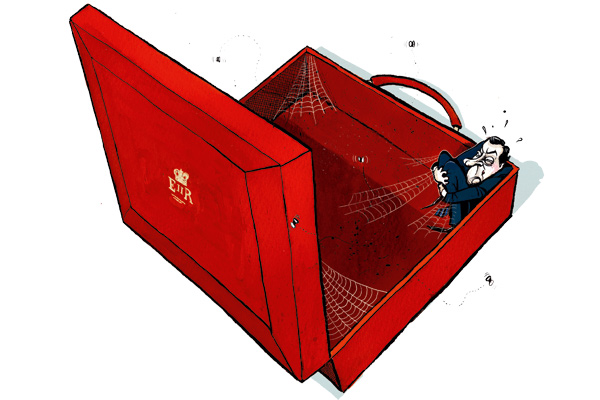

The idea of an ‘empty budget’ later this month is disappointing those who backed George Osborne in the hope of his fixing the problems he so eloquently outlined in opposition. If Brown proposed cutting the deficit by 33 per cent over two years, newspapers who criticised him at the time for lacking ambition — as Osborne did — can hardly be expected to applaud the Chancellor for cutting it by just 25 per cent over three years.

Faster progress is needed: on the deficit, and on economic growth. There are many tools that can be used and the Sunday Telegraph describes a few of them today in its leading article. It’s an important contribution to the debate. Here are its main points, and my take:

1. Cut taxes, especially corporation tax. Consider abolishing, or at least suspending, capital gains tax. Companies need persuading to part with their large bank balances.

It’s now clear that the UK recovery is being crushed by the sheer size and cost of the government machine. Taxes have proven too great a burden, given the economy has proven far weaker than Osborne was told even in June 2010. Lighten the tax load, and growth follows.

2. Rethink spending priorities. Although George Osborne has sensibly committed the Government to austerity, bolder reductions in public spending can still be made. Mr Osborne has cut total state spending by just 3 per cent in three years – after it increased by a staggering 58 per cent under Labour. The national debt is ratcheting up by £3,000 per second.

The Sunday Telegraph does something that few other newspapers do (not even the FT) which is to actually whip out a calculator and quantify the total cuts. They are 3 per cent so far, and this is put in the perspective of the 58 per cent rise of state spending in the Labour years. Armed with such information, readers can decide for themselves if the cuts as ‘harsh’ and ‘deep’ as Ed Balls alleges. This data also illustrates the potential for far greater savings. Labour cut more in one year than Osborne is doing in five, as the below graph shows:

3. Build a sustainable energy policy. Green taxes and red tape increase the cost of energy. Britain needs to accelerate the exploitation of shale gas, and press on with building nuclear and gas-fired power stations. Cheap power is vital to keep energy-intensive industries in Britain whereas environmental regulations and taxes chase business overseas.

Simon Nixon wrote in The Spectator recently about the transformative effect of shale — and cheap energy — on the US economy. The potential for fracking to do the same with the UK’s vast shale reserves is unclear, but Cameron ought not to lose a second in finding out more. Osborne has offered tax advantages for shale, but they are of limited use for as long as other government environmental and energy agencies are against it.

4. Lift the barriers to enterprise. The CBI recently warned that growth could be held back because the cost of red tape and bureaucracy is expected to rise by tens of millions of pounds. It is embarrassing that last year’s World Bank survey found that it is easier to hook a new business up to the electric grid in Trinidad and Tobago, Tonga, Suriname and Greece than it is in the UK.

Important, but hard when so many regulations are faxed across from Brussels

5. Send out a clear message. On the one hand, the Government claims that Britain is open for business; on the other, it sometimes indulges in populist, anti-enterprise rhetoric. The Chancellor needs to strike a consistent tone in his Budget, stressing that the UK welcomes wealth creators, rather than dwelling on the need to crack down on tax avoiders.

This means Osborne should scarp the now-obligatory part in his budget speech where he bears his teeth at bankers, or comes up with some populist policy involving private jets. His 47p top rate of tax is lower than the 52p, but still far higher than the 40p which survived under Blair. At a time when we countries compete for people, it’s woefully uncompetitive. Osborne did want to cut it to 42p, but was vetoed by the LibDems. He should have kept it at 52p and waited until he could abolish the supertax entirely. Swapping a temporary 52p tax for a permanent 47p tax is hardly a great result

All told, there are plenty of tools at the Chancellor’s disposal, as I discuss in this week’s View from 22 Podcast with Matthew Sinclair of the Taxpayers Alliance — click here to listen.

So how much will be done? We’ll see on 20 March. And if any CoffeeHousers want to come along that evening to hear the verdict (from James Forsyth, Andrew Neil and yours truly) at the Savoy then there are still some tickets on sale.

Comments