There is a strange pre-Lehman feeling in the air right now: the idea that something

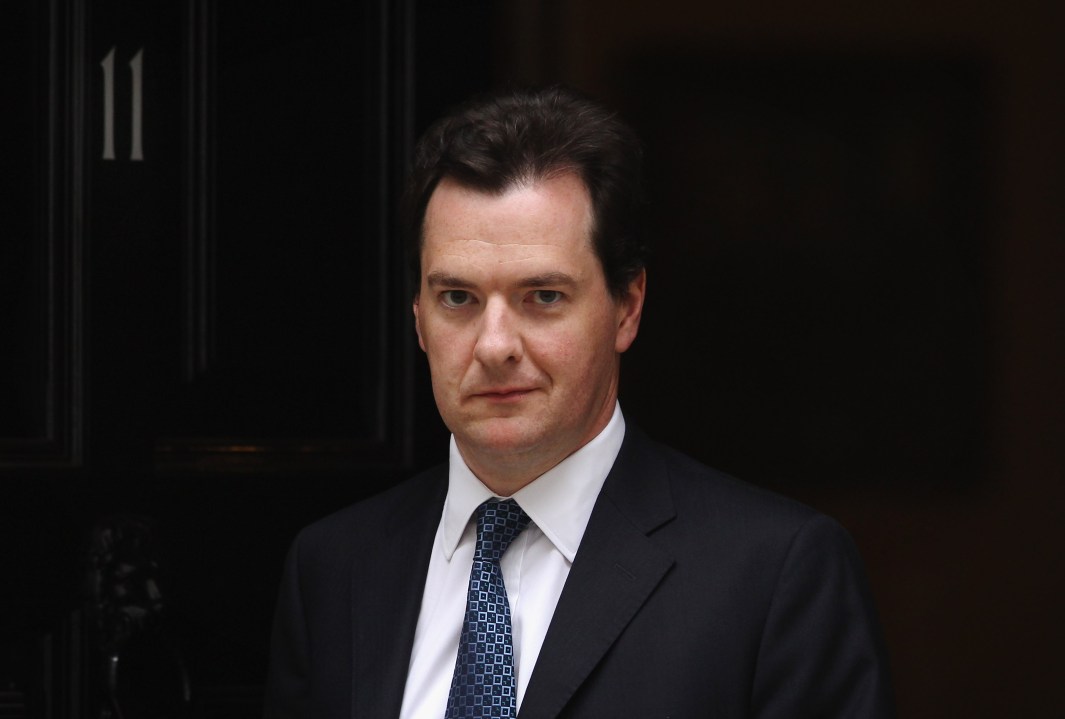

awful is going to happen, but no one knows what or when. This is laden with political ramifications. The problem for the Tories last time was not that George Osborne had been caught aboard HMS

Deripaska. The greater problem was that a crash had arrived and the Shadow Chancellor had nothing to say. Brown, at least, seemed to have an agenda, and the Tory poll lead was reduced to one vulnerable point. I admire Osborne, but he can do far better in making the case for the government’s

economic strategy. If there is a second crash, he’ll need all his skills to convey confidence – to sound as if he knows what he’s talking about. It won’t do to say “it

started in the Eurozone”, echoing Brown’s much-mocked “it started in America”. He’ll have to illustrate that any crash is not a reaction to cuts, given that state

spending from 2010-11 was the highest in British history, and then explain how he’ll rescue the situation.

There is a strange pre-Lehman feeling in the air right now: the idea that something

awful is going to happen, but no one knows what or when. This is laden with political ramifications. The problem for the Tories last time was not that George Osborne had been caught aboard HMS

Deripaska. The greater problem was that a crash had arrived and the Shadow Chancellor had nothing to say. Brown, at least, seemed to have an agenda, and the Tory poll lead was reduced to one vulnerable point. I admire Osborne, but he can do far better in making the case for the government’s

economic strategy. If there is a second crash, he’ll need all his skills to convey confidence – to sound as if he knows what he’s talking about. It won’t do to say “it

started in the Eurozone”, echoing Brown’s much-mocked “it started in America”. He’ll have to illustrate that any crash is not a reaction to cuts, given that state

spending from 2010-11 was the highest in British history, and then explain how he’ll rescue the situation.

Britain’s economic horizon is darkening. Michael Saunders at CitiBank now foresees unemployment rising from 7.9 per cent to 9 per cent – touching on the 3m unemployed of the 1980s. He has halved growth forecasts this year and next, to 1 per cent and an anemic 0.7 per cent respectively. I suspect the FT’s figure of revenue being £12bn lower than expected will be about a third of the final figure. Inflation may persist, and we could end up with a Britain where people eat less food because they can’t afford so much. Sustained economic misery, the like of which postwar Britain just hasn’t seen, may now be upon us.

All told, Osborne is in a fair bit of trouble. His last budget was billed by David Cameron as being “the most pro-growth budget this country has seen for a generation”. It was not to be. Instead we’ve seen more tax, more regulation, more spending – little sign of the supply-side reforms that you’d think a Conservative Chancellor would implement. For all the talk of cuts and paying down the nation’s credit card, the fact remains: Osborne’s Plan A will increase the UK national debt by 51 per cent over this parliament. This is less than the 59 per cent that Darling’s plan involved, but still quite some ask. As we all know, a recovery based on debt is not a recovery at all.

But a recovery based on QE? This, I suspect, will be the next question. The bond bubble, which Allister Heath described in his must-read cover piece last week, is still spewing out dangerously underpriced debt. Should this debt tap start to choke, Britain would be in very serious trouble. So government action may be pre-emptive. A Reuters poll on Wednesday showed the City consensus: QE will recommence in November, on a massive level. Up to £300bn could be printed. This will of course push inflation higher, making the cost of living worse and piling on the misery to ordinary voters who may well conclude that Cameron and Osborne have blown their chance to sort out the economy.

Cameron has been lucky in his enemies. Ed Miliband’s rather ponderous leadership has produced painfully few ideas, and his Shadow Chancellor is an ideologue whose obsession with cuts blinds him to declining living standards, a far more potent narrative. But if there is a new crisis and Osborne’s response is unimpressive, then it will have a palpable political impact. This is why you can’t afford to ignore the Labour Party conference in Liverpool next week. They may be short on solutions. But they are still terrifyingly close to power.

Comments