Getting to the truth of a Budget is far easier under George Osborne’s new system. His creation, the Office for Budget Responsibility, now writes its own report (pdf here) and it’s like having your own mole in the Treasury flag up what the Chancellor would rather gloss over*. I read its report over the weekend – it’s too rich a document to skim on Budget day. I found a few charts that CoffeeHousers may be interested in.

The graphs are all about Osborne’s decision to defer tough decisions – what James Forsyth brilliantly called his Saint Augustine tendency: give me fiscal discipline, Oh Lord – but not yet. Osborne’s glacial progress on cutting total state spending and his decision to abandon his 2010 debt reduction target (see my earlier blog on six scary graphs) will mean we’ll be spending £75bn on debt interest – way more than education or defence. This has produced the above graph on core government spending – one that that looks so radical as to be incredible.

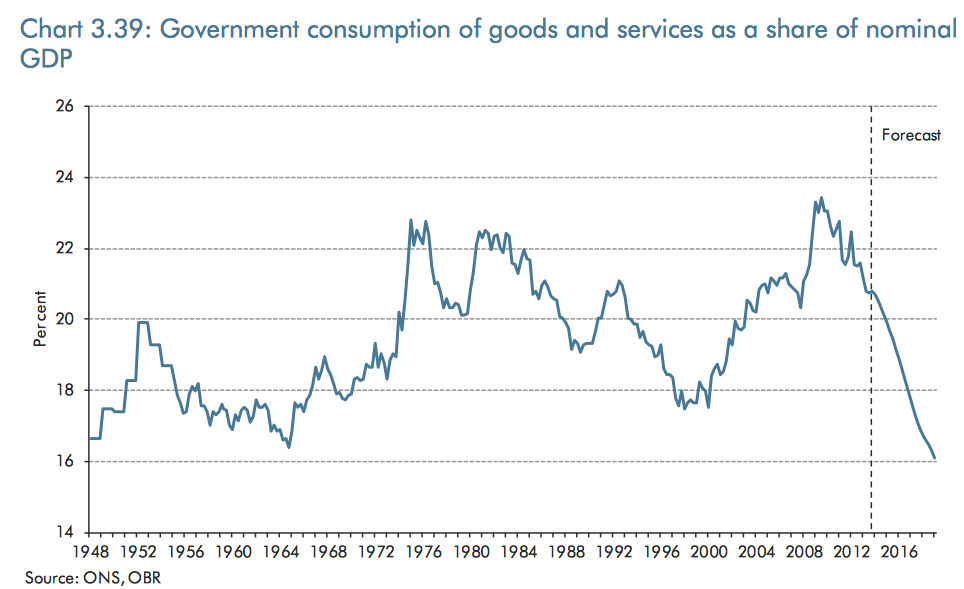

1. Government consumption (as a share of GDP) falls to the lowest level since records began in 1948. This is the graph above, OBR Chart 3.39. And its implications? Here’s Michael Saunders from Citi (pdf):-

“The post-2015 squeeze in the current plans would probably require a major reduction of the size and role of the state, well beyond the measures implemented so far. Within the current coalition, the Lib Dems may be reluctant to go along with such a plan”.

His point: don’t expect Labour to implement the kind of pain that Osborne shied away from. Don’t expect the LibDems to sign up to it in a future coalition. And given that the chances of a Tory majority are slim, should we expect anyone to do it? Or should we just expect a new fiscal crisis?

We’re all in favour of small government at the Spectator. But the graph is scary because it suggests that the years 2015-20 are being used as dumping ground, for problems deemed too difficult to solve in 2010-15. A crisis deferred, rather than a crisis addressed.

2. Dumping the agony on 2015-20. Am I unfair in suggesting that Osborne has ducked tough choices now? Here’s my second graph, from Citi’s Saunders. He has spotted that, with each Budget, more pain is deferred. How much more? The below graph shows, in red, the work that Osborne plans to be done by whoever is Chancellor between 2015-20. The green is the amount of pain he plans pre-election – which seems to shrink all the time…

3. After health, what’s left? Remember, promises have been made about keeping the NHS as expensive as it is now (or ‘protecting’ its budget). Promises have been made to increase overseas aid. And promises to the people to whom we’ll be repaying all that debt. So what does that leave?

Osborne hasn’t said, he’s in no rush to spell out his post-2015 spending plans. But, deliciously, the OBR has pieced it together anyway and forecast the mother of all squeezes on unprotected departments – the political soft targets like defence, police, prisons etc. I suspect that whoever threw this graph into the OBR report was politely trying to point out that protecting NHS budget, when the mega-squeeze begins in 2015, is just not tenable. It means health goes from 29pc of departmental spending to about 45pc.

*The OBR still has defects: it has little faith in supply-side economics, and it fails to analyse the (radical) implications of monetary policy, which is where the action is actually happening under this government. When Robert Chote was appointed to run it, my heart sank: he was from the Institute for Fiscal Studies and I feared he’d bring with him its biases (no interest in dynamic tax scoring, overseas tax-cutting experiments or even domestic ones). But Chote, a former journalist, is first and foremost an awkward git. I mean that as a high compliment. So his OBR document is choc-full of important facts that the Treasury are in no rush to tell us. Long may this continue.

Comments