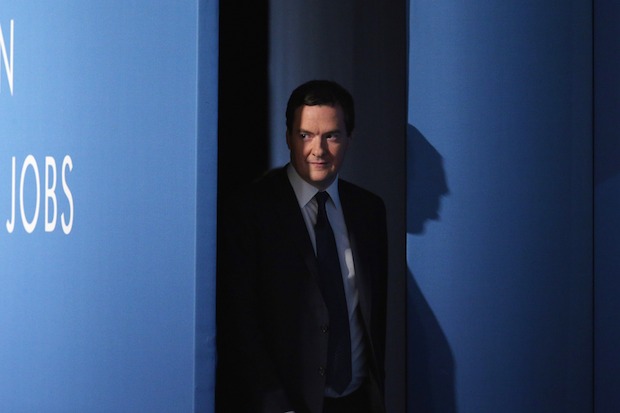

In politics, as in comedy, timing is everything. It is worth bearing this in mind when considering George Osborne’s ‘you can’t keep the pound’ speech and what has happened since.

There were many (including some senior Lib Dems) who were quick to criticise the Chancellor after he ruled out a shared Sterling zone with a independent Scotland earlier this month. Alistair Carmichael, the Scottish Secretary, even went public to suggest it may well have been ‘wrong from a tactical point of view’ to goad the Nats in this way, particularly as the Yes camp received a noticeable surge in support as a result.

But it now appears as if there was a clear calculating method in Osborne’s approach. Senior sources inside the No camp have revealed that the timing of the Chancellor’s declaration was carefully planned.

The Chancellor had been prepared to rule out a shared currency for some time but it was decided that this had to be done in February, close enough to the referendum to have real impact but also – crucially – ahead of all those springtime annual meetings and reports of Scotland’s big financial companies. So the aim was not so much to receive a boost in the polls but to force Scotland’s financial services industry into the debate.

No camp strategists knew that all the big Scottish financials – and the UK ones too for that matter – have to put out annual reports, confront shareholders and make declarations about the year ahead at this time of year. They wanted to frighten these so far reluctant business leaders into action and force them to make public their fears about Scottish independence. Up until now, this week’s decision by Standard Life to warn that it is considering shifting operations to England in the event of independence has been seen in the context of the Osborne announcement but the direct link between the two has really not been explored.

But these two key developments in the independence debate have to be taken together. Indeed they should be seen as cause and effect.

The Chancellor made his speech and then, on the back of it, Standard Life felt compelled to enter the debate, warning that uncertainty over currency was one of the big fears it faced as it looked towards the possibility of Scottish independence. If Standard Life is the only company to declare its fears in this way, then the Chancellor’s speech will have succeeded in its task, at least in part.

But Better Together strategists are convinced that more will follow the lead Standard Life has taken and the weeks to come will see company after company issuing warning after warning about the perils of independence and the prospect of lost jobs and businesses fleeing south of the border. It is also understood that Better Together strategists were well aware that they might suffer a setback in the polls from Osborne’s speech – or rather, the reaction to it and Alex Salmond’s allegations of ‘bullying’ which seemed to hit home.

But they also believed that the long-term gains caused by real fears over the currency would trump any short-term losses they would suffer. They won’t know whether that will actually be the case until much later in the campaign, specifically in the last six weeks when most undecideds make up their minds. It will be at that point that a combination of Osborne’s clear message that an independent Scotland will be outside a currency union with the UK and the list of businesses warning that they may have to relocate south of the border should have the most impact.

And if, at that point, the campaign does turn decisively in the No camp’s favour, then the strategists can look back, pat themselves on the back and realise that this was one occasion when they got the timing exactly right.

Comments