Everything we heard from the Chancellor today suggests the Treasury is extremely worried about unemployment surging. The measures he’s brought in (detailed below) are designed to keep unemployment figures as low as possible. That’s why jobs were at the forefront of the Chancellor’s summer statement this afternoon: supporting them, creating them and protecting them. But can Rishi Sunak pull off an economic miracle and deliver on his vow to never ‘accept unemployment as an unavoidable outcome’?

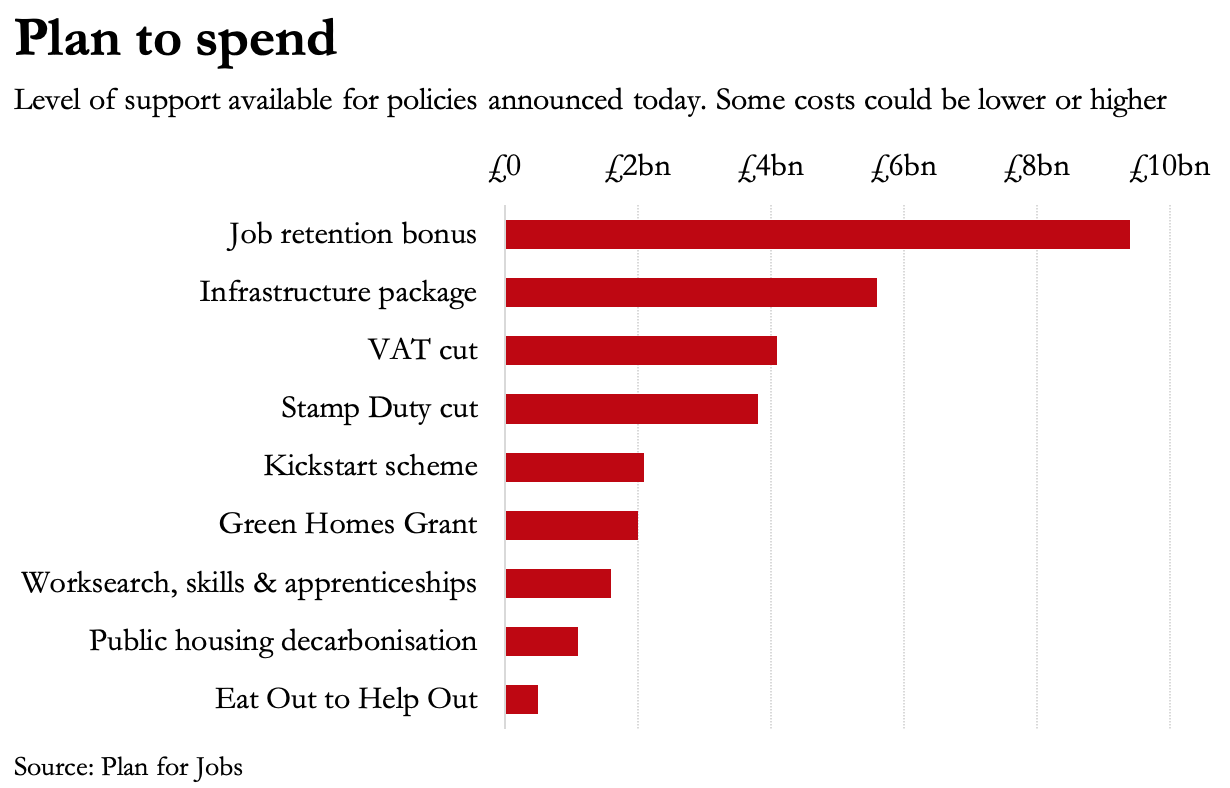

Among the major announcements today was a Job Retention Bonus – a move along from the furlough scheme – which will grant every employer who brings back a furloughed employee (until January at least) £1,000 for doing so. Already briefed but properly announced was the Kickstart Scheme: £2 billion to help young people on universal credit get back to work. In a bid to get youngsters into longer-term employment, these employees will have up to 100 per cent of their salary covered for a six-month placement.

Then came the more industry specific policies, with most of his attention directed towards the hospitality industry: this includes a substantial six month VAT cut – down from 20 per cent to five per cent – for food, accommodation and attractions. And the policy deemed most creative by the Chancellor: an Eat Out to Help Out voucher, which will offer a 50 per cent discount on meals up to £10 for the month of August, Monday to Wednesdays at venues that sign up to the scheme.

The emphasis on jobs – creating them and retaining them – suggests the government is under no illusion that job vacancies are bouncing back soon. The Kickstart Scheme is essentially another variation of the furlough scheme, but focused on age instead of sector. Even the forecasts from the Bank of England and the Office for Budget responsibility – showing V-shaped recoveries – have not been as positive about jobs, estimating that it will take much longer for the jobs sector to reboot than growth figures overall.

While today’s statement does not come with the bells and whistles of an OBR assessment, there’s little doubt from the policy proposals, including the cash payment to bring back employees, that the government fears many people sitting home furloughed are soon to discover they don’t have a job to come back to.

The Chancellor’s comments at the beginning of his speech about never accepting unemployment are bold words. The UK’s economy has contracted by a quarter in only a few months, making a rise in unemployment practically inevitable. They are likely meant to signal the seriousness with which the Treasury treats these losses – but if taken literally, they are words that may come back to bite in the not-so-distant future.

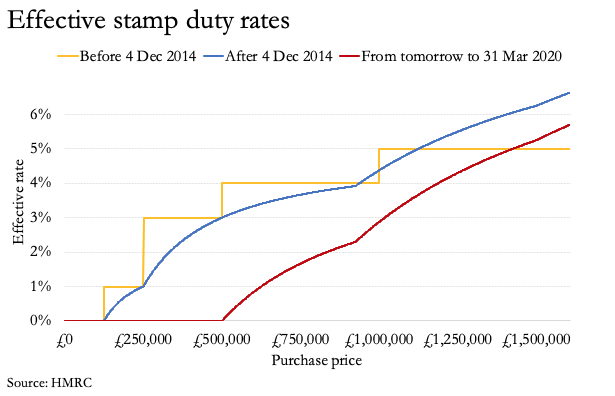

On the supply side, the Chancellor targeted two tax cuts: stamp duty and VAT. The former has long been criticised for distorting the housing market, ruining incentives for people to move home, even when it would be economically beneficial to do so. The cut is not just likely to pick up the housing market again, but may have knock-on growth benefits, as liberalisation of the planning system is often thought as a surefire way to boost productivity.

On VAT, it remains much less clear if the cut will actually stimulate the economy. Both the slash to five per cent and the voucher for discounted meals assume that people aren’t dining out because of money issues, when it is clear what is still keeping people indoors is not a lack of cash, but their fear of the virus.

While the Chancellor’s Budget in March feels like a lifetime ago, today’s summer statement mirrors it in several ways. This Tory government’s pivot from emphasis on the market to state intervention is becoming increasingly clear: just as the Chancellor declared state infrastructure spending and investment as the way to boost the economy back in March, he did so again today.

As teased by the Prime Minister last week, the majority of the government’s recovery agenda is based on more government involvement, rather than rolling the state back. Today’s announcements also total up to roughly £30bn of new pledges (with some question marks over how much the Job Retention Bonus will cost, assuming not every single one of the nine million furloughed workers is brought back). This was roughly the same amount of new spending Sunak announced in March, which at the time was thought to be a dramatic increase in spending, sending the size of the Government’s deficit on the up once more.

Sunak indicated that ‘over the medium term…he’ll be putting ‘finances back on track’. But no indication of how, or when, came today. They can push the conversation off for some time longer, but the question will invariably be asked and the answers may become increasingly uncomfortable the longer they wait.

If the schemes announced today don’t prove as successful as hoped at keeping people employed and getting customers back out, Sunak will need to explain both where the money went, and why he strayed from traditional Conservative remedies to kickstart the economy.

Comments