Sanctions hit both sides: this is a point that Joe Biden has made to Americans and Olaf Scholz is making to Germans. But Boris Johnson is not (so far) talking about the economic implications of this war. They will be — and in fact, already are — profound.

When Russian tanks moved into Ukraine, the price of gas for next-day delivery in the UK shot up 40 per cent. A study by Investec yesterday suggested this means typical household energy bills — already expected to approach £2,000 in April — could end up closer to £3,000. Quite a hit for a country already facing a cost-of-living crisis. And this is just one way in which the conflict could impact household budgets.

Oil prices rose above $100 a barrel for the first time since 2014 and continue to hover around that point. But government bonds remain calm, suggesting the markets expect this conflict to be relatively contained. The FTSE100 is up 150 points already this morning, and even Russian shares have rebounded.

On The Spectator’s data hub we have a new Ukraine section featuring oil prices, stock markets, maps and more. It shows how Putin has been preparing for sanctions with international currency and gold reserves of $630 billion, the fourth-highest in the world – only 16pc is held in dollars, up from 40pc five years ago. This should help shore up the rouble, at least in the short term. Putin has also been building a domestic alternative to Swift, the international (and Belgian-based) bank transfer system: a great many Russians are using their homemade alternative, limiting the blow if Russia is kicked out of the existing system.

Chancellor Rishi Sunak gave a speech about his vision for the UK economy yesterday — but there’ll be no tax cuts or a smaller state if a war ends up creating huge costs for British markets. Even before sanctions against Russia were being discussed, Sunak had launched a package of support to help families with their energy bill payments this year. If gas bills do surge a further 50 per cent, he’ll probably feel the need to cushion the blow again.

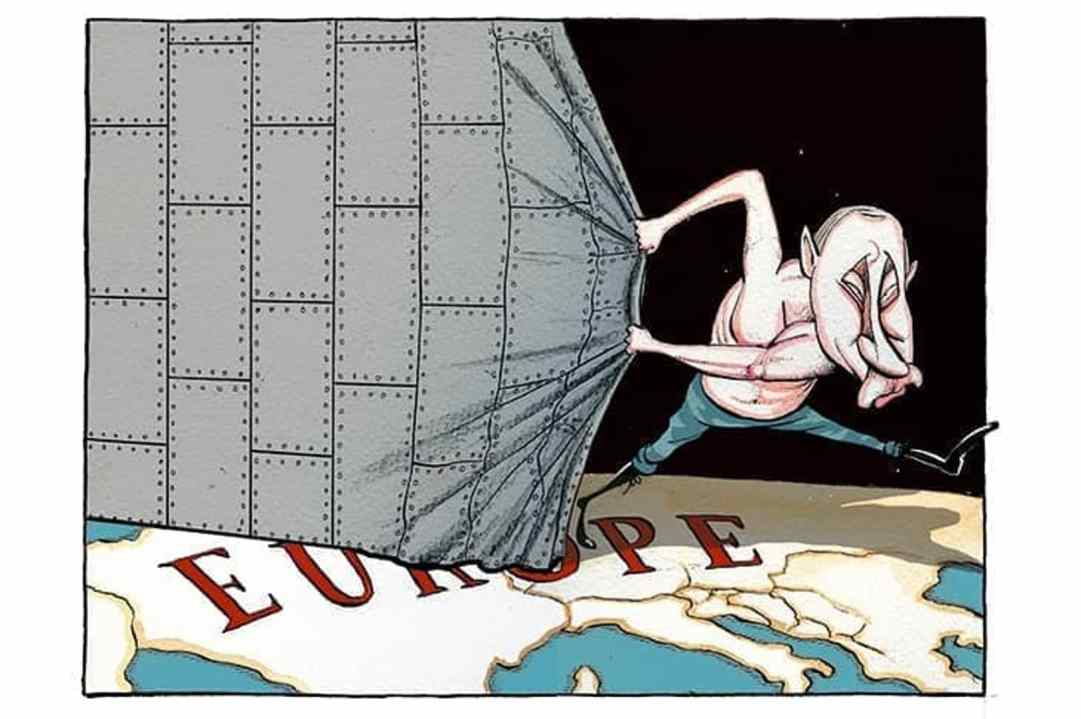

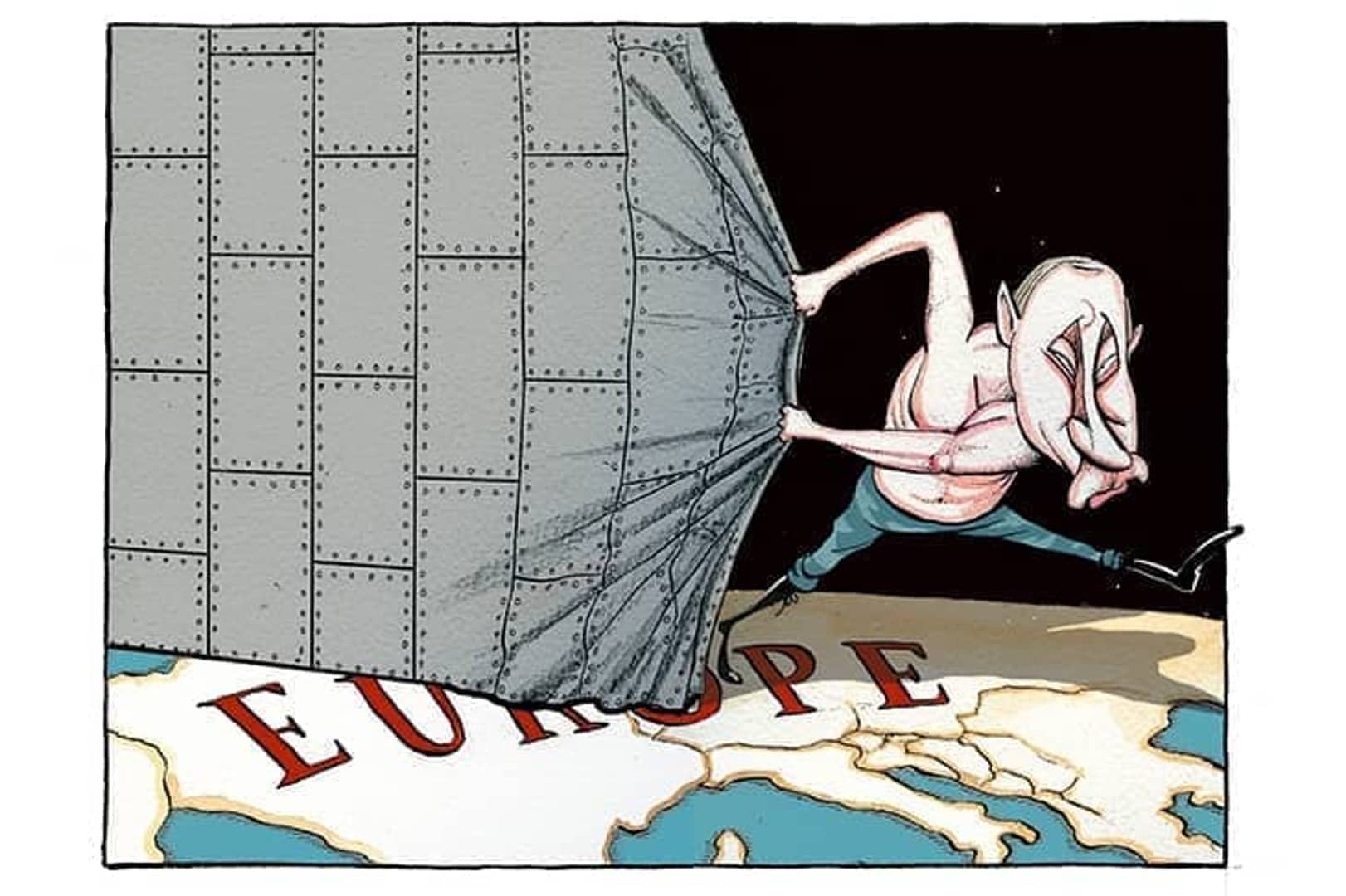

These are just some of the effects of sanctions which, so far have been widely criticised for not going far enough. Given Russia’s comprehensive preparedness for economic pain, there’s a sense that sanctions will need to get even tougher before they have an impact on Putin’s behaviour. But as James Forsyth points out in his column for the magazine this week, it’s not yet obvious that politicians in the UK have prepared their citizens for what this means: the cost of war this time around will not be boots on the ground, but higher prices and a tighter economic squeeze.

Russia sells about 23 billion cubic feet of gas a day to the outside world, of which about 85pc goes to Europe – and without NordStream2, much of that will have go through a pipeline that runs through Ukraine. Russian supplies to Europe are currently flowing at about 50pc capacity.

There may well be an appetite for the sanctions among the public, but it will still require far more frank messaging than what’s on offer at the moment.

Comments