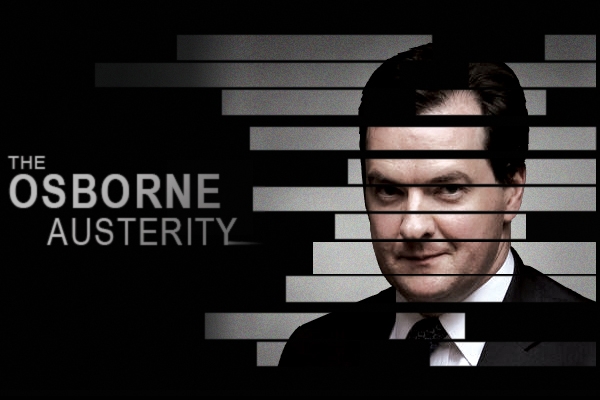

Fresh from his success nationalising the Post Office pension, which artificially knocked £23 billion off the national debt, the Chancellor has come up with another manoeuvre which effectively adds £35bn to the total of QE – and analysts think this just save him from having to tear up his fiscal rule in next month’s mini-Budget. CoffeeHousers may remember that two years ago, Osborne said that the debt-to-GDP ratio would be falling by 2015/16. But the outlook between his first budget and his last one has deteriorated rapidly.

But help may be at hand. There is a lot of spare cash from debt interest hanging about in the Asset Purchase Facility: the interest that has accumulated on the gilts bought as part of Quantitative Easing. It was today announced that the cash is being transferred from the Bank of England’s QE budget back to the Treasury. But not all at once! Michael Saunders from Citi explains how he sees things panning out:-

‘This transfer will “be staggered for operational reasons”, and subsequent APF net interest income, which is likely to be about £15bn (1% of GDP) per year, will be transferred quarterly. The overall effect would be to cut the debt/GDP ratio by about 2% initially and (relative to the prior baseline) by a further 1% of GDP or so each year.’

The ‘operational reasons’, I am told, are gilt auctions. Citi says that this move will have the effect of artificially lowering the debt-GDP ratio, but the Treasury disputes this. Either way, bagging cash from the Bank of England’s vaults is — as Saunders says — ‘more or less equivalent to extra QE, £35bn upfront and a further £15bn or so per year thereafter’.

UPDATE: I have amended the above, downgrading my headline from “cooking the books” – the Treasury says that, contrary to Citi’s analysis (and that of Nomura), the payments will not much affect the deficit figures as the ONS will allocate the interest to the year accrued not the year transferred. It will spice up the previous years’ accounts, however.

As Spectator contributor Faisal Islam tweets, this manouvre may have looked liked a Great British Fake-off but it is fairly standard cash management. And the Post Office move (where the government credits its account with the posties’ savings, but doesn’t factor in the liability) is in keeping with the still-dodgy way in which the Treasury accounts (or fails to account) for all public sector pensions.

Comments