The bankers would all move to Frankfurt. The hedge funds would all decamp to Zurich. The asset managers would be off to Paris and Dublin, and the lawyers, accountants and consultants would swiftly follow them.

For much of the last four years since the UK voted to leave the European Union, it has been assumed across most of the continent that one of the big prizes of Brexit would be repatriating the lucrative financial services industry out of the City of London to a series of European centres. Indeed, Paris was confidently expecting to boom on the back of all the business that would hop on the first Eurostar to make sure it stayed within the Single Market.

But hold on. Now that we are out, with only a relatively thin trade deal, and one that doesn’t even include financial services, it is not working out quite that way.

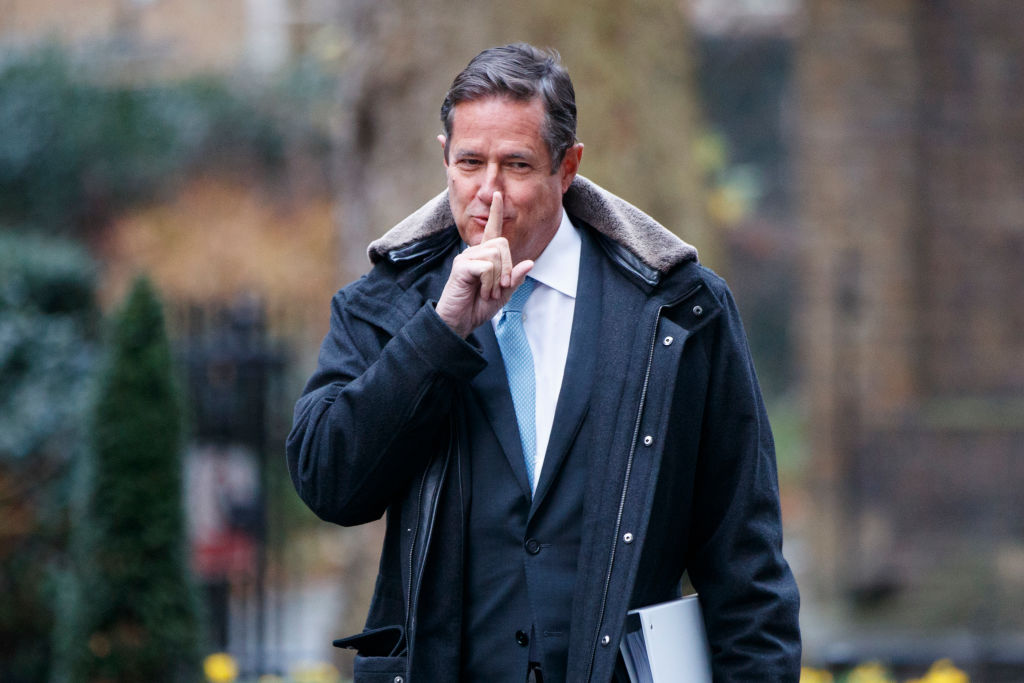

Jes Staley, the American chief executive of Barclays, an institution that straddles retail, wholesale and investment banking, argued today that the City was likely to come out ahead.

‘I think Brexit is more than likely on the positive side than on the negative side,’ he told the BBC. ‘I think what London needs to be focused on is not Frankfurt or Paris, (it) needs to be focused on New York and Singapore.’

True, there have been some losses since the start of the year. A lot of money has been shifted from accounts in London to mainland Europe to comply with EU regulations. So have some deals, and costs have increased as partners based within the EU have to be found for some transactions.

It is important not to exaggerate, however. Most money these days simply sits on a computer server somewhere. It doesn’t make a lot of difference where that is located: the wealth is generated by the people who use that money smartly, not by the chips that store it.

While some work is shifting to the other side of the Channel, much of it was not very valuable. At the same time, the City is starting to shift away from the EU’s burdensome rules, embracing a lighter, more flexible regulatory regime. Want an example? The City will soon start trading in Swiss equities again, still banned inside the EU after the two sides fell out over financial rules. In fact, the City is switching from being the main European financial centre to becoming a global one, focussed as much on Asia, the Middle East and Africa, as it is on France or Germany. It will be trade fewer eurobonds, and more green bonds, and deal less with Volkswagen and L’Oreal, and more Tik Tok and Tencent. Barclays has started to recognise that – and very soon the rest of the City will as well.

Comments