One of the occupational pleasures, and occasional hazards, of being a financial journalist is the need to keep up with your reading.

I’ve consumed a stack of books about the financial crisis and its aftermath, including Michael Lewis’s The Big Short and Vicky Ward’s riveting account of the downfall of Lehman Brothers, Devil’s Casino, notable for its portrayal of the designer clad bankers’ WAGs, whose minutely-observed social hierarchy mirrored the ups and downs of their husband’s careers.

(At a City dinner a few years ago I sat next to a former Lehman banker who appeared fairly prominently in the book – to my amusement, he was not remotely mortified but boasted loudly about being in it.)

For a devastating critique of over-leveraged banks, you can do no better than The Bankers’ New Clothes by Anat Admati and Martin Hellwig. And even if you have zero per cent interest in central bankers, Liaquat Ahamed’s Lords of Finance: The Bankers who Broke the World, is a work of sheer genius.

But if you want to understand the human side of a financial crisis, there’s only one thing for it: you need a novelist.

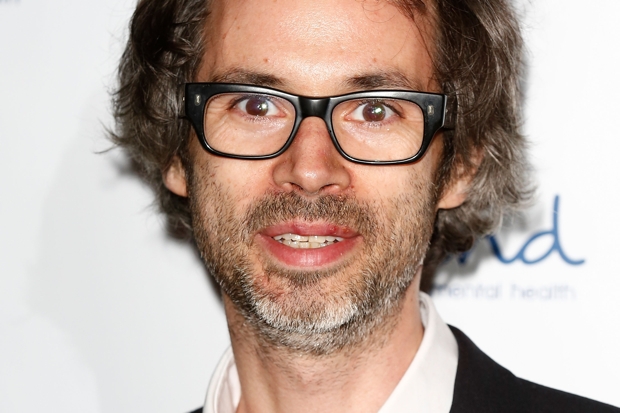

Step forward Lionel Shriver, the American author who made her name with We Need to Talk About Kevin.

In The Mandibles, an account of the decline of a once-rich family, she has done her economics homework and penned a terrifyingly plausible financial dystopia.

It begins just 13 years from now – in the centenary year of the financial crash of 1929 – by which time many of the troubling forecasts in today’s financial pages have hardened into reality.

The ageing population has aged. Wealthy ‘shrivs’ live in lavish retirement facilities and virtually the only jobs available for younger people are looking after them.

The US dollar is no longer the reserve currency but has been replaced by the ‘bancor’.

Ed Balls is the Prime Minister of the UK (it seems Strictly marked the start of his comeback).

The US president is not Donald Trump – even Lionel Shriver is not quite that pessimistic – but a Mexican, President Alvarado. A female Clinton does get to the White House by the 2040s, though.

Novels have become obsolete, partly because readers couldn’t understand why authors didn’t write more about money, but invented characters who made decisions because they were in love, without regard for their financial circumstances.

That’s not an objection that could be directed at great 19th century writers such as Anthony Trollope. The anti-hero of his masterwork, The Way We Live Now, the bombastic, shady and tyrannical financier, Augustus Melmotte, is still with us in spirit. We can all think of current incarnations.

As for William Thackeray’s Vanity Fair, it contains a chapter, ‘How to Live Well on Nothing A-Year’ which reminds us that financial irresponsibility, whether by individuals or institutions, has terrible repercussions for innocent victims.

Anti-heroine Becky Sharp and her stupid husband Rawdon live lavishly on unpaid credit, and in the process they ruin their landlord, Charles Raggles, a former footman who has painstakingly saved for years for his buy-to-let property.

We’re all familiar with the ‘trickle down’ theory of prosperity, but this is the trickle down of debt – or more accurately, from the point of view of poor old Raggles, a deluge.

Back with the Mandibles, perhaps the most entertaining character is an economist whose pronouncements are all wrong, except when in a flash of insight he admits ‘economics is closer to religion than science’.

In other words, once confidence and belief in an economic system drain away, that system is doomed.

The once vast Mandible fortune that has underwritten the family’s comfortable lifestyles has vanished into thin air. The only tangible assets worth having turn out to be gold bars and a gun.

If that sounds dark, it is. But in place of their wealth, the Mandibles rediscover some values they had lost: family togetherness, resourcefulness, and the realisation that the only point of having money is to share it with people you love. And, I would humbly add, to spend on good books.

Ruth Sunderland is City Features Editor of the Daily Mail

Comments