“Millionaire David Cameron wants you to pay off your credit card – are you going to obey the Prime Minister?” asked one local BBC radio station phone-in this morning. This is not

what No. 10 had in mind when releasing selective quotes from his speech last night. “The only way out of a debt crisis is to deal with your debts. That means households – all of us – paying

off the credit card and store card bills.” This line in his speech is now being rapidly rewritten – and for good reason. Because the Prime Minister was in danger of making a major

mistake.

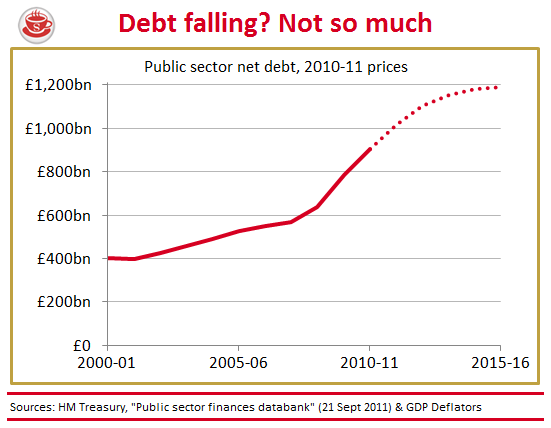

The premise of the now-never-to-be-delivered quote is incorrect. The British public actually are paying down their debts, while the British government is vastly increasing its borrowing. Here,

Treasury figures show what’s really happening:

So the Prime Minister would have been in dangerous territory had he made out as if he was the doctor, advising a debt-addicted patient to cut down. The below chart shows debt held by the British

public, verses debt being run up in their name by Cameron’s government:

It’s important to stress that Cameron is borrowing less than Labour would have. But not that much less. Over this parliament, Alistair Darling’s published plans would have meant debt up

by 60 per cent. Osborne’s plans suggest debt rising by 51 per cent. Far better, but the two parties’ position is closer than either would have you believe:

A Prime Minister worried about the nation’s borrowing habits usually changes the incentives to borrow and spend. Problem is, the incentives set by his government and the Bank of England

encourage debt. Look at the Bank of England’s “real” – ie, inflation-adjusted – base rate:

Consumer rates are higher, but anything less than 4.5 per cent means being paid to borrow. Again, Cameron has good reason to keep rates this low. But it’s a bit rich to pimp out all this

cheap debt, then complain that the country is borrowing a bit too much.

Savings rates are now below the rate of inflation almost everywhere in the high street. Little wonder there’s a liquidity problem in the banking system, one that would be remedied if the

banks had more attractive savings rates.

Cameron is right: we all need to deleverage. During the election, he made the very powerful point that a baby born in Brown’s Britain automatically held £17,000 of debt. It made a very

powerful poster, making a very valid point:

The problem is, this debt keeps piling on. Although Cameron’s doing it with a heavier heart, it doesn’t dimish the burden placed on the next generation by Gordon Brown’s decisions. Let’s look

at what that figure would be for babies born under the various years of his government:

The Prime Minister was right: it is unfair. Debt is nothing more than delayed taxation. To saddle the next generation with billions upon billions of debt is not just an economic failure, but a

moral failure. The public is doing its bit. Government: not so much. Cameron realizes this, I think, which is why he has changed the line in his speech. “The only way out of a debt crisis is

to deal with your debts,” he says. “That’s why households are paying down their credit cards.” He’s right: people are. The government is the problem.

Fraser Nelson

Fraser Nelson

Explaining Cameron's debt u-turn

Comments