Once, journalists trawled the Red Book (ie, the Budget statement) for stories. Now, the Office for Budget Responsibilities does this for us. There will be plenty in it for Brexiteers and Remainers. The former will be delighted that the OBR pretty much trashes the main assumptions made in HM Treasury’s now-notorious dossier on jobs, recession, house prices etc. But then again the OBR estimates a Brexit effect on the deficit: £3bn this year, peaking at £15.4bn in 2018/19. This has delighted Remain campaigners who now, at long last, have ammunition to write about the costs of Brexit – especially if you add the figures together and come up with a £50-odd billion Brexit effect. Expect plenty of this in the papers tomorrow.

The last year has taught us to take economists’ (and pollsters’) forecasts with a pinch of salt. The OBR has been wrong about jobs, about growth – its director, Robert Chote, likes to say that he knows each set of forecasts will be wrong. He’s an economist, not Mystic Meg. But the OBR forecasts are the closest we get to a crystal ball and the assumptions behind them are quite interesting. Here are a few that jumped out at me.

- Brexit will lower net immigration by 80,000. Or, more accurately, immigration would have been 80,000 higher had Britain voted to Remain. The OBR has always seen net migration as a big contributor to GDP, and it says lower migration accounts for about chunk of its Brexit-related downward revision.

- OBR factors in no Brexit growth effect after 2018 Thereby rejecting the idea – relied upon by the Remainers – that the Brexit would result in permanently lower growth. The OBR is hardly Panglossian about Brexit, assuming it will mean less trade and stresses that it cannot model a Brexit deal it doesn’t know anything about. But it makes a few assumptions anyway. It has downgraded its 2017 and 2018 forecasts, but has not changed its 2019 or 2020 forecasts. Which is significant. It says it would have revised up its later growth forecasts if not for Brexit, but it doesn’t say by how much – and the figure can’t be very high. You can see why George Osborne would not let the OBR make a Brexit analysis: it would have rubbished his talk of recession, house collapse, significant and lasting hit to growth, jobs collapse etc.

- Inflation will peak at 2.6pc at the end of 2018. This matters because some of the Remain campaigners, like the NIESR, have been forecasting 4pc inflation: this is now (way) outside the consensus. When the pound crashes, only 20pc of increased import prices are passed on to consumers says the OBR. The ONS has said that some import prices are up by 10pc, which led to a great expectation for prices to surge – but they haven’t, and will rise only modestly as a result. The OBR says CPI inflation will peak at 2.6pc in about two year’s time. If so, inflation will be far closer to the government’s target than it has been for the last few years.

- No sign of that house price crash promised by the Treasury dossier. If we voted for Brexit, the Treasury officials said (or were made to say) that house prices would fall by up to 13pc. The OBR now says they’ll grow for the foreseeable.

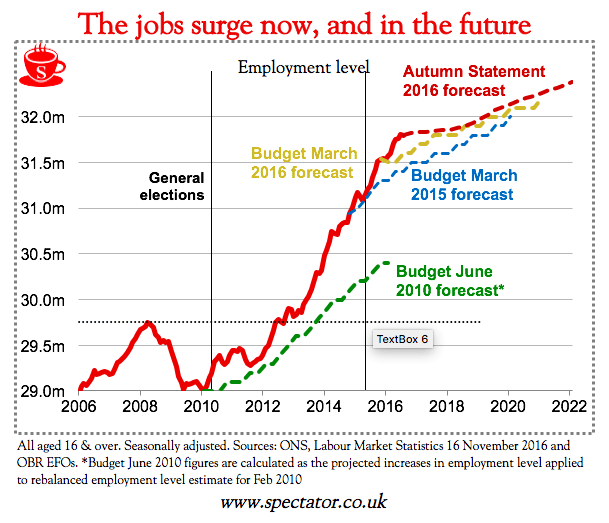

- “We do not, at this stage, forecast that Brexit-related uncertainty will prompt more aggressive job-shedding”. It expects employment to keep on rising (graph, above) half a million more jobs, not half a million less as the Treasury had said in that now-infamous Brexit dossier. As ever, the quid-pro-quo for more jobs is stagnant wages. Personally, I’d thought that employment would have peaked by now and we’d see stronger wage growth. But the OBR thinks the jobs numbers up/real wages down equation will continue for a bit longe

- But three-quarters of that net employment growth will be accounted for by immigration the OBR says. It doesn’t elaborate but that’s quite striking: about half of net employment growth under Cameron was accounted for by immigration. And it rises to 75pc, after a Brexit vote that the OBR thinks will curb inflation!

- Wages to be hit by ‘apprenticeship levy’ and other Osbornian schemes. “Additional costs created for firms and workers by the introduction of the apprenticeship levy, ongoing auto-enrolment into workplace pensions and the levying of NICs on termination payments will largely be borne through lower wages”. This point should get a lot more attention. Politicians are forever upping burdens on business while pretending there won’t be a hit on wages.

- But the £9 Living Wage will exert “upward pressure” on unemployment according to the OBR. It doesn’t say now much, but previous official estimates have been in the 60,000 range. With an all-party consensus now behind the living wage, there’s no one left to ask questions about its downsides. Such as: what will become of these people who are being priced out of the economy?

- Bank of England base rate to stay lower for longer, too.

Comments