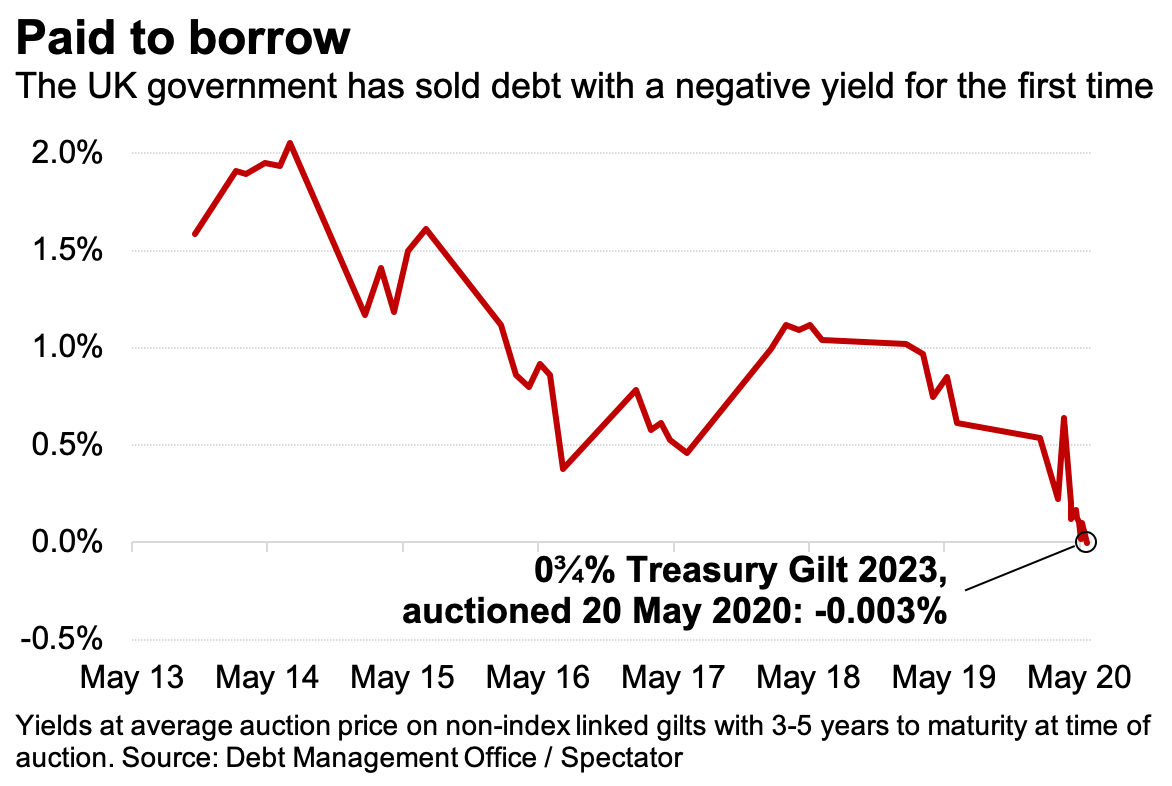

A few months ago, Boris Johnson fought a general election saying that there was no ‘magic money tree’ and accusing Jeremy Corbyn of naively believing otherwise. This morning, something strange sprouted from the economic undergrowth, looking very much like a magic money tree. Britain sold its first long term bonds with negative yields: ie, sold at an average of -0.003 per cent. This dip below zero means investors are knowingly making a loss – paying more overall for the bonds than what their investment will return.

The yield may be only a fraction below zero, but its cross into negative territory marks a difficult moment for the prevailing economic narrative: that markets will punish the Government through the bond market if it overspends. Today’s news suggests the opposite – on a temporary basis at least, the government is being paid to borrow money. Investors are buying government debt, knowing they’ll make a loss, yet are still willing and eager to do so.

Despite scenarios touting a V-shaped recovery, it doesn’t seem that investors share this optimism.

Is this a temporary blip, or the new normal? Andrew Bailey, the newish governor of the Bank of England, told a parliamentary committee today negative interest rates are under “active review”. Not unheard-of: the Swedes and Swiss have dabbled in this, but when he was running for the job Bailey had ruled this out. But it’s a sign of how fast things are changing. Denmark even had negative interest rate mortgages (ie, paying people to borrow) for a while.

Ultra-low interest rates have been warned against for the better part of a decade now – but they’ve stayed at rock bottom, convincing not one, but two Tory Chancellors that a new wave of spending pledges are justified. Perhaps we’re on the path to a deflationary period and the old rules just don’t apply. But unlike historical instances of deflation – often triggered by emerging and growing markets and more consumer choice – this one will be triggered by cautious and fearful spenders.

Good news for a government racking up a colossal deficit this year, but a worrying indicator for our Covid recovery. Despite scenarios touting a V-shaped recovery – which would see the economy back up and running as quickly as it dropped off, it doesn’t seem that investors share this optimism. Choosing a negative yielding bond over an investment in the corporate sector is the most cautious approach: you’ll lose money on the former, but at least you know some of it will be there in a few years’ time, unlike so many businesses and sectors affected by Covid-19.

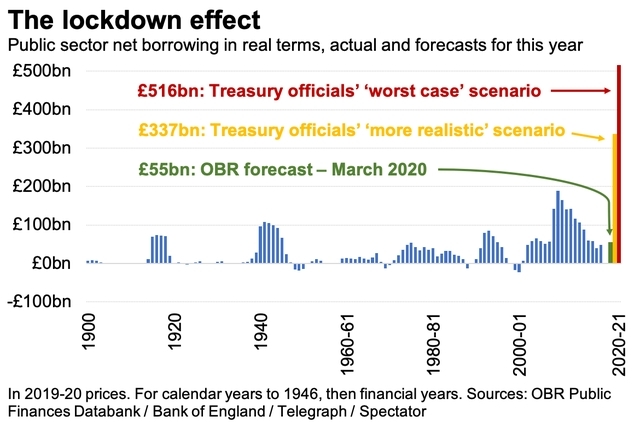

But the biggest question today’s bond sales raises is also the most worrying one: at what point, if any, does the market get spooked? If a £55bn deficit in March didn’t do it, and now a projected £300bn deficit doesn’t do it (see chart above), is there a figure that will? Are we anywhere close to reaching the cliff edge, and what happens when we go over it? While borrowing certainly seems to have proven more possible than the fiscal hawks claimed, a sudden drop in investors or spike in inflation could see an already fragile system unravel fast. As the Covid pandemic has proven, you never know what’s around the corner.

Comments