Hopes for economic recovery have faded a little of late as Covid-19 cases continue to rack up in many parts of the world. The grand reopening of bars, restaurants and the like has turned into a bit of damp squib, serving to remind everyone how far we remain from normality. Yet today comes a double bill of good news – verging, indeed, on the dramatic. The Office for National Statistics put out its figures for retail sales in June, which turned out to be 13.9 per cent up on those in May.

This is way in excess of what economists were expecting – a survey for Reuters showed a consensus of around 8 per cent – and takes retail sales pretty much back to where they were before the crisis struck. Year on year, sales for June were down just 1.6 per cent – remarkable, given that it was only halfway through June that shops were allowed to reopen. Unsurprisingly, the figures show a dramatic difference between the relative fortunes of bricks and mortar retail and online retail – non-food, store-based retail is down 15 per cent on February while online retail is up 53.6 per cent. But while that might be a problem for retailers who have failed to fully embrace online sales, what matters is the health of the economy as a whole.

Today comes a double bill of good news – verging, indeed, on the dramatic

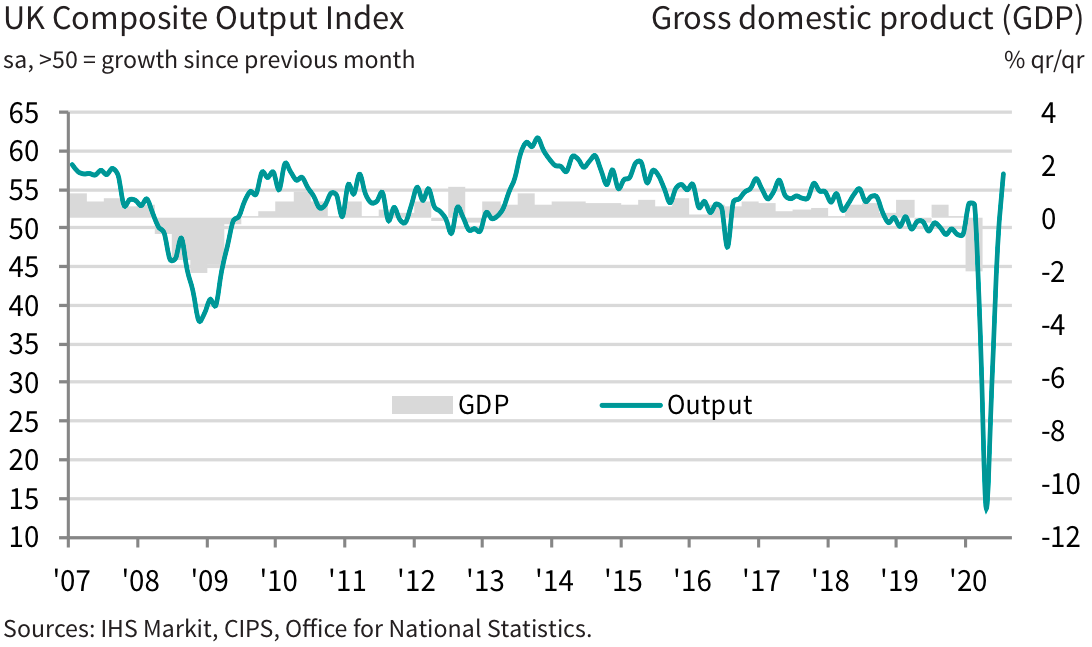

What’s more, IHS Markit announced that its composite Purchasing Managers’ Index (PMI) rose from 47.7 in June to 57.1 in July, where anything above 50 denotes expansion of the economy.

Again, this was way ahead of what economists had expected – a Reuters poll suggested it would rise to 51.5. Reading today’s figures, the recovery looks unquestionably V-shaped. There are, however, some caveats.

The retail figures would not look so good without food and drink sales being 5.3 per cent higher than in February. Much of this will be down to the continued closure of pubs and restaurants throughout June – it is a case of the retail sector benefitting at the expense of the hospitality sector.

Moreover, some of the sales recorded in June might have been displaced from April and May when non-food shops were closed – remember the queue for baby clothes when Primark reopened? We will need to wait for July’s figures to see how much of June’s bounce-back was caused by desperation from being unable to shop for nearly three months.

Apart from food, household goods was the only other sector where sales in June were higher than in February (by 1.9 per cent). Clothing and footwear were down by 34.9 per cent compared with February (a 26.8 per cent rise in online sales failing to counter a 50.8 per cent fall for in-store sales). Paradoxically though, there might be a grain of good news for brick and mortar stores here —the discrepancy is an indication of how much the sector relies on bricks and mortar stores to generate sales. If consumers can’t view and try on the goods, they seem to loathe buying at all.

As for the PMI, growth is coming off a very low base. While the economy may now be growing strongly, it is still a long way down on where it was before the crisis. IHS Markit does not expect the economy as a whole to get back to the size it was before. Nevertheless, today’s figures are unquestionably good news and indicate that fears of a long slump – a ‘U’-shaped recovery – may be overdone.

Comments