Lockdown is convulsing the British economy on multiple fronts. ‘Going to work’ has been upended, hitting transport and commercial property sectors. The demise of the high street accelerates as online retail surges. Yet the definitive Covid-related economic trend is happening within the national accounts, as the government spends vast sums on furloughing and other business support, while our locked-down economy struggles to generate tax. This has big implications for investors.

The UK borrowed an astonishing £215 billion between April and October, almost twice the annual NHS budget. Our national debt now exceeds £2,000 billion — and just outstripped annual GDP, a first in our peacetime history. Amid renewed lockdown, with furlough extended until spring, voters blink at the mind-boggling numbers. How can we afford this? When will we pay it all back?

Apparently, never. That’s increasingly the view of Britain’s political and policymaking establishment on all sides. The government can keep spending freely, the argument goes, with the Bank of England ‘printing’ money ad infinitum under the ‘quantitative easing’ programme.

Back in 2009, the sub-prime crisis was so serious that cutting interest rates was deemed insufficient. The Bank of England — with the US Federal Reserve and other leading central banks — launched a one-off QE programme, creating money to avoid the disastrous economic and political fallout of a full-scale banking collapse.

But the UK’s £50 billion QE rescue scheme, meant to last just a few months, continued for over a decade. Central bank largesse juiced up share prices and, when used to buy government bonds, meant the state could borrow cheaply. Investment banks and successive governments became addicted to it and by early this year, UK QE had ballooned to £425 billion — eight times the original plan.

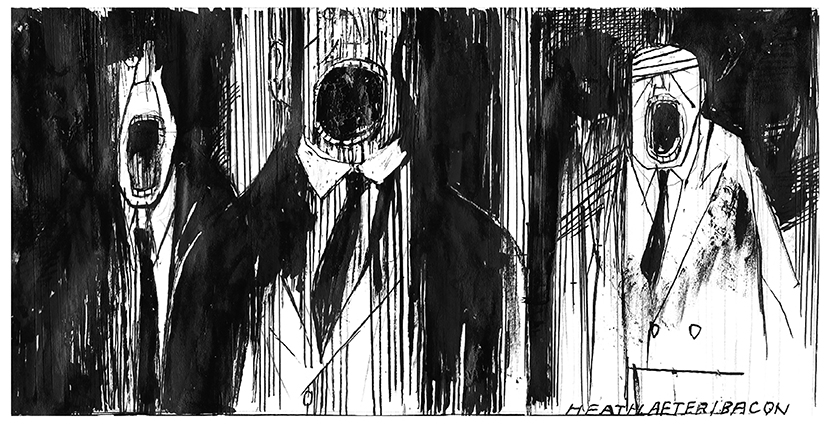

The more QE is used, the harder it is to stop without sparking collapse

Since the last financial crisis, then, QE has kept stock markets elevated while shielding ministers from tough spending decisions. Perhaps that’s why it’s come under so little scrutiny, barely debated in parliament. Yet by boosting stock and property prices, QE has made the asset-rich even richer, but housing even less affordable for countless ordinary families. Related ultra-low interest rates have meanwhile punished tens of millions of savers, not least those living on modest annuitised pensions.

Bank lending has been skewed towards incumbent ‘zombie’ companies by QE, starving smaller, dynamic firms — the kind that boost growth — of finance. It’s created international tensions, too, with states trying to ‘out-print’ each other to gain competitive advantage. We’ve seen ‘currency wars’ for the first time since the 1930s, not least between the US and China.

On top of all that, it’s long been understood that the more QE is used to support financial markets, the harder it is to stop without sparking another collapse — with all the related economic and political carnage. Yet authorities everywhere, not least Britain, have carried on regardless.

Covid, though, has taken such ‘extraordinary monetary measures’ to a whole new level — which is why investors must take renewed care. With government finances under serious lockdown pressure, this policy — and the borrowing it facilitates — have gone into overdrive.

Since March, UK QE has surged to £875 billion, expanding more over six months than during the previous nine years — following a similar move by the Federal Reserve. The UK’s central bank is now buying gilts twice as fast as after the sub-prime crisis and will soon own almost half of outstanding government debt.

Turbo-charged QE has pushed the S&P 500 ever upward, despite the US economy sharply contracting. Even before recent news of a vaccine, this bellwether index was at an all-time high, detached from economic reality.

UK stocks now present an ‘historic buying opportunity’, investors are frequently told, because the FTSE 250, at the time of writing, is still 12 per cent down since early this year, when nobody had heard of Covid. Yet this is the worst economic slump in 300 years. Vaccines may help, but won’t be rolled out for months.

Yes, some shares are at relatively low valuations, but investors must also factor in sterling, with UK debt rising much faster than in other big economies. Then there’s the danger of a broader collapse. For while QE isn’t new, this latest surge is so much bigger in scope as well as magnitude.

Prior to Covid, QE was basically an asset swap, with new central bank liquidity staying within the banking system. So the resulting inflation has been in stock and bond prices, both deep into global bubble territory despite sluggish growth — and, to some extent, real estate too.

Covid-era QE is different, with the new liquidity, hundreds of billions of pounds of it, now being sent directly from government, via the furlough scheme, into the bank accounts of businesses and the broader population. This amounts to ‘helicopter money’, otherwise known as ‘modern monetary theory’ — the idea, promoted in the US by advisers to Bernie Sanders and now Joe Biden, that central banks can print and governments can spend without limit, and only immoral people can possibly object.

This may work in the US for a while — having the world’s reserve currency helps. But elsewhere it’s a recipe for disaster, as the history of the Roman Empire, Weimar Germany and countless Latin American dictatorships so starkly illustrates.

Overstated? You decide. But consider that UK QE has ballooned almost half a trillion pounds since March, driving hundreds of billions of government borrowing — with much of that central-bank-created liquidity, via Covid-support schemes, now entering the ‘real economy’.

Consider, also, that gold — the traditional inflation hedge — lately hit an all-time high. And bitcoin, a trendy cybercurrency equivalent, is 140 per cent up since the start of this year.

Comments