‘I’m on the beach with my BlackBerry,’ a senior banker told the Financial Times back in early August. ‘Normally, banks run on half or two thirds of normal staff in August, which can make it difficult, so every banker has to remain vigilant, even if you’re on the beach like me.’ But, at precisely the same time, in a small back office at an investment bank on Wall Street, one highly vigilant trader was in a frenzy of activity — constantly checking seemingly unbelievable market data and firing off trade after trade, but still ending the week 30 per cent down, and wiping nearly $1 billion off the value of a major investment fund. The bank was Goldman Sachs. The fund was its flagship Global Equity Opportunities fund. And the trader was a computer.

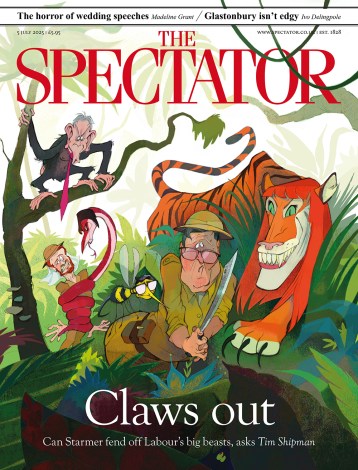

In fact, if anything has come of the recent stock-market turbulence, it’s an updating of the old parable of causality and chaos theory. Where once we pondered Chinese butterfly wings and American hurricanes, now the saying seems to be: ‘If a computer goes berserk in New York, a thousand pensioners will eventually queue outside banks in Newcastle.’ More worryingly, both the Wall Street firm and the high-street bank found themselves powerless as market sentiment turned negative. Where, then, can British private investors hope to shelter from the storm?

To identify a safer investment strategy, it’s useful to work out what went wrong with the old one. While the world’s bankers were trying not to spill piña coladas into their BlackBerrys, they had left the management of their funds to rather more powerful computer hardware.

Quantitative hedge funds, or ‘quants’, use mathematical computer models to identify very small price differences between shares. Their computer programmes then execute the buy and sell trades themselves, using leverage — borrowing to invest more money — to amplify their potential returns. But in August, they encountered market conditions that, literally, did not compute. David Viniar, Goldman’s chief financial officer, was forced to explain that his computer was ‘seeing things that were 25-standard deviation events, several days in a row’. A 25-standard deviation event is, as every statistician knows, something that only happens once in every 100,000 years. Admittedly, the global credit crisis that began in August did ultimately result in a once-in-143-years event: a run on a London bank. To suggest, however, that it was a historical first is a bit rich. As one Wall Street wag put it, ‘People say these are one-in-100,000-years events, but they seem to happen every year.’

What was actually happening was that shares were moving in ways that hadn’t been programmed into the computer models. Liquidity was tightening but it was shares in the larger, more stable companies that were being sold. That was because the leveraged hedge funds were getting margin calls from their lenders — being asked to put up more cash against their borrowings. They couldn’t sell out of illiquid securities linked to sub-prime mortgages, so they raised the money by selling shares in blue-chip companies. This seemed irrational to the Mr-Spock-like computers, which were all programmed with similar quant models. So they all made ‘crowded trades’ into a falling market.

This has now called into question the strategies of all kinds of hedge funds, not just quants. They are meant to be safer than conventional equity funds in volatile markets, because they can ‘short-sell’ shares — and therefore make small but regular profits from falling prices as well as rising ones. US hedge fund Long-Term Capital Management once described this approach as ‘hoovering up nickels’. But the events of August suggest that Nassim Nicholas Taleb was more accurate when in his book The Black Swan (recommended in this issue by Jonathan Davis) he described the practice as more akin to ‘picking up pennies in front of a steam-roller’. Arguably, the risk of being flattened was already well known, given the collapse of Long-Term Capital Management in 1998.

Consequently, it wasn’t only Goldman’s quant fund that finished August with huge losses. Almost all hedge fund managers — whether they were on the beach or not — got caught out.

For example, the managers of so-called Equity Market Neutral hedge funds were supposed to use their judgment to take long positions in stocks that could outperform the market, and short positions in the stocks that were most likely to underperform. But somehow their short positions failed to generate significant returns from a market that fell by more than 6 per cent in the first two weeks of August. Nor did their long positions compensate when the S&P 500 recovered to finish the month up 1.3 per cent. So, overall, the HFRX Equity Market Neutral Index was down more than 2 per cent by the end of the month.

Similarly, Long/Short Equity (or Equity Hedge) fund managers combine long holdings of equities with short sales of stocks or options. According to Hedge Fund Research, they use this method to ‘decrease net long exposure or are even net short in a bear market’. Clearly, though, they weren’t ‘net short’ when the market turned bearish. So the HFRX Equity Hedge Index was down 2.3 per cent.

This might not have mattered to investors like you and me if it weren’t for the fact that many ‘funds of funds’ now put our money into these hedge funds. According to Trustnet, the London-listed Absolute Return fund of funds was down 2.4 per cent in the month to 28 August — mainly because 35 per cent of its money was in Macro, Equity Long Bias, and Equity Hedged funds. At the same time, the Alternative Investment Strategies fund was also down 1.9 per cent in a month, probably due to its 43 per cent reliance on Long-Short Equity hedge funds.

Thankfully, though, there are some UK funds where human common sense has led to a better forecast of the direction of the markets. Thames River Hedge+ was launched in February 2004 with the aim of achieving absolute returns in excess of 10 per cent a year ‘through opportunistic investment in a portfolio of both directional and non-directional hedge funds’. Even through the squalls of August, it seemed to get the direction right, both long and short. In the period from October 2006 to September 2007, the share price has risen from 116.5p to 151p — a return of nearly 30 per cent. According to chief executive Charlie Porter, ‘While many hedge funds suffered during August’s market turbulence, [fund manager] Ken Kinsey-Quick and his team have continued to deliver outstanding performance for shareholders.’ More importantly, the fund sees the ongoing credit crisis as providing ‘exciting investment opportunities, especially in the distressed area over the next 12 to 24 months’.

Another distressed asset class — property — provides a simpler directional play for long-short funds. With UK Property unit trusts and Oeics losing an average of 2.5 per cent of their value so far this year, funds taking short positions in property shares and property derivatives have been delivering strong returns. Iceberg Alternative Real Estate, a European property relative-value hedge fund, has delivered a net return of 6.9 per cent since its launch in May this year. Equally, BlackRock Absolute Alpha, which has allocated 10-20 per cent of its cash to long and short property positions, has returned 6.7 per cent in the year to date. Significantly, both prospered in August. Iceberg delivered a positive return of 5 per cent in the month, and BlackRock kept its head above water with a 0.9 per cent return. BlackRock manager Mark Lyttleton says, ‘W e have taken the view that the commercial property market is weakening across the UK. So we have a deliberate strategy to be short of stocks where the quality of assets is of a less strong nature. To balance that to a degree, we’re buying other companies that have development potential to offset net asset value declines.’

So the secret to sitting on the beach, rather than on the pavement outside your bank, is simple: make sure your fund is shorting the right stocks — not its computer circuits.

Matthew Vincent edits FT Money.

Comments