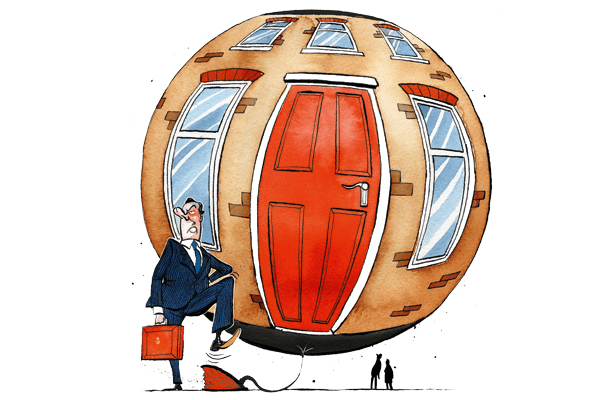

Gordon Brown used to joke that there are only two types of Chancellors: ‘those who fail and those who get out in time.’ Inside this joke lay his strategy: he was stoking a debt-fuelled bubble that was going to burst, but he hoped it would do so after the election or on someone else’s watch. It’s the textbook definition of putting party over country. I’m afraid that we can see its reflection in Help to Buy.

David Cameron’s article in the Sun today shows this politicking is back. Look, he said, this policy shows I’m on the side of aspirational voters. If you want to get on in life, the Tories are on your side – they’ll kit you out with a sub-prime housing loan. After all, what could possibly go wrong?

As James says, this strategy may pay political dividends for the Conservatives. But it is a piece of economic madness. In his piece today, Cameron says:-

Unbelievably, there are people who actually oppose Help to Buy and don’t want people like Kayleigh and Chris [two customers of his sub-prime debt] to get on. I’ll let you guess who they are. Yes, the same old Labour Party. The party that oversaw the biggest boom and the biggest bust.

It is all too believable that people oppose Help to Buy – and it’s not just Labour. Concern has been expressed by any sane economic forecaster old enough to remember George W Bush’s sub-prime disaster or Brown’s debt bubble. They are worried because Cameron is borrowing from the Brown play book: place your faith in debt, debt and debt again. Here are a few of the ‘unbelievable’ opponents of Help to Buy:-

· The IMF has warned that it will just jack up house prices even further, providing a subsidy to housing when “”housing market is already recovering quite well”.

· The Institute of Directors’ chief economist has this to say: ““The world must have gone mad for us to now be discussing endless taxpayer guarantees for mortgages. Instead of trying to pump-up prices, the Government should focus on relaxing planning laws and reducing Local Authority charges on developers to make it easier to build more homes.“

· Société Générale’s head global strategist, Albert Edwards, puts it even more strongly:

‘Why are houses too expensive in the UK? Too much debt. So what is George Osborne’s solution for first-time buyers unable to afford housing? Why, arrange for a government-guaranteed scheme to burden our young people with even more debt! Why don’t we call this policy by the name it really is, namely the indentured servitude of our young people. I believe it truly is a moronic policy that stands head and shoulders above most of the stupid economic policies I have seen implemented during my 30 years in this business.’

· And Fathom Consulting’s Andrew Bridgen is the most scathing of all:

‘Had we been asked to design a policy that would guarantee maximum damage to the UK’s long-term growth prospects and its fragile credit rating, this would be it.’

Ed Balls will never criticise any tactic that relies on debt, whether making it cheaper (QE) or increasing the national debt by £3,200 per second as Osborne is doing now. The Chancellor will be calculating – as Brown calculated – that the danger of a bubble bursting will lie on the safer side of the election. He may well be right, and if all you care about is the narrow self-interest of the Conservative Party then this may be a good idea. But as the Chancellor pumps the economy full of debt again, he should not expect the applause from those of us who lambasted Gordon Brown for precisely the same tactic.

Comments