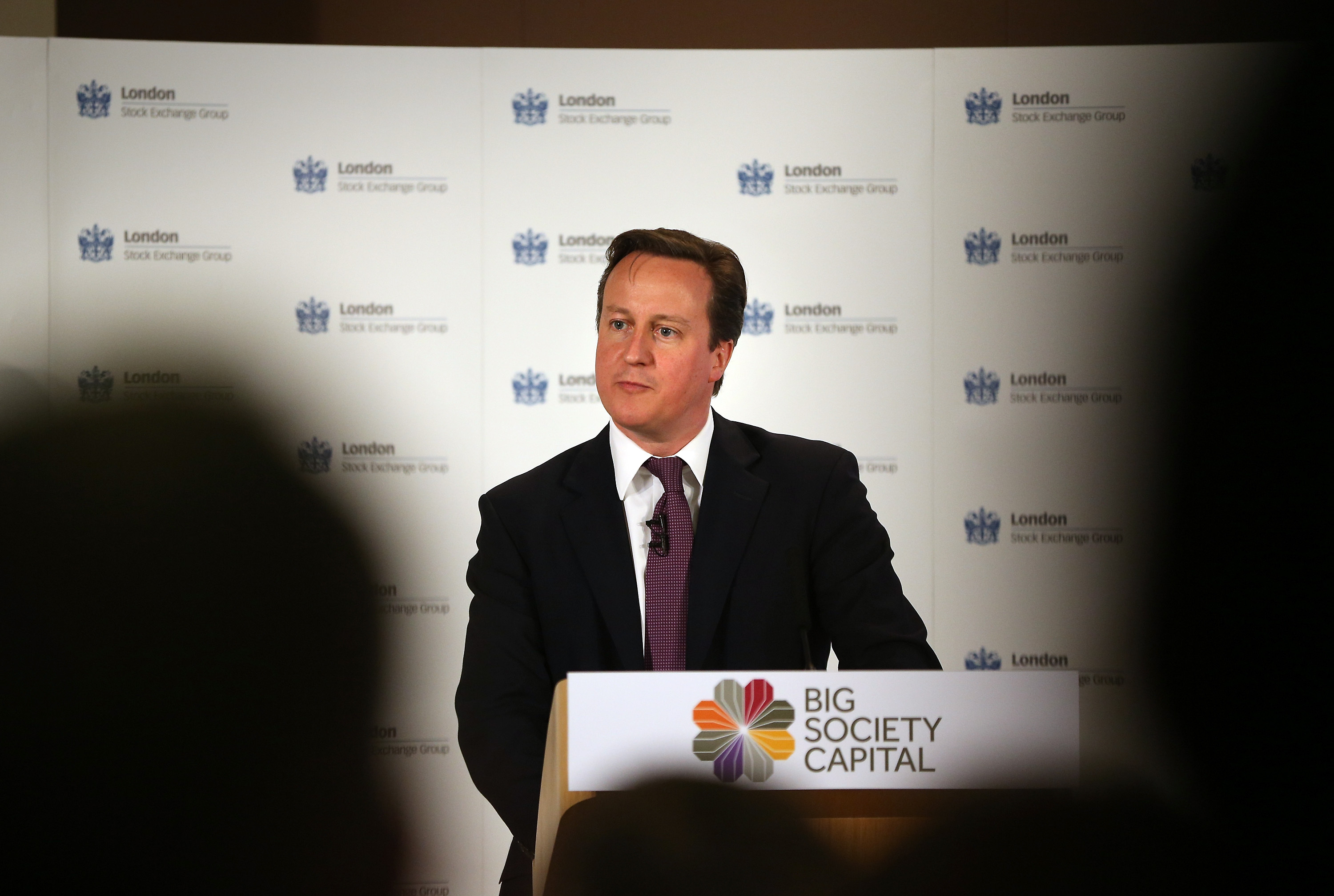

Michael Dugher is only half right when he tweets that you know the government is in trouble when it dusts down another Big Society announcement. The idea, in principle, is a good one, or at very least it is an interesting and important experiment in finding new ways of funding public services. Sir Ronald Cohen, the chair of Big Society Capital, was once a close ally of Gordon Brown and much of the thinking in this area happened in the New Labour era. There is no need for this to become a party-political battleground. The real question is, will it work? Or is it another example of boom-time policy making that will prove unfit for purpose in harder times?

For a start, the government needs to get its message on this clear. Big Society Capital will not save charities now facing closure because of the withdrawal of local or central government grants. This is about creating a whole new culture of social investment that should probably not be called charity at all. Those encouraged to invest under the new models developed by Big Society Capital will be expecting a return. This is not philanthropy.

Much of the explanation of the social investment proposed by Big Society Capital has been opaque, but there is a good explanation from Oliver Wright in today’s Independent. Charities will not apply direct to Ronald Cohen’s outfit for loans. BSC will put its £600 million into specialist investment funds such as Big Issue Invest, which will in turn invest in charities and social enterprises.

But it’s not even as simple as that. As Ronald Cohen made clear on the Today programme, what he really wants to see is the development of a market in social impact bonds, which would pay out a proportion of savings made to the exchequer on social projects such as youth employment or prisoner rehabilitation schemes.

This scale of change proposed by the Big Society Capital model is massive. Traditional free-market Conservatives might ask why social impact bonds don’t already exist if they are such a good idea. As with the government’s health and welfare-to-work reforms, the paradox is that the creation of market models involves the intervention of central government in unprecedented and untested ways.

The point is that no one knows whether this neo-liberal Utopianism will work. But its advocates will need to explain it more clearly before individual or corporate investors can be expected to sign up with hard cash.

Comments