There was a kind of grand jury feel to Gordon Brown’s appearance before the select committee chairs today. “I’m not sure I can make my hearing as exciting as the one you’ve had in the last two days,” he said. “Get started,” said John McFall. Brown has a great genius in neutralising hostile questions by dragging it down into minutiae – a trick that Blair, the incurable thespian, could never quite master. I won’t blog the points that ran into the sand. Here’s my summary of Brown’s appearance, and my take on it:

There was a kind of grand jury feel to Gordon Brown’s appearance before the select committee chairs today. “I’m not sure I can make my hearing as exciting as the one you’ve had in the last two days,” he said. “Get started,” said John McFall. Brown has a great genius in neutralising hostile questions by dragging it down into minutiae – a trick that Blair, the incurable thespian, could never quite master. I won’t blog the points that ran into the sand. Here’s my summary of Brown’s appearance, and my take on it:

1. Printing money. Brown said that the BoE has a “statutory duty” to keep inflation up if it falls below the 2% target. “Our target is not zero inflation”. But after the crippling inflation of last year, what’s so bad about zero inflation? Wasn’t it this “symmetrical” inflation target the root error that caused the whole crash? From 2000 onwards The BoE pumped the economy full of underpriced debt in a pointless battle against benign cheap Chinese imports, this is what led to the asset boom, which begat the debt bubble, which ended in the crash. This is what they’re all missing: the obsession with inflation targeting hasn’t led to stability, but the mother and father of all economic busts.

2. Bonuses. McFall quoted Congressman Barney Frank saying: “they’re hating us, the politicians, because we’re hanging around with the bankers.” Why do banks get rescued and not Woolworths? Why do they need to get bonuses? Strikingly, this is a presentational point: it’s as if McFall is saying ‘we have to bash these bloody bankers because it’s hitting Labour’s poll ratings’. Or, in his exact words, “Prime Minister there’s a long hard road to go to bring the public round on this issue.”

3. Curbing those pesky bonuses. Brown says the board members are not getting bonuses: this is, of course, a decoy for the press. The mega bucks are paid to the traders. Let’s not forget, the Exchequer took a 40% cut OF those bonuses through tax: it was very much a shared greed. “The short-term bonus culture in banks has got to end” said Brown. Every banker now knows this: you need to shift to a more venture capital-style, longer-term bonus. It would happen without regulation

4. Befuddled McFall. “Prime Minister, you befuddled me,” said McFall at one point when he forgot his second question. Too true. That, in a nutshell, is why the Treasury Select Committee has been so ineffective: the debt bubble was obvious. It, like the FSA, was a watchdog that failed.

5. Brown’s war game. A theme of Brown’s defence is that, a few years ago, he took part in what he refers to as a “war game”. In his own words:- “In 2006 we carried out a huge exercise in to examine what would happen to a bank running into problems, or a major institution in America or Britain. We did a simulation exercise, we brought in the chair of the US Federal Reserve, the Treasury Secretary Hank Paulson, we had all the American regulatory authorities present. We had the governor of the Bank of England, we had the chairman of the FSA, myself as Chancellor, the [UK] Financial Secretary to the Treasury and we did this video conferencing, looking at the problems that might occur.”

6. Arrow Assessments. In 2002, Brown says, the FSA conducted a risk assessment – the so-called “Arrow Assessment” of HBOS and it concluded it was fine. Obvious question: that was seven years ago. When was the last such assessment of Northern Rock?

7. Damning HBOS. “The reason HBOS fell was its business model, its whole business model, was wrong.” Again, makes you think it would have saved the taxpayer a few bob if there was something called ‘a regulator’ pointing out what Brown seems to regard as an obvious error.

8. Third bailout. “There are no more arrows you think we can afford,” asked Edward Leigh? “I’m not going to get into what’s in the Budget,” said Brown – later revealing it will be on 22 April. That’s not what Leigh was asking. Brown is evidently planning a third bailout

9. Building Schools for the Future. Brown said the “Treasury is about to bring forward proposals” to accelerate this scheme with 100 schools in progress. But why? It’s not the masonry that’s the problems in our schools, but the quality of the teaching that goes on inside them. The move towards huge Grange Hill-style secondaries is unwelcome, and I suspect the Tory school liberalisation programme will see smaller boutique schools because this is what the public want.

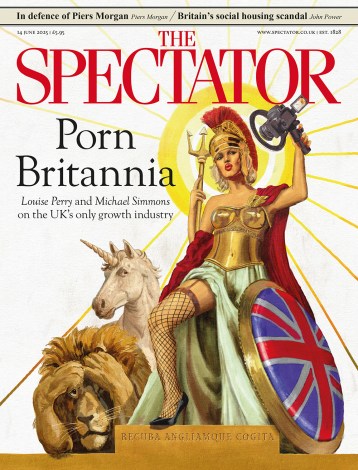

10. We Need An Inquiry. Tony Wright put it very well. “When we have a catastrophe in this country, we normally have a proper forensic inquiry to find out what lessons are to be learned. Don’t we deserve an inquiry like that?” Tony Wright. Brown said no, because it’s a global issue. The Spectator says: absolutely. That’s why we’re doing ours – and inviting suggestions as to what we ask. Click here for more.

11. National Government. People want all parties to work together, said Sir Patrick Cormack. Shouldn’t Brown have invited his rivals in? We did, said Brown, but Cameron welshed on him.

As I have blogged before, you can divide analysis of the recession into two categories: AD and BC. The BC (before the crash) approach argues that everything was going pretty well in 2007 and it was only an unpredictable banking collapse that scuttled things. It means asking why there isn’t more lending. We need someone taking the AD (After Downturn) line – asking why there was so much debt in the first place, and how we can stop this happening again. Half the lending in Britain was done by foreign banks who are now offski, said Brown, so the existing British banks must do more. Again, implying that previous levels of lending were desirable – and he wasn’t challenged on this point. This was very much a BC session, but not without its points.

P.S. If CoffeeHousers will indulge me, the below graph shows the rise of the Grange Hill model – how state school pupils have been shepherded into ever-larger schools. Building Schools for the Future will exacerbate what most parents would, I suspect, consider a worrying trend:

Source: House of Commons Library (pdf here).

Comments