Britain is set for the slowest economic bounce-back in the G7 and one of the slowest recoveries among wealthy nations, according to new forecasts published today by the Organisation for Economic Cooperation and Development.

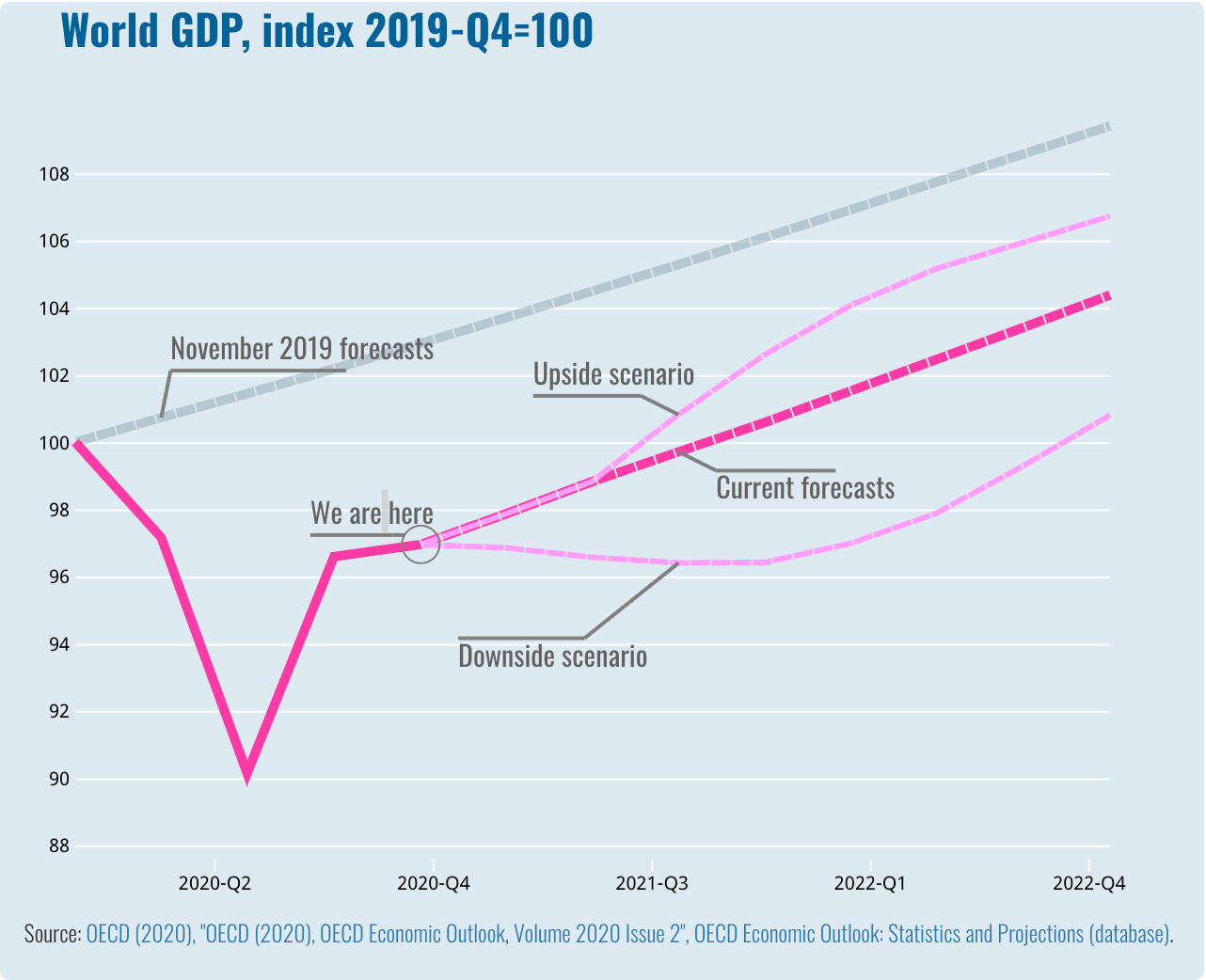

The OECD has updated its forecasts for global economic recovery, showing a return to pre-Covid GDP levels by the end of next year. The central scenario estimates a 4.2 per cent fall in global GDP this year, matched by a 4.2 per cent lift next year – while suggesting that its ‘upside scenario’ becomes more likely if successful vaccines are rolled out at a relatively fast pace.

But while these latest forecasts bode better for the global economy, the findings are a blow to the UK. On some counts, the OECD’s scenarios for Britain’s economic recovery are roughly on par with what the Office for Budget Responsibility published last week. On other counts, they are notably more pessimistic.

The OECD projects Britain’s economic output will fall by 11.2 per cent this year (0.1 less than the OBR), while both forecasts show unemployment peaking at 7.5 per cent (roughly 2.5 million people) in 2021.

But while last week’s OBR update showed UK GDP recovering by Q4 in 2022, the OECD projects that Britain’s economy will still be 2.4 per cent smaller at the end of the 2022 than it was before the pandemic hit. Where the UK does rebound, the OECD suggests this will be a result of increased consumption, but predicts ‘business investment will remain weak due to spare capacity and continued uncertainty.’

Even more jarring are the comparisons between the UK’s economic trajectory and the 18 other countries analysed by the OECD. Britain’s economic contraction is found to be the second most severe, and only exceeded by Argentina at 12.9 per cent. Britain’s economic fall is more than double that of Canada or Germany, and nearly triple the contractions seen in Australia or the United States. While both the world economy and the G20 are set to return to and exceed pre-Covid levels by Q4 2021, the UK is still estimated to be 7 per cent smaller by this time next year.

Today’s updates from the OECD put into perspective – yet again – how badly the UK economy has fared from Covid-19 and subsequent lockdowns. While the UK’s dependency on the services industries is thought to partially explain why it has taken such an economic hit, today’s forecasts will likely lead to louder questions about the government’s decisions to implement full lockdown measures for a second time.

The OECD describes the UK as being at an ‘historic and critical moment’, as it decides how to handle the pandemic over the winter months and goes down to the wire in the Brexit negotiations, which require a breakthrough imminently to see a deal secured. Indeed, decisions made in the coming days and weeks will have a huge impact the economy’s prospects for recovery. But today’s forecast reminds us that the decisions already made will have an impact for many years to come.

Comments