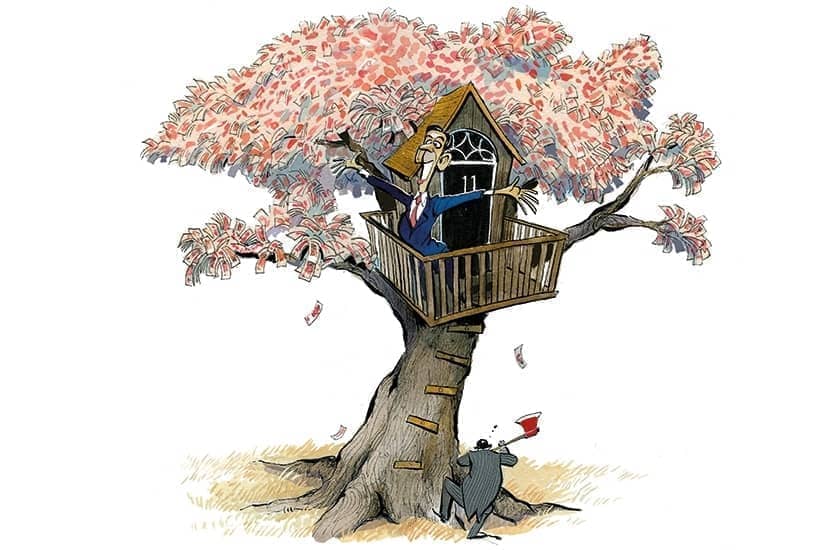

Could Rishi Sunak really have saved the taxpayer £11 billion by insuring against higher interest rates last year? That was the extraordinary claim made by the National Institute of Economic and Social Research (NIESR) and in the Financial Times on Friday.

The NIESR claims that the government could have saved the money had the Chancellor taken up the institute’s own suggestion last year and forcibly converted £600 billion worth of reserves held by commercial banks at the Bank of England into two year fixed-rate bonds. By failing to foresee rising inflation and interest rates, the FT asserts, the Chancellor has blown even more money than Gordon Brown did by selling half Britain’s gold reserves at the bottom of the market in 1999.

Gordon Brown’s mistimed sale of the gold reserves remains one of the most-remembered contributions to UK economy

That’s quite a charge, given that Brown’s mistimed sale of the gold reserves remains one of the most-remembered contributions to UK economy – no doubt because it conjures images of the film Goldfinger, and its massive stacks of gold the arch-villain planned to steal from Fort Knox. The concept of forcing banks to swap their deposits for two-year fixed bonds is a little more esoteric – and not everyone is convinced that it would have been remotely practical.

For one thing it would have involved the Chancellor ordering the Bank of England how to manage its deposits – not a good look given that the Bank of England is supposed to be independent (thanks to one of Gordon Brown’s better decisions) and an order from the Treasury would have undermined that, reducing confidence in Britain’s monetary policy. Similarly, forcing banks to swap deposits for bonds would have undermined confidence. Would any of us like it if our bank contacted us to say that it was converting our savings account into bonds, and that we would only get our money back in two years’ time? Such a transaction would itself have risked driving up the interest rates at which the government is able to borrow. The £11 billion sum claimed by the NIESR doesn’t appear even try to take this into account.

Mysteriously, the FT fails to address any of these concerns – which is odd for a newspaper which tried to position itself throughout Brexit as the sane voice of reason which would never cease to ask the difficult questions. Never mind the £11 billion which could theoretically have been saved in a world where governments and central banks can carry out massive transactions without any effect on markets, the real reason that taxpayers are on the hook for so much debt interest is that for two decades no UK government has succeeded in balancing the public books – with the result that debt has been piled on debt. Even when inflation and interest rates were on the floor in 2020/21 the government still spending £39.4 billion on debt interest.

One further point: the NIESR, and the FT report on it, asserts that the Chancellor should have been wise to the risk of inflation, but wasn’t. The FT is not exactly best-placed to criticise him for failing to see inflation at 9 percent. Indeed, the FT failed to see inflation coming itself, a piece in its Alphaville column criticising other publication for warning of inflation – memorably entitled ‘The Spectator joins the inflation doom-mongers’.

Comments