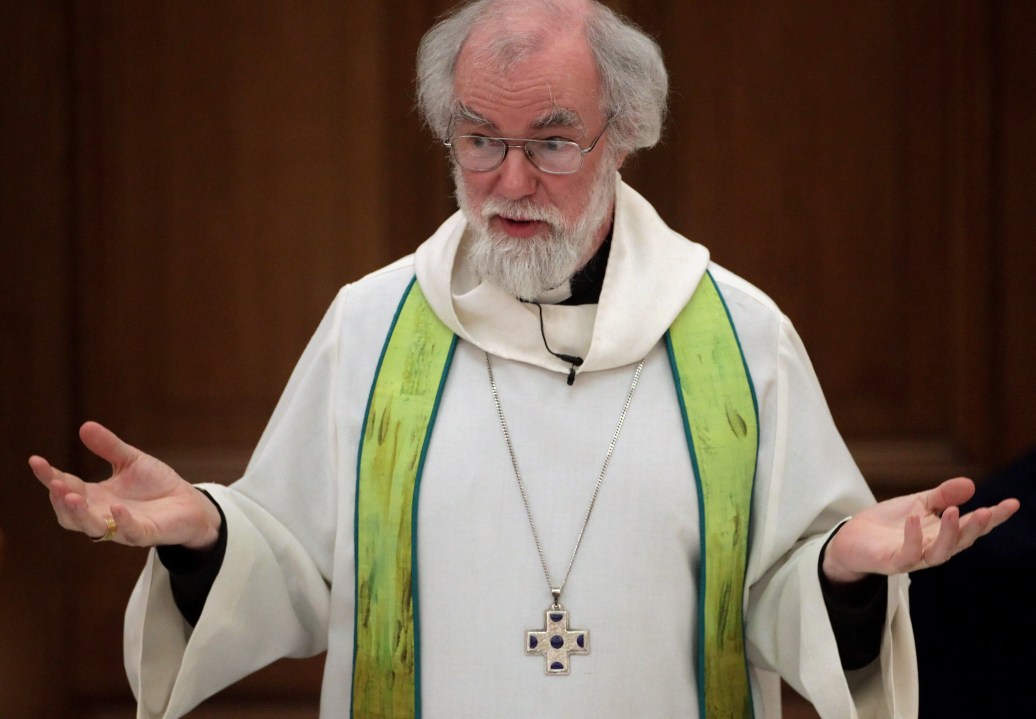

To mark today’s news that Rowan Williams will be stepping

down as Archbishop of Canterbury, here’s a piece he wrote for The Spectator during the financial crash of 2008:

Rowan Williams, Face it: Marx was partly right about capitalism, 24 September 2008

Readers of Anthony Trollope will remember how thoughtless and greedy young men in the Victorian professions can be lured into ruin by accepting ‘accommodation bills’ from their shifty acquaintances. They make themselves liable for the debts of others; and only too late do they discover that they are trapped in a web of financial mechanics that forces them to pay hugely inflated sums for obligations or services they have had nothing to do with. Their own individual credit-worthiness, their own circumstances, even their own personal choices are all irrelevant: the debt has acquired a life of its own, quite independent of any real transaction they are involved in.

A prescient student of Trollope would have seen that he is identifying an endemic feature of the world of borrowing and lending. A lender takes a calculated risk in offering the use of their money to someone else, and rates of interests express the recognition of this — and the rewards that may be secured for taking such a risk. But it is not too difficult to see how the notional gain involved here can be used as security against a further risk. And so the transaction moves further and further from the original transaction with its realistic assessment of levels of risk within the context of measurable standards of credit-worthiness. Any face-to-face element, any direct calculation of what and who is reasonably worth trusting (which assumes some common frame of reference), fades away. Like Trollope’s hapless young clerics and feckless young landowners, individuals find that their own personal financial decisions and calculations have nothing to do with what is happening to their resources, in a process for which a debt is simply someone else’s wholly disposable asset.

It is a sort of one-syllable nursery parable of what the last couple of weeks have illustrated in the world of global finance and, of course, a reminder that what we have been witnessing is not just the product of a couple of irresponsible decades.

Trading the debts of others without accountability has been the motor of astronomical financial gain for many in recent years. Primitively, a loan transaction is something which enables someone to do what they might not otherwise be able to do — start a business, buy a house. Lenders identify what would count as reasonable security in the present and the future (present assets, future income) and decide accordingly.

But inevitably in complex and large-scale transactions, one person’s debt becomes part of the security which the lender can offer to another potential customer. And a particularly significant line is crossed when the borrowing and lending are no longer to do with any kind of equipping someone to do something specific, but exclusively about enabling profit — sometimes, as with the now banned practice of short-selling, by effectively betting on the failure of a partner in the transaction.

This crisis exposes the element of basic unreality in the situation — the truth that almost unimaginable wealth has been generated by equally unimaginable levels of fiction, paper transactions with no concrete outcome beyond profit for traders. But while we are getting used to this sudden vision of the Emperor’s New Clothes, there are one or two questions that, in government as in society at large, we at last have a chance to ask. Some of these are elementary and practical. Given that the risk to social stability overall in these processes has been shown to be so enormous, it is no use pretending that the financial world can maintain indefinitely the degree of exemption from scrutiny and regulation that it has got used to. To grant that without a basis of some common prosperity and stability, no speculative market can long survive is not to argue for rigid Soviet-style centralised direction. Insecure or failed states may provide a brief and golden opportunity for profiteering, but cannot sustain reliable institutions.

Without a background of social stability everyone will eventually suffer, including even the most resourceful, bold and ingenious of speculators. The question is not how to choose between total control and total deregulation, but how to identify the points and practices where social risk becomes unacceptably high. The banning of short-selling is an example of just such a judgment. Governments should not lose their nerve as they look to identify a few more targets.

Behind all this, though, is the deeper moral issue. We find ourselves talking about capital or the market almost as if they were individuals, with purposes and strategies, making choices, deliberating reasonably about how to achieve aims. We lose sight of the fact that they are things that we make. They are sets of practices, habits, agreements which have arisen through a mixture of choice and chance. Once we get used to speaking about any of them as if they had a life independent of actual human practices and relations, we fall into any number of destructive errors. We expect an abstraction called ‘the market’ to produce the common good or to regulate its potential excesses by a sort of natural innate prudence, like a physical organism or ecosystem. We appeal to ‘business’ to acquire public responsibility and moral vision. And so we lose sight of the fact that the market is not like a huge individual consciousness, that business is a practice carried on by persons who have to make decisions about priorities — not a machine governed by inexorable laws.

And this is part of the same mindset that turns the specific, goal-related transactions of borrowing and lending into a process producing pseudo-things, paper assets — but pseudo-things that (when matters do not go well) cause real and crippling damage to actual persons and institutions. The biggest challenge in the present crisis is whether we can recover some sense of the connection between money and material reality — the production of specific things, the achievement of recognisably human goals that have something to do with a shared sense of what is good for the human community in the widest sense.

Of course business is not philanthropy, securing profit is a legitimate (if not a morally supreme) motivation for people, and the definition of what’s good for the human community can be pretty widely drawn. It’s true as well that, in some circumstances, loosening up a financial regime to allow for entrepreneurs and innovators to create wealth is necessary to draw whole populations out of poverty. But it is a sort of fundamentalism to say that this alone will secure stable and just outcomes everywhere.

Fundamentalism is a religious word, not inappropriate to the nature of the problem. Marx long ago observed the way in which unbridled capitalism became a kind of mythology, ascribing reality, power and agency to things that had no life in themselves; he was right about that, if about little else. And ascribing independent reality to what you have in fact made yourself is a perfect definition of what the Jewish and Christian Scriptures call idolatry. What the present anxieties and disasters should be teaching us is to ‘keep ourselves from idols’, in the biblical phrase. The mythologies and abstractions, the pseudo-objects of much modern financial culture, are in urgent need of their own Dawkins or Hitchens. We need to be reacquainted with our own capacity to choose — which means acquiring some skills in discerning true faith from false, and re-learning some of the inescapable face-to-face dimensions of human trust.

Comments