When George Osborne releases the bumpf accompanying his Autumn Statement tomorrow, I understand that there will be one paper that will be quite unlike anything presented by a previous chancellor. There will be a study on dynamic tax scoring: ie, recognizing that tax cuts stimulate the economy, and that the Treasury can expect to claw back money when it liberalises.

This paper is seen by Team Osborne as something of a quiet revolution in the Treasury. The machine they inherited was programmed to see tax cuts as a permanent loss to the government, when in fact most tax cuts recoup some of their cost in the extra activity they unleash. The new Treasury paper shows a brand new way of thinking about tax – and one which, if you follow the logic, paves the way for a lot more tax cuts.

This particular paper will focus on Osborne’s flagship reform: corporation tax cuts. He is bringing it down from 28 per cent to 20 per cent, and the analysis published tomorrow will, I understand, say that two-thirds of the ‘cost’ of the tax cuts will be clawed back by the Treasury because of the effect. That is to say: more companies set up in Britain, relocate to Britain or declare taxes in Britain. In this global race, countries must compete for people – and companies. When tax is low enough, they come. Osborne has found a way of factoring this in to Treasury calculations.

The paper, I understand, suggests that over 20 years, the corporation tax cuts will add about 0.7 per cent to GDP (about £12 billion) and increase business investment by as much as 4.5 per cent of GDP.

Osborne has been wanting to do such calculations this for ages: I remember being told that the new Office for Budget Responsibility would do dynamic tax

scoring. If only. I suspect the OBR (which is, in effect, the Treasury forecasting division in exile) will be deeply hostile to this, and try to cast doubt on the methodology. Ed Balls will go bananas. But they should have seen this coming. Back in March last year, Osborne told MPs (p47, pdf):-

‘There is an interesting question about whether the Treasury should undertake more work on dynamic scoring, in other words trying to take into account more of the economy effects of different tax rates. I am not proposing we change the way the score card is calculated, and I am not proposing we change the way that the OBR does its work—I think we should be cautious about making these changes—but I think the Treasury can now, and I have asked for this to happen, start undertaking some real research into dynamic scoring and what the broader-economy effects are of changes to taxation.’

And tomorrow, he’ll present what he regards as state-of-the-art Computable General Equilibrium Model for dynamic tax scoring.

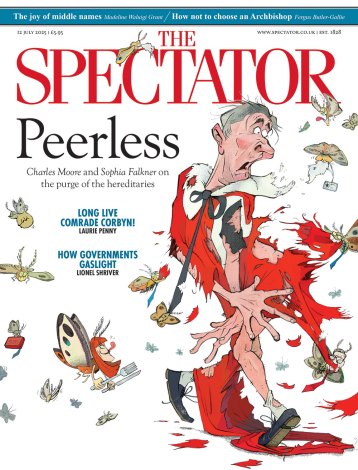

We say in the leading article for the new Spectator (out tomorrow) that this is a welcome and overdue step. The idea that tax cuts are a dessert to be served up once we’ve finished our austerity gruel is finally being killed off. Sweden used a tax cut for the low-paid as a stimulus to help the economy recover: it was able to do this only because it has an economist as a finance minister (Anders Borg) and he knew that the old static models were nonsense. Sweden is now on its fifth such tax cut. Sweden rejected as false the choice between cutting taxes and cutting deficits.

And 51 years ago this week, someone else rejected this as false. It’s great that the Treasury in 2013 is beginning to grasp what JFK told the New York Economic Club in 1962: the ‘paradoxical truth’ that lower tax rates can mean higher tax yields.

UPDATE Allister Heath’s City AM column finds someone else to support this: JM Keynes.

“Nor should the argument seem strange that taxation may be so high as to defeat its object, and that, given sufficient time to gather the fruits, a reduction of taxation will run a better chance than an increase of balancing the budget. For to take the opposite view today is to resemble a manufacturer who, running at a loss, decides to raise his price, and when his declining sales increase the loss, wrapping himself in the rectitude of plain arithmetic, decides that prudence requires him to raise the price still more–and who, when at last his account is balanced with nought on both sides, is still found righteously declaring that it would have been the act of a gambler to reduce the price when you were already making a loss.”

Comments