As another £30 billion of taxpayers’ money is handed over to banks, the role of banking sector in the continuing UK recession cannot be understated.

1990s Japan taught the world that developed economies with zombie banking systems don’t grow. Crippled by bad debts, lending margins on solvent borrowers increase, credit availability declines and ongoing bailouts are needed. This hampers growth in the rest of the economy. The more indebted the private sector, the greater the damage a bust banking system inflicts.

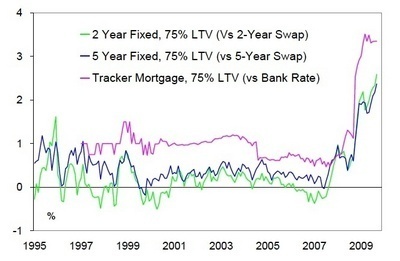

The above chart shows how margins on UK mortgages – the gap between borrowing from the Bank of England and what is then leant to mortgage holders – have soared since September last year. In most other countries mortgage rates fell with the central bank rate: mortgage rates for existing borrowers are between 1% and 2% in much of the rest of Europe now. The massive increase in Britain has cost households over £30 billion during the past year, unless they have been lucky enough to be on trackers. £30 billion is more than 2% of UK GDP, explaining the underperformance of the UK economy over recent months.

Credit growth has also collapsed. While mortgage lending has risen slightly in recent months, the 95% slump in lending since the start of the crisis in mid-2007 has not been addressed. As well as the dive in new mortgage availability, remortgage flows have slumped. With banks like Barclays and Northern Rock charging almost 5% to customers trapped on standard variable rates, it is certainly not lack of demand for cheaper mortgages holding things back. Lending to businesses for investment has also been severely curtailed since the start of the bank crisis.

The above chart illustrates recent trends in non-mortgage lending, on credit cards for example. With banks falling over themselves to cut credit limits and shut down accounts, credit availability has collapsed. None of the cheap financing the taxpayer provides the banks, via the Bank of England, is passed on in lower monthly credit card interest bills.

The advent of another massive bailout package for UK banks simply reinforces how botched the job of fixing the banks has been thus far. The cost to the UK economy and taxpayer is very high.

Comments