economics. That just wasn’t foreseen at the time.

I think the other thing is there was an assumption, probably throughout the 90s and a lot of the last decade, that simply getting people in to work was good enough in itself. And, you know, nature would take care of the rest. It hasn’t. That’s why I think the problem of low pay is one of the big political challenges for the next five years.

FN: So your tax credits had the unintended consequence of keeping low wages down?

AD: Well, undoubtedly. You know, if the state is making up the difference between what would be unacceptable and what is acceptable then the employer’s not paying it – now, that’s expensive for the state. I think it was a good policy when it was introduced because it was smoothing out some of the losses that people would otherwise make. It was helping people transition in to, you know, wages where the employer was paying the lot.

As Keynes famously said: when the facts change, you change your mind. Well, the last five years have changed quite a lot of people’s assumptions. I do think this is why we do need to look now at people’s spending power – and, in particular the effect of what the state does and what is happening in the private sector.

FN: So, tax credits designed to promote equality of outcome ended up promoting inequality of wages?

AD: I just think that whenever you introduce any policy on tax, on spend, on benefits, you need to look all the time as to what it’s actually doing – and what are the unintended consequences. One of the unintended consequences is that we are now subsidising lower wages in a way that was never intended.

That is not an argument for scrapping tax credits, it is an argument for making sure that you adjust the system. And it’s also an argument for making sure that we do our level best to drive up those level of wages – because, after all, people who earn more they spend more. And that’s one of the reasons one of the ways the economy will start to recover properly.

Comments