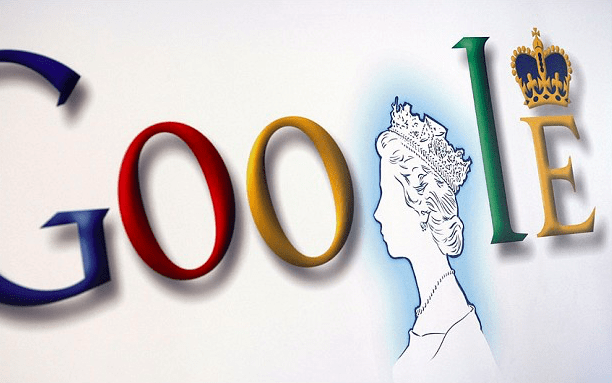

If Google hoped for some good PR in offering £130 million to settle UK tax claims dating back to the Labour years, it was a miscalculation: Labour regards the offer as “derisory” and the BBC is leading its news bulletins the better to sock it to its rival. Why did Google bother? It has run up against the standard anti-business narrative: that the social worth of businesses can be measured only by how much cash they give to the government. In fact, Google provides its services to millions of Britons (worth at least £11 billion, by some estimates) at no cost at all: this is its contribution to society. As for its contribution to the government’s coffers, Google has – from the offset – been following the rules. And for this, it has been lambasted.

It ought to come as no surprise that paying tax has been revolutionised in an electronic, borderless environment world. And yet an awful lot of people are in a constant state of shock that taxpayers adapt. As we have seen with Google, Apple – and even pop groups like U2, fronted by Saint Bono, which moved part of its business to the Netherlands for tax reasons. As Bono explained:-

It’s just some smart people we have working for us trying to be sensible about the way we’re taxed

Google has also hired smart people to plan its tax exposure. The fact that governments, including our own, are still using the term ‘tax avoidance’ shows how little they have understood the issue. We’re in an era of tax competition: governments need to compete for people. And they do. Why is George Osborne offering the lowest corporation tax in the G20? Why is he boasting about his restraint on taxing overseas profits? To try to tempt big companies away from Ireland and other lower-tax countries.

Quite properly, any government will investigate and prosecute companies who break the rules. But if the tax system is addled with loopholes, can it really blame a company — or a stand-up comedian — that (legally) takes advantage of them?

And, anyway, companies can’t pay tax: only people can. Osborne’s steady reduction of corporation tax to 20pc has left companies with more money to hire workers and keep prices low. His policy just might just be related to Britain having zero inflation and record employment.

Google’s contribution to the UK economy is so big that there are serious worries about it screwing up the GDP figures: we’re all paying nothing for hugely valuable digital products and nothing shows up in the economic output. Google’s popularity has made it very powerful – too powerful for my liking. A lot depends on its good behaviour which is, perhaps, why its tax arrangements cause such interest. But the general principle holds: if you don’t like the tax rules, then it’s best to change the rules – rather than blame companies for following them.

Comments