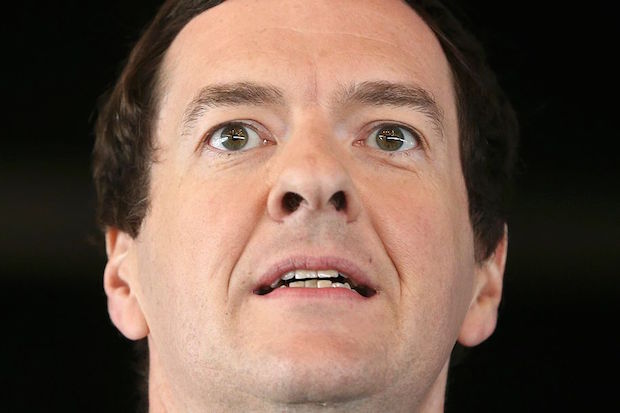

Finally George Osborne has seen an upside to Britain voting to leave the European Union. The Chancellor used this morning to abandon another one of his own economic targets, blaming it on Brexit. He has long been warned by experts such as the Institute for Fiscal Studies that he is likely to fail to deliver a £10bn surplus on the public finances by 2020, and today he admitted as much. The Chancellor said:

‘Now, as the governor of the Bank of England said yesterday, the referendum result is as expected likely to lead to a significant negative shock for the British economy. How we respond will determine the impact on people’s jobs and on economic growth. The Bank of England can support demand.

‘The government must provide fiscal credibility, so we will continue to be tough on the deficit but we must be realistic about achieving a surplus by the end of this decade. This is precisely the flexibility that our rules provide for. And we need to reduce uncertainty by moving as quickly as possible to a new relationship with Europe and being super competitive, open for business and free trading. That’s the plan and we must set to it.’

In all likelihood, Osborne won’t be Chancellor to face the reckoning that would come if he failed to meet this rule anyway. But given attention is mostly on the Tory leadership contest and Labour’s meltdown, it is a convenient time for him to accept that he’s not going to meet it. That he thinks it’s important to do this suggests that Osborne still thinks he has a political future that he needs to protect.

Comments