Would you touch a ‘green gilt’ issued by the government, with an interest rate of just 0.87 per cent? Some people, apparently, would. The Treasury announced yesterday that it had shifted the first £10 billion tranche of ‘green gilts’ to raise finance for projects such as zero-carbon buses, wind farms and other green things. Indeed, the bond – which matures in 2033 – was ten times oversubscribed. The government had already planned to issue a further £5 billion, and might now be encouraged to issue far more.

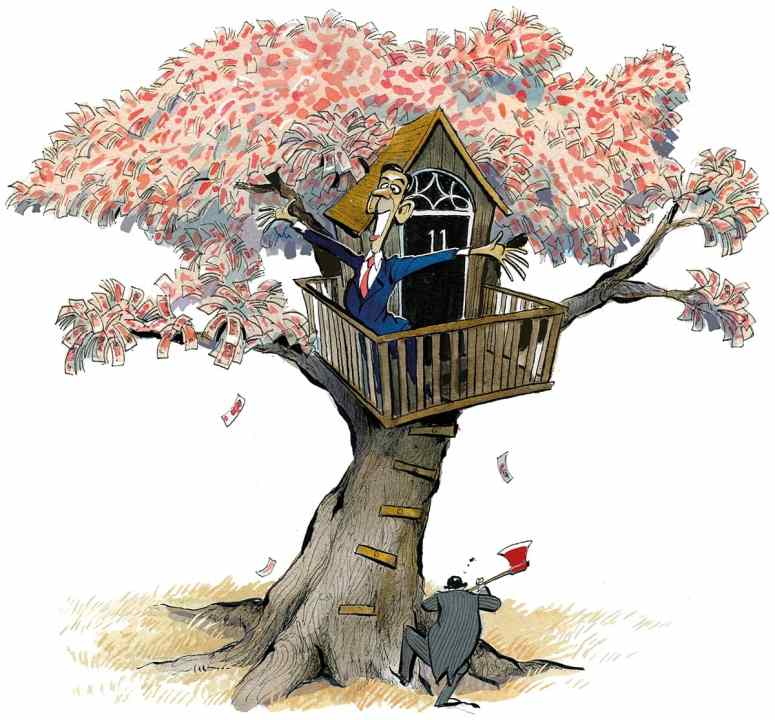

Green gilts are just more government borrowing, rebranded to make lending to the government look virtuous

With the government’s preferred measure of inflation, CPIH, rising rapidly to 3 per cent in August, and with many expecting it to rise much further in coming months, green gilts look a pretty sure-fire way to erode your wealth. In real terms it is a return of less than, well, net zero. It has echoes of the war bonds which the government issued during the first world war to finance the war effort – and sold with the aid of patriotic posters. That is pretty well what it was: a patriotic act. In the long run, the government more or less got its war for free, thanks to inflation eating away the real value of the bonds. Initially issued with interest rates between 3.5 per cent and 5 per cent, the government in 1932 exercised a right to reduce the higher-paying bonds to 3.5 per cent. They carried on paying that rate through years of high inflation until the last tranche was finally redeemed in 2015.

Green gilts are just more government borrowing, rebranded to make lending to the government look virtuous. Meanwhile, the issuing of index-linked savings certificates – which protect savers against the ravages of inflation – has been trimmed back. They are no longer on sale to new customers, although existing holders have the right to renew their certificates, albeit at rates which offer virtually nothing on top of the CPI index. A decade ago, private investors could buy certificates paying one per cent over the rate of the Retail Prices Index, which tends to run higher than CPI.

Green gilts are an astonishingly bad deal by comparison. True, they pay a little more interest than the derisory sums paid by High Street savings accounts nowadays, but most of the latter are at least instant access, so you can get back the full value of your savings at any point and invest it elsewhere. With green gilts, you will have to wait 12 years to get your investment back. Buy them if you want to feel a warm glow from having helped to finance a zero-emission bus. But it you want to actually maintain the value of your wealth, you would be better off looking elsewhere – virtually anywhere else.

Comments