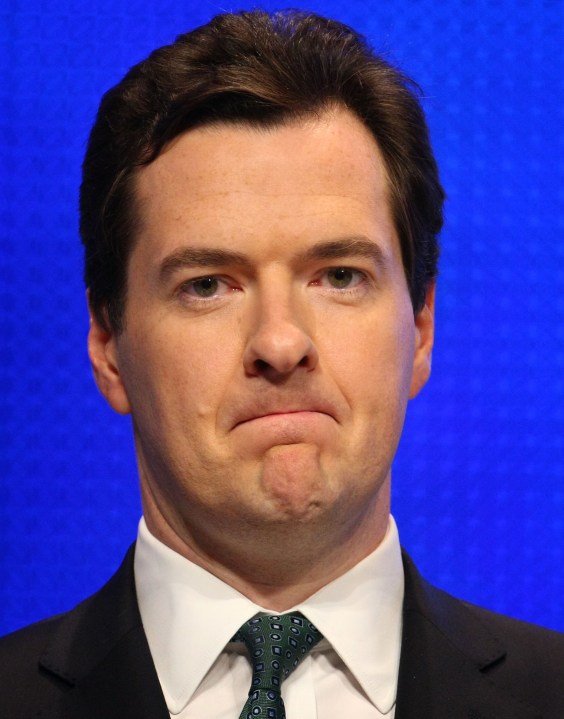

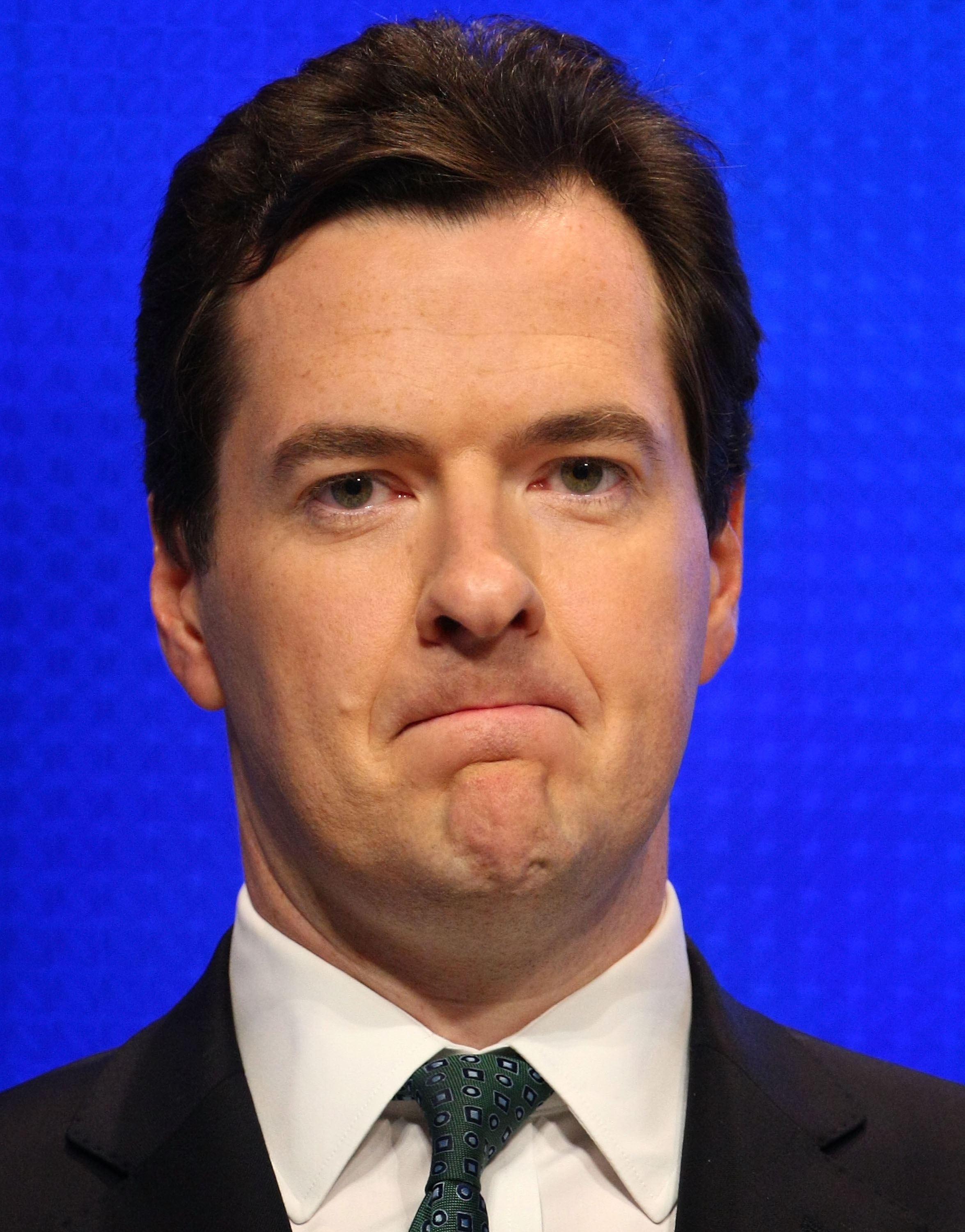

So, George Osborne’s unveiled his new line of attack on the Government – warning that, in light of sterling’s recent plunge, Brown’s addiction to debt could trigger a run on the pound. It’s a prognosis not entirely without basis, but is now the right time to make it, politically? After all, the trends aren’t currently heading in the direction of the Shadow Chancellor’s worst-case scenario, and the devaluation of sterling could even result in a few benefits. Gary Duncan puts it best in today’s Times:

So, George Osborne’s unveiled his new line of attack on the Government – warning that, in light of sterling’s recent plunge, Brown’s addiction to debt could trigger a run on the pound. It’s a prognosis not entirely without basis, but is now the right time to make it, politically? After all, the trends aren’t currently heading in the direction of the Shadow Chancellor’s worst-case scenario, and the devaluation of sterling could even result in a few benefits. Gary Duncan puts it best in today’s Times:

“How much does any of this really matter? There are two main dangers. First, as Mr Osborne argues, a weak pound that makes it even less attractive to invest in Britain could make it harder for the Treasury to borrow in the markets by selling government bonds. In turn, that means that it may end up having to pay more to finance surging government borrowing.

Secondly, a weak currency risks igniting inflation by driving up the nation’s import bills.

For now, however, while the pound’s fall is sharp, it is not unprecedented and the threat to Treasury fundraising remains limited. Nor is the second problem a real headache for now. Inflation is set to tumble. In a recessionary climate, businesses are unlikely to be able to pass on the higher cost of imports.

Crucially, a weaker pound will actually help to bolster the economy, making British exports more competitive. As other economies revive, this ought, eventually, to allow an export-led recovery. Provided that the pound does not collapse in a destabilising and disorderly way, its slide can be seen as a tonic, not a torment.”

In light of this analysis, the worry for Osborne is that he’s pulled this attack out of the locker too early. The shadow chancellor’s right to have concerns about the pound, but by voicing them now he is – rightly or wrongly – open to the accusation that he’s encouraging the “torment” scenario rather than the “tonic” scenario. If the Guardian’s latest dispatch from inside Team Brown is anything to go by, that’s a charge the PM will be making shortly.

UPDATE: And sure enough, here’s the PM…

Comments