Today’s FT cover-story probably wins the prize for Most Worrying News Item of the Day:

Today’s FT cover-story probably wins the prize for Most Worrying News Item of the Day:

“Lenders in Europe are bracing themselves for a rising wave of consumer debt defaults as the credit card crisis that has caused billions of dollars in losses among US banks spreads across the Atlantic.

The International Monetary Fund estimates that of US consumer debt totalling $1,914bn, about 14 per cent will turn sour.

It expects that 7 per cent of the $2,467bn of consumer debt in Europe will be lost, with much of that falling in the UK, the continents biggest nation of credit card borrowers.

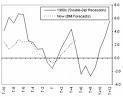

National Debtline of the UK said that the number of calls it had received from UK consumers worried about loans, credit cards and mortgage arrears had reached 41,000 in May double the 20,000 calls it had received in May 2008. It added that the number of calls showed no sign of abating.” Around Westminster, it seems more and more people are worried about a “double-dip” recession. The bursting of a credit card bubble may not, by itself, drag us into another trough. But it’s clear that many of the debt-related problems which contributed to the slide in the first place still remain.

Comments