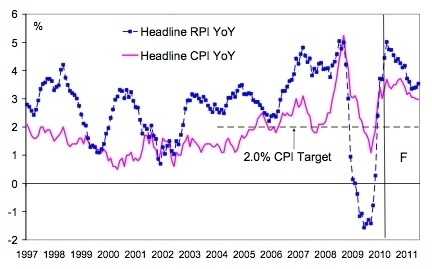

Who would have thunk it? Inflation has again “surprised” on the upside – 3.4 per cent against a 2.0 percent target. Why so high? Even the return of 17.5 percent VAT does not justify this bounce. Might it have something to do with all those bank notes which were being printed by the Bank of England? Might interest rates be going up now to control this inflation – and, if so, what impact would this have on a UK economy which is already the most indebted of any major economy in history? The March figures show Britain has, by some margin, the highest inflation of any major European economy: it’s way higher than that of France (1.7 percent) Spain (1.5 percent) Italy (1.4 percent) or Germany (1.2 percent). And in America, 1.1 percent.

I’m sure that George Osborne will be jumping right on this data, pointing out that we have yet another manifestation of Gordon Brown’s economic incompetence. That Brown’s

obsession with consumer inflation rendered him blind to a debt bubble (and soaring asset price inflation) and that his decision to print £200 billion of notes used to purchase government debt

is akin to the “helicopter money” scenario (which Willem Buiter explains in depth here. If you drop freshly-minted notes out of a

helicopter, and people start spending them, it won’t be long until prices start to soar. The below graph shows that such high inflation – way above the 2.0 percent target – will

be with us way into next year.

If you print too much money, prices soar. All fairly basic stuff. Brown’s VAT cut allowed him to artificially lower inflation, and justify Quantiative Easing (or, as Liam Halligan calls it,

Mugabe Money) on the grounds that deflation was somehow a huge danger. In fact, stomaching the gentle fall of prices in 2000-02 would have prevented the debt bubble and led to stability. CPI

fundamentalism is the intellectual father of the crash worldwide. In Britain, it was simple greed for political capital: the desire to send a nation shopping on the never-never and taking a bow for

all this fake prosperity which they thought they had.

As for QE, it just created zombie buyers for his UK government debt. Some analysts even think that the Bank of England may have to start printing the money again, as buyers for the UK’s IOU notes dry up – but how they’d justify that with CPI way above the target I don’t know.

The Tories should tear into Brown for this: the emperor never had any clothes. His strategy was simple: blew a debt bubble, mis-labelled it “prosperity” and jacked up state spending when it went bust. Through the debt interest bills, we’ll be paying the price for this for years to come. How many years? I’ll sign off with one final, stomach-churning graph. This is Brown’s one and only legacy.

PS: My colleague at the Centre for Policy Studies, George Trefgarne, wrote an excellent pamphlet about QE and inflation. Download the pdf here.

Comments