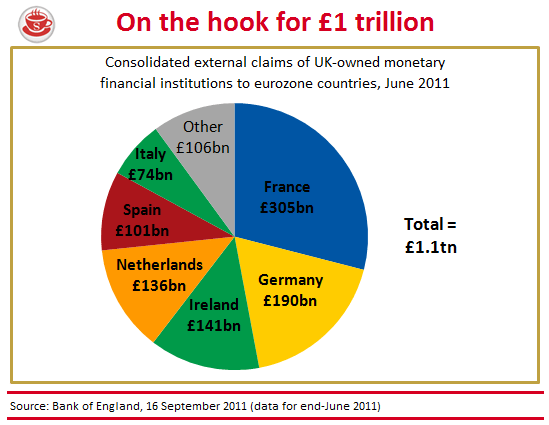

Be careful what you wish for, arch Eurosceptics. UK banks are exposed in the Eurozone to an eye-watering £1 trillion. The taxpayers’ fiscal union with the banks in 2008 has exposed the UK to the Eurozone’s indebted periphery, just as if we had joined the Euro.

The Bank of England’s cross-border lending data shows the scale of the problem. This isn’t simply government bonds; it’s total bank lending, including Barclays’ retail expansion in Spain and Lloyds’ corporate lending in Ireland.

The EU/IMF bailouts are as much a bailout of Britain as they are the debt-ridden countries of the Eurozone. If these countries do end up defaulting -– thankfully still a very unlikely

scenario in my view -– there’s a risk of a very large bill coming our way.

Bounderby is the pseudonym of a City financier who occasionally despairs at the behaviour of his clients.

Comments