Here’s a takeover tale that captures the zeitgeist. It involves two FTSE 250 companies and some deep-pocketed US investors – and I’ll explain it as simply as I can. In essence, how would you feel if your GP surgery fell into the hands of American investors associated with the book title Barbarians at the Gate?

The first of the two London-listed companies is Assura, which owns 600 NHS surgeries and diagnostic facilities and has accepted a cash offer of £1.6 billion from a pair of New York investment giants. They are Stone-peak, which holds a huge global portfolio of infrastructure assets, and Kohlberg Kravis Roberts, whose initials KKR may be familiar to older readers as a pioneer of aggressive private–equity dealmaking – most famously the 1989 buyout (chronicled by Bryan Burrough and John Helyar in the Barbarians bestseller) of the food and tobacco group RJR Nabisco. Imbued with Trumpist swagger, investors like these habitually prowl the London market for undervalued targets.

The second company, Primary Health Properties, is the only other significant player in Assura’s marketplace, as the owner of 516 GP facilities in the UK and Ireland – and has cut in to offer £1.7 billion for Assura in cash and shares. KKR claims PHP’s deal will hit competition issues, though the merged company would hold a relatively small proportion of the NHS surgery estate, most of which is owned by the GPs themselves.

In an era in which public markets are shrinking and private equity is rampant, largely to the detriment of smaller investors, this is a rare example of a listed company challenging the Goliath of KKR and its ilk. I’ve written about PHP before but I’m not a shareholder: the cost efficiencies of a merger are obvious and a company whose mission is to provide decent new buildings for the NHS (while collecting guaranteed rents that make steady dividends for shareholders) is an asset the London market can ill-afford to lose to bargain-hunting foreign financiers, American or otherwise.

Chorus of approval

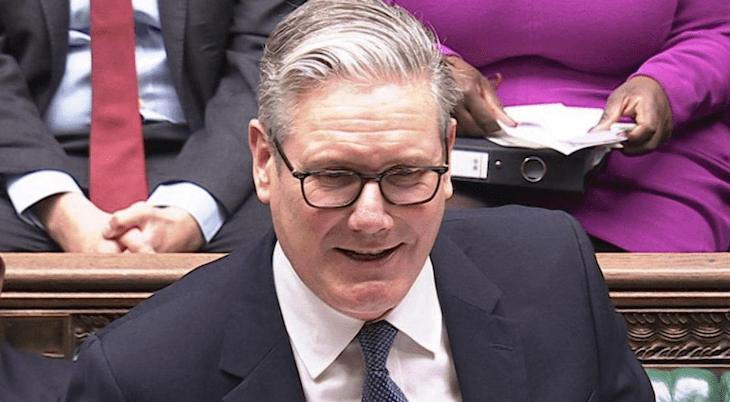

Last week, our beef farmers were sacrificed for the greater good of UK-US trade; this week, fisherman are the outright losers in Sir Keir Starmer’s ‘reset’ with Brussels. But there’s a line in the UK-EU ‘Common Understanding’ that gives a glimmer of hope for another all-but-abandoned economic minority: the musicians, opera singers and theatre professionals who were blocked from working on the continent as a wholly unnecessary and unintended consequence of Brexit. Point 15 of the signed document recognises the value of ‘artistic exchanges, including the activities of touring artists’ and pledges continuing efforts in their interest.

I take that to mean UK negotiators asked for free movement of performers, to which the response was ‘Not now, but sink your fishing fleet and toe our line on Points 1 to 14, and maybe we’ll think about it’. At least that’s a half-positive signal.

Rename the airport

To Sheffield for the annual Cutlers’ Feast, a grand assembly of metal-bashing business-owners who represent the last and best of industrial England. Sentiment at my table can be summarised as mild optimism about trade deals, mild scepticism about the 0.7 per cent first-quarter growth figure and continuing rage at the punitive cost of Labour’s hike in employers’ national insurance contributions. Business Secretary Jonathan Reynolds was due as a guest speaker but perhaps wisely pulled out.

A topic on which I had my ear extensively bent during dinner was the fate of Doncaster Sheffield Airport. The former RAF Finningley, with its huge runway built for nuclear bombers, is owned by the Peel property group but has been closed since 2022. Now leased by Doncaster council with support from the South Yorkshire mayoral authority, it’s due to reopen next year. The model is the revival of Teesside airport under public ownership, driven by the Tees Valley mayor Ben Houchen. The economic benefits for a struggling region are blindingly obvious, despite opposition from environmental groups. And the amusing twist is that Chancellor Rachel Reeves has endorsed the Doncaster Sheffield relaunch – so Westminster sources whisper – as a sop to the MP for Doncaster North after his furious opposition to a third Heathrow runway was overruled in cabinet.

He is of course the Secretary of State for Energy Security and Net Zero, Ed Miliband, and he evidently has no qualms at all about a major airport development in his own patch. They should name it after him, as a monument to political hypocrisy.

Drab parade

Few commentators have squeezed more mileage out of the Sunday Times Rich List than me over the past three decades. I still squirm at the memory of the ‘spoiler’ I wrote for the Mail on Sunday long ago, claiming at the editor’s insistence that hand-to-mouth hacks are happier than millionaires. But in most years I have found at least a handful of plutocrats to admire for their entrepreneurial grit and charitable largesse.

Not so this time: of the 156 top names between the London resident Gopi Hinduja, perched on his £35 billion pile, and a Russian fertiliser tycoon called Vladimir Makhlai with a modest single billion, at least half are completely unknown to me.

Few have created flourishing UK businesses within this century, and even fewer have done anything noticeable for the good of the world. Perhaps the best have already joined the great exodus of wealth that Michael Simmons wrote about in The Spectator last week. Others may have brought injunctions to keep them out of a line-up you’d be mad to want to be seen in, given the risk of tax grabs, burglaries and British public resentment even towards legitimate fortunes. Whatever the reasons for this year’s drab parade, it’s time to bin the Rich List.

Comments