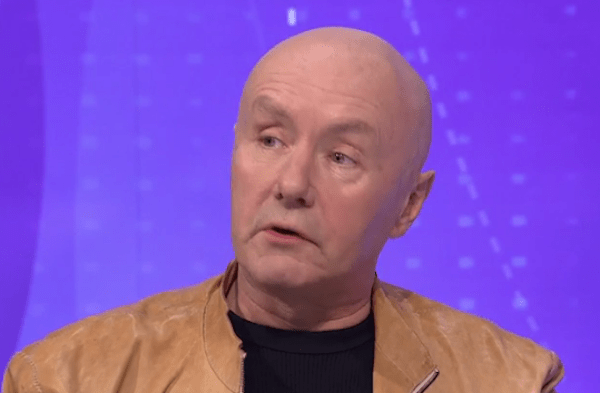

Last night’s Question Time saw David Dimbleby joined by Anna Soubry, Chris Bryant, Douglas Carswell, economist Ruth Lea and Irvine Welsh. As Soubry, Bryant and Carswell all bickered about the government’s use of £9m of taxpayers’ money for EU leaflets, Welsh — who lives in Chicago — said that even if he had a vote, he probably wouldn’t use it. While the Trainspotting author leans towards Brexit, he says the choice is a ‘spurious’ one as either way the economic system will not work to the advantage of the masses:

‘It’s a spurious choice, life goes on very much in the same way and we’ve seen how the world economy operates. How the global economy operates and how it operates to the advantage of very few people and the disadvantage of many people. But you can’t defend the EU as an institution, you can’t defend something that is fundamentally undemocratic, you can’t defend something that’s led by commissioners.’

The Trainspotting author later went on to blast the Tories’ ‘neo-liberal agenda’ before claiming that ‘they don’t give a toss’ about the steel industry. However, the issue that dominated the show was the Panama Papers. Following the release of the secret documents which highlight the tax evading habits of the world’s super-rich, several audience members raised concerns that the current system was unfair. Soubry made the point that everybody should pay their tax — no matter who they are:

‘The most important thing is that everybody should pay their tax, it doesn’t matter who they are, everybody should do it.’

However, not everyone on the panel has always agreed with that sentiment. When an audience member suggested that all tax returns be made public to allow for greater transparency, Welsh was asked to offer his take. The Scottish writer simply said that these documents were most likely ‘the tip of the iceberg’:

‘I think it’s inevitable and it’s probably the tip of the iceberg, with everything that’s happened over the last 30 years economically kind of seems to kind of indicate that. I mean it’s such a strange thing, when you look at what’s actually happening and the response of the people involved, the great tragedy for them is that they’ve actually been caught.

You can bet that every single resource will be going in to making sure that the public don’t get that kind of information again that they got in the Panama leaks. So this is probably the last of this thing you’ll hear for a while, but you can bet your boots it will continue going on.’

With the Scottish author planning to leave his answer there, it then fell on Dimbleby to probe him about his own tax habits. Surely the left-wing millionaire — who takes issue with a global economy that operates to the advantage of very few people and the disadvantage of many — has never failed to pay tax himself?

DD: Have you ever been tempted to put your money in the Virgin Islands from Chicago where you live now?

IW: Umm yeah, the Virgin islands is probably too far away I’d go for the Cayman islands

DD: So, you’ve been tempted that way?

IW: Not really, no. I mean when I lived in Dublin writers were exempt from the tax.

Welsh then proceeded to give a defence of his use of the optional tax scheme. He argued that it wasn’t the responsibility of people like him to choose not to use such schemes. Instead the government were to be blame for not putting ‘controls on people’s basic instincts’:

The thing is it’s not about individuals, if the system is set up for greed, if the system is encouraging people to act on greedy impulses then… human beings are complex characters, they’re not only about greed, they’re about all sorts of emotions — but if an economic system is set out to be based around greed you’re gonna get these outcomes.

When human beings are violent and we don’t want to have wars all the time to satisfy that kind of thing, we have to have some kind of balance, some kind of controls on people’s basic instincts and right now we don’t have that in our economic system.

Soubry appeared unconvinced by Welsh’s explanation:

AS: Is that why you lived in Dublin, so you didn’t pay taxes?

IW: No, I lived in Dublin because my wife moved there

AS: He sounded like he lived there because he didn’t pay taxes

DD: Well, hang on. A lot of artists and writers did move to Ireland because it had a special tax regime.

While Dimbleby is right that a lot of writers made use of Ireland’s tax regime, Welsh proved to be one of the more controversial figures to do so due to his lack of ties with the country. Although he moved there because of his wife’s study, he wasted no time in signing up for tax-free status on his next book. At the time Welsh told the Guardian: ‘anybody would agree with a scheme where they don’t have to pay tax’.

Comments