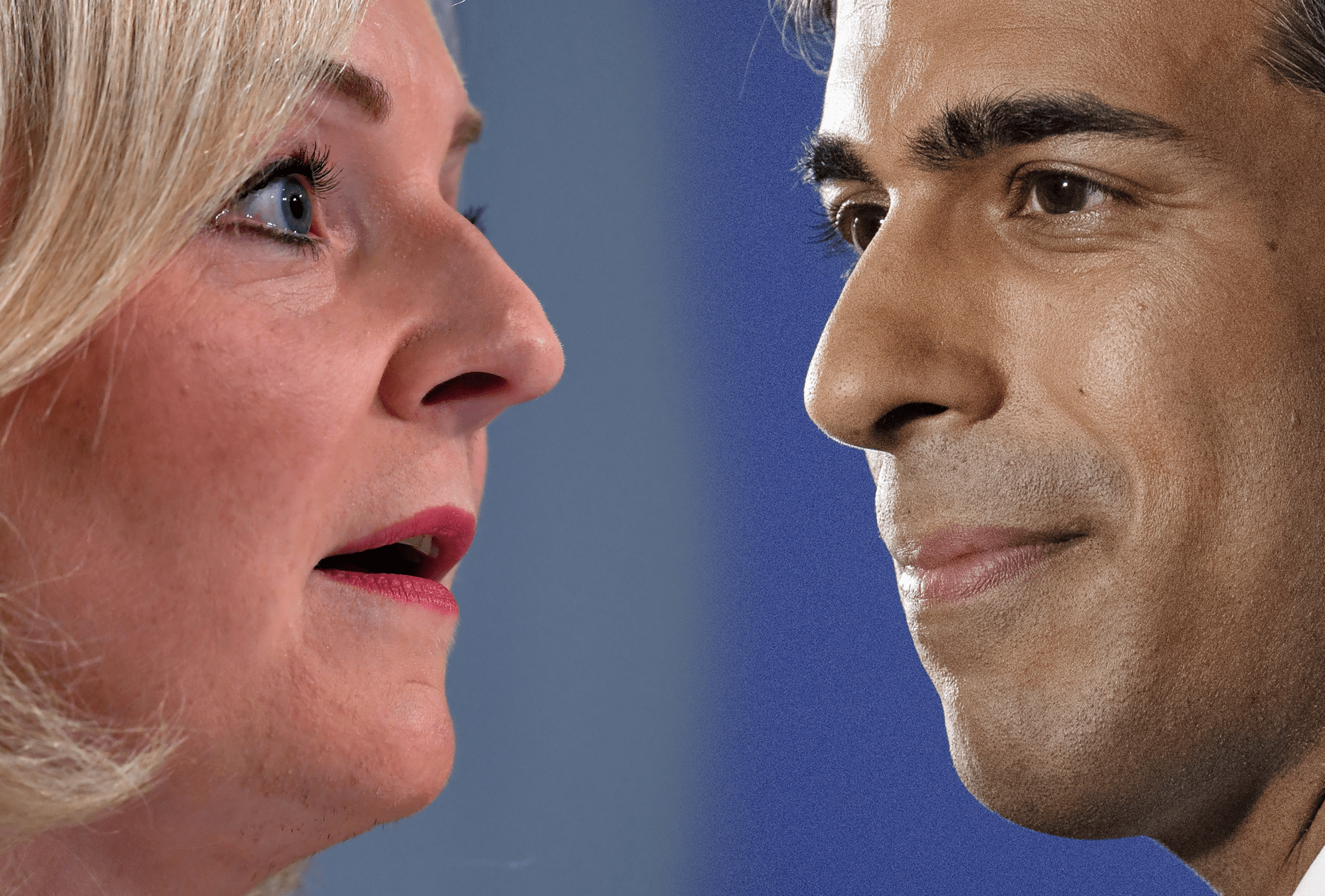

It’s a red letter day for Rishi Sunak. No, he hasn’t succeeded in fulfilling any of his five priorities. Instead, the average two-year fixed-rate mortgage has today passed the peak seen in the wake of the Truss government’s mini-budget. Mortgage rates have soared in recent months, following the Bank of England’s interest rate hikes to try to tackle rampant inflation. Two-year fixed deals have now reached 6.66 per cent on average – a level not seen since August 2008.

That rate is of course higher than the 6.65 per cent reached on 20 October last year, when Tory MPs were in full meltdown. Back then some Sunak allies were crowing that they had seen this all coming: that her unfunded tax cuts made this inevitable and that a U-turn was needed. Throughout the summer leadership campaign, Rishi Sunak himself unveiled an interactive calculator to show how much voters’ mortgage monthly payments would rise with 5 per cent interest rates – a figure which, er, the UK hit in June this year. Mortgage brokers believe the average two-year fixed rate will now peak around 7 per cent and not fall until 2024.

Mr S wanted to go and use the calculator to see what would happen to his mortgage if rates continued to rise under Sunak. But sadly the website was quietly deleted a couple of months ago. Funny that! As a source close to Truss told the Times: ‘We now find ourselves with higher interest rates and stagnant growth, with none of Liz’s reforms being enacted’. What were the last nine months all for, eh?

Comments