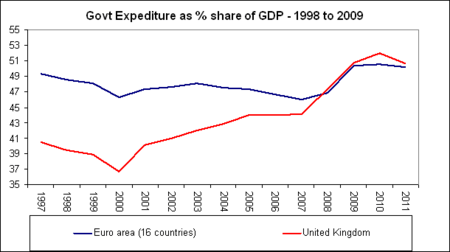

The Government debt mountain grew by a further £11.4billion in October. The UK now has one of the most expensive governments in the European Union – now materially above the Eurozone average and within touching distance of France and Sweden in spending above 50% of GDP. Blaming large Government per se for economic problems is overly simplistic – larger Government spending countries like Sweden and Finland have managed to build export market shares and provided stock market returns over the past couple of decades that put the UK to shame. Spain now has thousands of miles of high speed railways and over 50% of their energy needs come from renewables. Smart and productive investment by the Government in high quality education, healthcare and infrastructure are widely recognised by global investors as a major enhancement to the global competitiveness and living standards of a country. Making sure the numbers add up, and that spending is useful and productive, counts for far more than simply the size of government.

Government spending has now soared to almost £200billion above income – virtually the sum of the entire health, education and defence budgets. The basic rate of tax would have to rise by 40p to over 60% to pay for the spending mismatch. As the above chart shows, spending has increased by 125% since 1997, while income has only increased by only 73%. The huge rise in spending was predicated on two core assumptions: ever growing bank bonus pools representing a “New North Sea Oil” to provide permanently growing tax revenues; while the end of the last few centuries of economic cycles and downturns meant that the remainder of the spending increases could be funded on the never-never. Sadly, the growth of the recent decade turned out to be just another boom/bust cycle of the kind the UK has grown so familiar to over the past couple of centuries. The growth of the banks to the world’s biggest and most risky – so proudly cheered on from No 11 – has turned into a taxpayer hangover to give the World Wars a run for their money. As the bubble tax revenues have dried up, the gap between government spending and income has soared – in much the fashion many leading economists predicted and have been seen all too often before.

The attempt of the Labour Party to present huge spending increases as “something for nothing” is a key reason why there is so little to show for this spending bonanza. While the UK now moves close to topping the European league table of expensive Government, we don’t seem to have the great French trains, the Spanish renewable energy generation or the world beating Finnish schools to show for it. A more honest approach – making clear more government services would need to be paid for ultimately in higher taxes but represented a worthwhile investment – may well have left us with much more to show for this huge debt we now are stuck with.

The scale of the UK’s plight is made clear by a comparison of our deficit problem compared to the 6 EU countries who have larger Government shares of their economy. The UK has by some way the largest financial hole, having failed to follow the example of most other big Government countries in Europe in running a balanced budget or a surplus in the boom times. It is in this obvious lack of understanding, that there’s no free lunch in running an economy – the numbers do have to add up in the end, that the inexperience of this Labour Government in economic management is so painfully obvious.

Comments