So, is the post-Covid inflation panic over? That is how it looked last month, when the government’s preferred inflation index, CPIH, fell to 2.1 per cent from 2.4 per cent a month earlier. We will have the latest news on Wednesday morning, but for the moment it appears that consumer prices inflation hasn’t taken off like we feared. It is a similar story in the US, where inflation fell back from 5.6 per cent in July to 5.3 per cent in August.

The fact that house prices have risen so strongly throughout the deepest recession in modern times ought to be a warning sign

Yet there are good reasons to suspect that the summer slowdown in inflation is a lull and that a rebound is coming. Just look at US producer prices, which ratcheted up to 8.3 per cent in August, up from 7.8 percent in July. That is a leading indicator, which feeds into consumer prices a little further down the line. Oil prices continue to rise, as do commodity prices more generally. Wages, too, are rising at their strongest rate since the crash of 2008/09. Businesses are being bitten on several fronts, with raw materials and labour adding to costs. At the same time, continuing disruption to global trade domestic producers find it easier to raise prices.

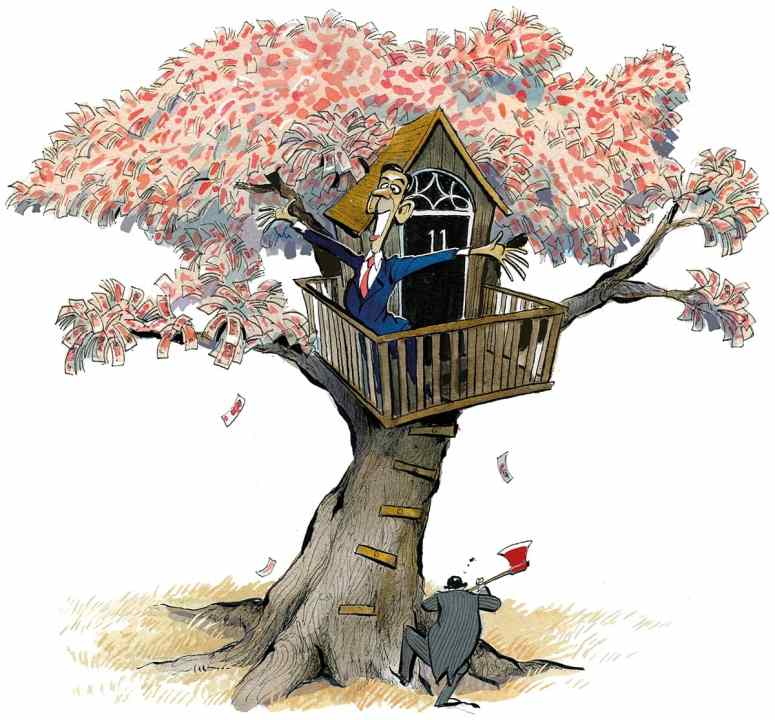

And then, of course, there is the stimulus from central banks. Ultimately, you cannot create money out of thin air – which is what quantitative easing (QE) is all about – without it eventually making its presence known. We have had inflation since QE began in 2009 – it is just that so far it has been mostly limited to asset prices. The fact that house prices have risen so strongly throughout the deepest recession in modern times ought to be a warning sign – all that extra money is going to go somewhere, and eventually it will surely spill over into consumer inflation.

To add to that, many western governments have a vested interest in inflation. They have built up such vast debts and continue to run huge deficits that it is very much in their interests to allow inflation run a little ahead of what it has done over the past three decades. Expect not too much action on the part of governments and central banks to rein-in inflation over the next few years. If they think they can get away with getting savers to pay off national debt for them – just as happened after the second world war – then they surely will.

Comments